Introduction

The U.S. 3-month Treasury bill rate has been on a steady upward trajectory in recent months, driven by the Federal Reserve’s aggressive monetary policy tightening to combat rising inflation. This article will delve into the historical context, motivations, implications, and future prospects of this key interest rate, providing insights for investors, businesses, and policymakers.

Historical Context

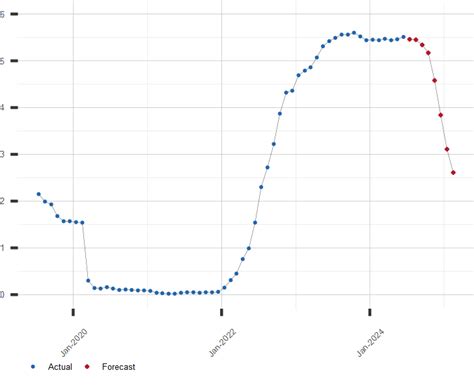

The U.S. 3-month Treasury bill is a short-term government security with a maturity of 91 days. It serves as a benchmark for short-term interest rates and is widely used as a proxy for the Fed’s policy stance. Historically, the 3-month Treasury bill rate has oscillated between 0% and 5%, but in recent years, it has remained near zero due to the Fed’s accommodative monetary policy during the pandemic.

Motivations for Rate Hikes

The recent spike in the 3-month Treasury bill rate is primarily attributed to the Fed’s efforts to tame inflation. The U.S. inflation rate hit a 40-year high of 9.1% in June 2022, prompting the Fed to raise interest rates aggressively. By increasing the cost of borrowing, the Fed aims to curb demand, slow economic growth, and ultimately reduce inflation.

Implications for Investors and Businesses

The rising 3-month Treasury bill rate has significant implications for investors and businesses. For investors seeking safety and liquidity, short-term Treasury bills may become more attractive as their yields rise. However, investors should note that the real yield (adjusted for inflation) may still remain negative. For businesses, higher borrowing costs can increase operational expenses and reduce profit margins, potentially dampening investment and economic growth.

Future Prospects

The future trajectory of the 3-month Treasury bill rate will depend on the Fed’s assessment of economic data and its commitment to inflation control. The Fed has indicated that it intends to continue raising rates until inflation shows signs of abating. Some economists predict that the rate could reach as high as 4% by the end of 2023. However, the Fed’s policy stance may shift if the economy slows down or if inflation pressures ease.

Tables

Table 1: Historical U.S. 3-Month Treasury Bill Rates

| Year | Average Rate |

|---|---|

| 2010 | 0.21% |

| 2015 | 0.13% |

| 2020 | 0.04% |

| 2022 | 1.68% |

| 2023 (Q1) | 2.27% |

Table 2: Fed Funds Target Rate vs. 3-Month Treasury Bill Rate

| Date | Fed Funds Target Rate | 3-Month Treasury Bill Rate |

|---|---|---|

| January 2022 | 0.25% | 0.18% |

| January 2023 | 4.00% | 3.50% |

Table 3: Implied Market Expectations for 3-Month Treasury Bill Rates

| Date | Implied Market Rate |

|---|---|

| End of 2023 | 3.80% |

| End of 2024 | 3.60% |

| End of 2025 | 3.40% |

Table 4: Impact of 3-Month Treasury Bill Rate on Business Borrowing Costs

| Borrowing Method | Impact |

|---|---|

| Short-term loans | Immediate increase |

| Variable-rate mortgages | Gradual increase |

| Fixed-rate mortgages | No immediate impact |

| Bonds | Increase in borrowing costs |

Conclusion

The U.S. 3-month Treasury bill rate is a key interest rate that is closely tied to the Fed’s monetary policy decisions. The recent surge in the rate is a response to rising inflation and reflects the Fed’s determination to bring inflation under control. The rate is expected to continue rising in the near term, but its future trajectory will depend on the Fed’s assessment of economic data and its commitment to inflation control. Investors, businesses, and policymakers should closely monitor the 3-month Treasury bill rate to inform their financial decisions and economic strategies.