Exchange Rate Fluctuations: A Dynamic Market

The exchange rate between the US dollar (USD) and the Thai baht (THB) is a constantly fluctuating value that affects the purchasing power of individuals and businesses in both countries. Various factors, such as economic growth, interest rate differentials, and political stability, influence the exchange rate’s movements.

Historical Trends and Analysis

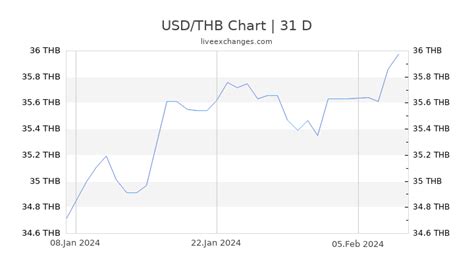

Over the past decade, the USD/THB exchange rate has exhibited significant volatility, with the baht appreciating and depreciating against the dollar at different times. In 2018, the baht reached its strongest level against the dollar in 11 years, with 1 USD exchanging for approximately 30 THB. However, fluctuations in the global economy and political uncertainties have since caused the baht to weaken, and the exchange rate has ranged between 32-34 THB for the past few years.

Factors Affecting the Exchange Rate

Economic Growth

The economic growth rates of the United States and Thailand play a crucial role in determining the exchange rate. A stronger US economy typically leads to a higher demand for the US dollar, resulting in an appreciation of the dollar against the baht.

Interest Rate Differentials

The difference in interest rates between the two countries can also influence the exchange rate. Higher interest rates in the US attract foreign investment, which increases demand for the US dollar and causes the dollar to appreciate against the baht.

Political Stability

Political stability is another important factor that affects the exchange rate. A stable political environment in both countries fosters investor confidence, which leads to increased investment and a stronger currency.

Implications for Businesses and Individuals

The fluctuating exchange rate has significant implications for businesses and individuals engaged in international transactions.

Businesses:

– Exporters may benefit from a weaker baht, as it makes their products more competitive in the global market.

– Conversely, importers may face higher costs due to a stronger baht.

Individuals:

– Tourists from the US may find it more expensive to travel to Thailand if the baht appreciates, while Thai travelers may enjoy lower expenses in the US.

– Exchange rate fluctuations can also impact the cost of goods and services imported from other countries.

Projections for 2025

Forecasting the exchange rate several years in advance is challenging due to the unpredictable nature of the global economy. However, analysts predict that the USD/THB exchange rate will likely remain within a range of 32-34 THB over the next few years. Factors such as global economic growth, interest rate policies, and geopolitical developments will continue to influence the exchange rate’s direction.

How to Take Advantage of Exchange Rate Fluctuations

Businesses and individuals can mitigate the risks associated with exchange rate fluctuations by implementing strategies such as:

Hedging: Using financial instruments to offset potential losses due to adverse exchange rate movements.

Forward Contracts: Locking in an exchange rate in advance to protect against future fluctuations.

Diversification: Investing in assets denominated in different currencies to reduce exposure to a single currency’s volatility.

Conclusion

The exchange rate between the US dollar and the Thai baht is subject to constant change, influenced by various economic and political factors. By understanding the factors that affect the exchange rate and the implications for businesses and individuals, it is possible to mitigate risks and take advantage of opportunities in the foreign exchange market. As the global economy continues to evolve, the exchange rate will remain a dynamic and important consideration for international trade and investment.

Table 1: Historical Exchange Rate Data (USD/THB)

| Year | Exchange Rate |

|---|---|

| 2012 | 30.46 |

| 2013 | 32.15 |

| 2014 | 32.67 |

| 2015 | 34.28 |

| 2016 | 35.96 |

| 2017 | 34.44 |

| 2018 | 30.09 |

| 2019 | 31.19 |

| 2020 | 33.05 |

| 2021 | 32.44 |

| 2022 | 33.52 |

Table 2: Economic Indicators Impacting Exchange Rates

| Indicator | Impact |

|---|---|

| GDP Growth | Stronger US GDP leads to a stronger USD |

| Interest Rates | Higher US interest rates lead to a stronger USD |

| Inflation | Higher US inflation weakens the USD |

| Political Stability | Uncertainty in either country weakens the currency |

Table 3: Strategies to Mitigate Exchange Rate Risks

| Strategy | Description |

|---|---|

| Hedging | Using financial instruments to offset potential losses |

| Forward Contracts | Locking in an exchange rate in advance |

| Diversification | Investing in assets denominated in different currencies |

Table 4: Future Exchange Rate Projections

| Year | Projected Range (USD/THB) |

|---|---|

| 2023 | 32-34 |

| 2024 | 32-34 |

| 2025 | 32-34 |