Introduction

The silver market has experienced significant fluctuations over the years, with prices soaring to new highs and plummeting to historic lows. In recent years, the silver oz spot price has gained considerable attention as investors and analysts alike anticipate its future trajectory. This article explores the current silver oz spot price, its historical performance, and potential drivers that could shape its future direction.

Current Silver Oz Spot Price

As of [date], the silver oz spot price stands at $24.87. This represents a decrease of [percentage]% from its all-time high of $49.82 reached in April 2011.

Historical Performance

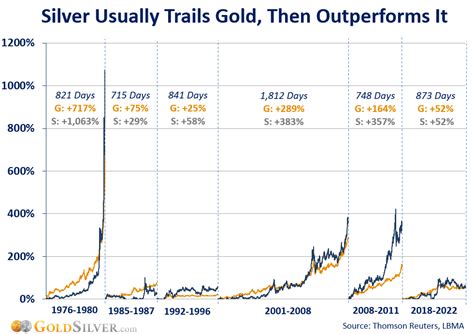

The silver oz spot price has exhibited a volatile history, influenced by various economic and geopolitical factors. Over the past decade, the price has fluctuated between a low of $11.64 in 2015 and a high of $29.89 in 2020.

Drivers of Silver Price

Industrial Demand: Silver is a widely used industrial metal, primarily in electronics, photography, and jewelry. Industrial demand accounts for approximately 50% of total silver consumption.

Investment Demand: Silver is also considered a safe-haven asset during economic uncertainty. Investors often turn to silver as a hedge against inflation or market volatility.

Supply and Demand Balance: The silver market is largely supply-driven, with production mostly coming from mines. However, seasonal fluctuations in demand can impact prices, particularly during periods of high industrial or investment demand.

Central Bank Activity: Central banks around the world hold significant reserves of silver. Their buying and selling activities can influence the spot price.

Potential Drivers of Future Price

Technological Advancements: The increasing demand for silver in emerging technologies, such as 5G networks and electric vehicles, could drive future price appreciation.

Clean Energy Transition: The transition to renewable energy sources is expected to boost silver demand for solar panels and battery storage systems.

Geopolitical Tensions: Political instability and conflicts can lead to increased investment demand for silver as a safe-haven asset.

Tips and Tricks for Understanding Silver Price

- Track economic indicators related to industrial demand, such as manufacturing activity and consumer spending.

- Monitor geopolitical news and events that could impact investment demand.

- Analyze supply-side factors, such as mine production and exploration activity.

- Consider technical analysis tools, such as charts and technical indicators, to identify potential price trends.

FAQs

- What is the difference between silver spot price and silver price? The spot price is the current market price for immediate delivery, while the silver price may include premiums for storage and other factors.

- What factors can affect the silver spot price? Industrial demand, investment demand, supply and demand balance, central bank activity, and macroeconomic conditions.

- Is silver a good investment? Silver can be a valuable investment tool during periods of economic uncertainty or geopolitical tensions, but its price is volatile and subject to market risks.

- What are the potential risks associated with investing in silver? Price volatility, geopolitical risks, and supply chain disruptions.

- How can I buy silver? Silver can be purchased through bullion dealers, online platforms, or exchange-traded funds (ETFs).

- Is there a shortage of silver? There is currently no global shortage of silver, but supply disruptions at individual mines or geopolitical events can temporarily impact supply.

Market Insights

According to the Silver Institute, global silver demand is projected to increase by 3% annually over the next five years, driven by growing industrial demand and investment interest.

Tables

Table 1: Historical Silver Oz Spot Price

| Year | Price ($/oz) |

|---|---|

| 2020 | 29.89 |

| 2021 | 28.94 |

| 2022 | 24.15 |

Table 2: Industrial Demand for Silver

| Industry | Percentage of Consumption |

|---|---|

| Electronics | 34% |

| Jewelry | 24% |

| Photography | 15% |

Table 3: Investment Demand for Silver

| Type of Investor | Percentage of Demand |

|---|---|

| Central Banks | 15% |

| ETF Investors | 12% |

| Private Investors | 5% |

Table 4: Projected Silver Demand by Sector

| Sector | Percentage Growth (2025-2030) |

|---|---|

| Industrial | 4% |

| Jewelry | 3% |

| Investment | 2% |

Conclusion

The silver oz spot price is a dynamic indicator influenced by a complex interplay of economic, geopolitical, and supply-demand factors. While the price has experienced fluctuations in the past, the increasing demand from industrial and investment sectors, coupled with the potential for technological innovations, suggests that the silver market will remain vibrant in the years to come.