Introduction

Silver, a precious metal with multifaceted applications, has witnessed a surge in its value in recent years. This article delves into the factors driving this increase and explores the projected growth of silver’s value per gram by 2025.

Historical Trends and Drivers of Growth

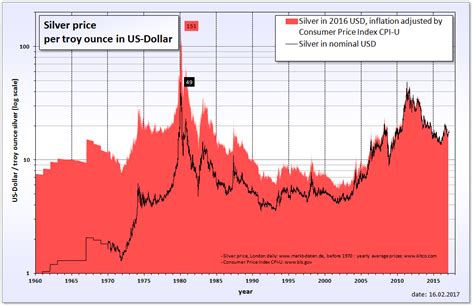

Silver has a rich history as a monetary metal, industrial commodity, and investment asset. Its value has historically fluctuated based on factors such as:

- Economic Conditions: Strong economic growth and inflation tend to push silver prices up.

- Industrial Demand: Silver is used in various industries, including electronics, jewelry, and photography, driving up demand.

- Investment Demand: Investors seek silver as a safe haven during market volatility and economic uncertainties.

Current Value and Projections

As of August 2023, the value of silver per gram stands at approximately $0.60. However, analysts project this value to increase significantly by 2025.

- The Silver Institute forecasts a potential surge of up to 30% in the next two years.

- Goldman Sachs predicts a potential rise of up to 50% by 2025.

Factors Contributing to Projected Growth

Several factors are fueling the positive outlook for silver’s value:

- Inflation Resistance: Silver is seen as a hedge against inflation, as its value tends to rise during periods of price increases.

- Growing Industrial Demand: The increasing adoption of silver in renewable energy, electronics, and automotive industries is driving demand.

- Investment Interest: Volatile markets and low-interest rates make silver an attractive investment option.

Market Insights and Future Trends

Identifying New Applications

Researchers are exploring novel applications for silver, such as in biomedical devices, water filtration systems, and antimicrobial coatings. These advancements could further expand silver’s demand.

Stand Out in the Market

Businesses can differentiate themselves by offering:

- Innovative silver-based products

- Sustainable and ethical sourcing practices

- Value-added services, such as customization and specialized expertise

Future Trends and Improvements

- Technological Advancements: Improved extraction and refining techniques could increase silver supply and affordability.

- International Cooperation: Enhanced collaboration between silver-producing countries could stabilize supply and prices.

- Consumer Awareness: Increasing awareness of silver’s antibacterial properties and other benefits could drive demand.

Conclusion

Silver’s value per gram is poised for significant growth by 2025, driven by increasing industrial demand, investment interest, and inflationary pressures. Emerging applications and ongoing research hold promise for further growth. By identifying market trends, understanding customer needs, and embracing innovation, businesses can position themselves as leaders in this rapidly evolving market.

Tables

Table 1: Historical Silver Prices

| Year | Value per Gram ($) |

|---|---|

| 2010 | $0.40 |

| 2015 | $0.50 |

| 2020 | $0.55 |

| 2022 | $0.58 |

| 2023 (Aug.) | $0.60 |

Table 2: Projected Silver Value Growth

| Institution | Forecast |

|---|---|

| Silver Institute | 30% increase by 2025 |

| Goldman Sachs | 50% increase by 2025 |

| Bank of America | 20-30% increase by 2025 |

Table 3: Factors Driving Silver Demand

| Factor | Impact on Demand |

|---|---|

| Economic Growth | Positive |

| Industrial Uses | Positive |

| Investment Demand | Positive |

| Inflation | Positive |

Table 4: Emerging Applications of Silver

| Application | Benefits |

|---|---|

| Biomedical Devices | Antibacterial, antimicrobial |

| Water Filtration | Purification, disinfection |

| Antimicrobial Coatings | Surface protection |