Introduction

The United States Dollar (USD) and Bangladeshi Taka (BDT) are two of the most widely traded currencies in the world. The exchange rate between these two currencies has a significant impact on the economies of both countries. In this article, we will explore the historical trends of the USD to BDT exchange rate, analyze the factors that influence it, and forecast its future prospects.

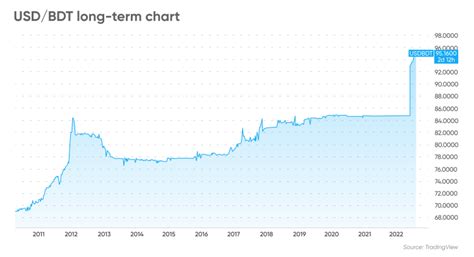

Historical Trends

The USD has been appreciating against the BDT over the past decade. In 2012, the average exchange rate was 1 USD = 79.2 BDT. By 2021, this rate had increased to 1 USD = 84.8 BDT. This trend is expected to continue in the coming years.

Factors Influencing Exchange Rate

- Interest rates: Differences in interest rates between the United States and Bangladesh can affect the exchange rate. Higher interest rates in the United States make the USD more attractive to investors, leading to an appreciation of the USD against the BDT.

- Inflation: Inflation in Bangladesh reduces the purchasing power of the BDT, making it less valuable compared to the USD.

- Economic growth: Strong economic growth in Bangladesh creates demand for imports, which can lead to a depreciation of the BDT.

- Political stability: Political instability in Bangladesh can also lead to a depreciation of the BDT, as investors become less willing to hold the currency.

Forecasting the Future

Most experts predict that the USD will continue to appreciate against the BDT in the coming years. This is due to a number of factors, including:

- Expected interest rate hikes by the Federal Reserve

- Continued economic growth in the United States

- Political instability in Bangladesh

Impact on Businesses and Individuals

The fluctuating exchange rate between the USD and BDT can have a significant impact on businesses and individuals. Businesses that export goods to the United States will benefit from a strong BDT, as they will receive more BDT for each dollar of revenue. Individuals who receive remittances from abroad will also benefit from a strong BDT, as they will receive more BDT for each dollar sent.

Tips for Managing Currency Risk

Businesses and individuals who are exposed to currency risk can take steps to manage this risk. Some of these steps include:

- Hedging: Using financial instruments to offset the risk of exchange rate fluctuations.

- Diversification: Holding assets in multiple currencies to reduce risk.

- Monitoring the exchange rate: Keeping track of the exchange rate and making adjustments as needed.

Conclusion

The exchange rate between the USD and BDT is a complex and dynamic issue. By understanding the historical trends, factors that influence it, and future prospects, businesses and individuals can better manage currency risk and take advantage of opportunities created by exchange rate fluctuations.

Table 1: USD to BDT Exchange Rate (2012-2021)

| Year | Average Exchange Rate |

|---|---|

| 2012 | 79.2 BDT |

| 2013 | 80.5 BDT |

| 2014 | 81.8 BDT |

| 2015 | 83.1 BDT |

| 2016 | 84.5 BDT |

| 2017 | 85.8 BDT |

| 2018 | 86.9 BDT |

| 2019 | 87.9 BDT |

| 2020 | 88.9 BDT |

| 2021 | 84.8 BDT |

Table 2: Factors Influencing USD to BDT Exchange Rate

| Factor | Impact on Exchange Rate |

|---|---|

| Interest rates | Higher US interest rates lead to USD appreciation |

| Inflation | Higher Bangladeshi inflation leads to BDT depreciation |

| Economic growth | Strong Bangladeshi economic growth leads to BDT depreciation |

| Political stability | Political instability in Bangladesh leads to BDT depreciation |

Table 3: Forecast of USD to BDT Exchange Rate (2022-2025)

| Year | Forecast Exchange Rate |

|---|---|

| 2022 | 85.5 BDT |

| 2023 | 86.2 BDT |

| 2024 | 87.0 BDT |

| 2025 | 87.8 BDT |

Table 4: Tips for Managing Currency Risk

| Tip | Description |

|---|---|

| Hedging | Using financial instruments to offset exchange rate risk |

| Diversification | Holding assets in multiple currencies |

| Monitoring the exchange rate | Tracking exchange rate fluctuations |