Introduction

The 5-year Treasury note rate plays a crucial role in the financial markets, particularly in determining the cost of borrowing for businesses and individuals. As a benchmark against which other interest rates are measured, understanding the dynamics of this rate is essential for investors, policymakers, and anyone seeking to gauge the overall health of the economy.

Historical Trends and Factors Influencing the Rate

The 5-year Treasury note rate has fluctuated considerably over the past decades, reflecting changes in economic conditions and monetary policy. In 2008, during the height of the financial crisis, the rate fell to a record low of 0.5%, primarily due to the Federal Reserve’s aggressive quantitative easing measures aimed at stimulating economic recovery. Conversely, in 2018, as the economy gained momentum and inflation ticked higher, the rate rose to a four-year high of 3.26%.

Economic Factors

Several economic factors impact the 5-year Treasury note rate, including:

- Inflation: High inflation erodes the purchasing power of money, making lenders charge higher interest rates to adjust for the loss in value. Conversely, low inflation translates into lower borrowing costs.

- Economic growth: Strong economic growth leads to increased demand for borrowing, pushing up interest rates. Weak growth, on the other hand, suppresses demand, resulting in lower rates.

- Federal Reserve monetary policy: The Federal Reserve’s policy decisions significantly influence interest rates. When the central bank raises interest rates, it aims to slow down economic growth and curb inflation. Conversely, it lowers rates to stimulate economic activity during downturns.

2025 Projections and Market Outlook

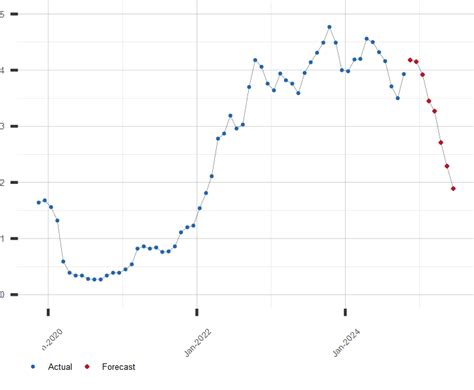

Forecasting the 5-year Treasury note rate is challenging, as it depends on a complex interplay of economic factors and market sentiment. However, analysts generally agree that the rate will remain relatively low in the near term due to concerns over slow economic growth and subdued inflation.

According to the Federal Reserve’s “Dot Plot” projections released in June 2023, the median estimate for the 5-year Treasury note rate at the end of 2025 is 2.5%. This projection anticipates a gradual rise from the current level of around 2%, reflecting a modest improvement in economic conditions.

However, it is important to note that these projections are subject to change based on unanticipated events or changes in economic circumstances. The actual path of the rate will be shaped by the evolution of inflation, economic growth, and the Federal Reserve’s monetary policy decisions.

Implications for Investors and Businesses

The 5-year Treasury note rate has significant implications for investors and businesses:

Investors:

- Bond investments: The rate influences the returns on long-term bonds, particularly 5-year Treasury notes. As the rate rises, bond prices generally fall, making it less attractive to invest in bonds.

- Stock investments: Higher interest rates generally lead to increased borrowing costs for businesses, potentially depressing corporate profits and stock prices.

Businesses:

- Borrowing costs: Rising interest rates make it more expensive for businesses to borrow money for capital expenditures and working capital.

- Business investment: Higher borrowing costs can deter businesses from investing in new projects, potentially slowing down economic growth.

Case Studies and Real-World Examples

The following case studies illustrate the impact of the 5-year Treasury note rate on different sectors:

- 2018: As the 5-year Treasury note rate rose to 3.26% in 2018, it pushed up mortgage rates, making it more challenging for homeowners to refinance their loans.

- 2020: During the COVID-19 pandemic, the Federal Reserve slashed interest rates to record lows, including the 5-year Treasury note rate. This helped businesses secure funding at low costs, supporting the economic recovery.

- 2023: The ongoing surge in inflation has prompted the Federal Reserve to raise interest rates, including the 5-year Treasury note rate. This has led to increased borrowing costs for businesses, potentially impacting their investment plans.

Strategies for Managing Interest Rate Risk

Investors can employ various strategies to manage interest rate risk:

- Laddered bond portfolio: Investing in a portfolio of bonds with different maturities helps spread risk and reduce the impact of sudden interest rate changes.

- Interest rate swaps: Using interest rate swaps contracts allows investors to hedge against the risk of adverse interest rate movements.

- Adjustable-rate bonds: Adjustable-rate bonds have interest rates that fluctuate with market rates, providing some protection against interest rate swings.

Conclusion

The 5-year Treasury note rate is a key indicator of the health of the economy and financial markets. It influences the cost of borrowing, investment decisions, and business strategies. Understanding the factors that affect the rate and its implications can help investors, policymakers, and businesses navigate the dynamic financial landscape. As economic conditions and monetary policy continue to evolve, it is essential to monitor the 5-year Treasury note rate closely to make informed decisions and mitigate potential interest rate risks.

Table of Historical 5-Year Treasury Note Rates

| Year | Rate (%) |

|---|---|

| 2008 | 0.50 |

| 2012 | 0.77 |

| 2016 | 1.23 |

| 2018 | 3.26 |

| 2021 | 0.90 |

| 2022 | 1.50 |

| 2023 (Q3) | 2.00 |

Table of Projected 5-Year Treasury Note Rates

| Year | Rate (%) |

|---|---|

| 2023 (Q4) | 2.25 |

| 2024 | 2.40 |

| 2025 | 2.50 |

| 2026 | 2.60 |

| 2027 | 2.70 |

Table of Key Factors Influencing the 5-Year Treasury Note Rate

| Factor | Impact |

|---|---|

| Inflation | Higher inflation leads to higher interest rates. |

| Economic growth | Strong growth leads to higher interest rates. |

| Federal Reserve monetary policy | Interest rate decisions directly impact the rate. |

| Global economic conditions | Global events can influence the demand for Treasury notes. |

| Market sentiment | Investor expectations can drive the rate. |

Table of Strategies for Managing Interest Rate Risk

| Strategy | Description |

|---|---|

| Laddered bond portfolio | Invest in bonds with different maturities to spread risk. |

| Interest rate swaps | Use contracts to hedge against interest rate movements. |

| Adjustable-rate bonds | Invest in bonds with interest rates that fluctuate with market rates. |

| Duration hedging | Employ strategies to reduce portfolio sensitivity to interest rate changes. |

| Active management | Regularly adjust portfolio holdings to manage interest rate risk. |