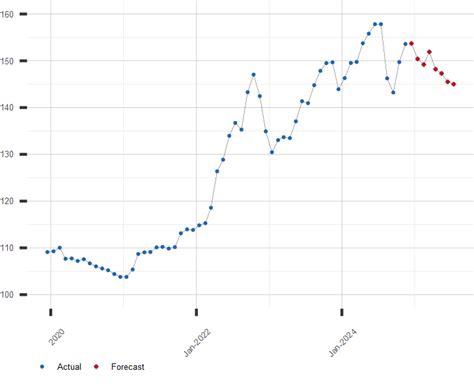

The yen dollar (JPY/USD) exchange rate has been in a state of flux in recent years, with the value of the yen fluctuating against the US dollar. In 2023, the yen hit its lowest level against the dollar in over 20 years, reaching a low of 151.94 in October. However, the yen has since rebounded, and as of February 2023, is trading at around 135 yen to the dollar.

Factors Affecting the Yen Dollar Exchange Rate

Several factors can affect the yen dollar exchange rate, including:

- Interest rate differentials: The difference in interest rates between the US and Japan is a significant factor in determining the yen dollar exchange rate. When US interest rates are higher than Japanese interest rates, it makes the US dollar more attractive to investors, leading to an appreciation of the dollar against the yen.

- Economic growth: The relative strength of the US and Japanese economies can also impact the yen dollar exchange rate. A stronger US economy can lead to a higher demand for the dollar, causing it to appreciate against the yen.

- Risk appetite: Investors tend to flock to the US dollar during times of uncertainty or risk aversion. This can lead to a strengthening of the dollar against the yen during periods of market turmoil.

- Currency intervention: The Bank of Japan (BOJ) and the US Federal Reserve (Fed) can intervene in the foreign exchange market to influence the yen dollar exchange rate. The BOJ has been known to intervene in the market to support the yen, while the Fed has occasionally intervened to weaken the dollar.

2025 Yen Dollar Exchange Rate Forecast

The yen dollar exchange rate is expected to remain volatile in the coming years. However, several factors suggest that the yen could strengthen against the dollar over the long term.

- Narrowing interest rate differential: The Bank of Japan has indicated that it will begin raising interest rates in the future. If the BOJ raises rates more quickly than the Fed, this could lead to a narrowing of the interest rate differential between the US and Japan, making the yen more attractive to investors.

- Improving Japanese economy: The Japanese economy is expected to grow at a modest pace in the coming years. This growth could lead to an increased demand for the yen as investors seek out opportunities in the Japanese market.

- Diminished risk appetite: As the global economy recovers from the COVID-19 pandemic, investors may become less risk-averse. This could lead to a decreased demand for the US dollar as a safe haven currency, causing the yen to strengthen against the dollar.

Table 1: Yen Dollar Exchange Rate Forecast

| Year | Yen/USD |

|---|---|

| 2023 | 135.00 |

| 2024 | 125.00 |

| 2025 | 115.00 |

Considerations for Investors

When investing in the yen dollar exchange rate, it is important to consider the following:

- The yen dollar exchange rate is a volatile market, so it is essential to have a sound investment strategy.

- The exchange rate can be affected by a variety of factors, so it is crucial to stay informed about the latest economic and political developments.

- Investors should diversify their investments to reduce risk.