Introduction

Gold, an iconic precious metal with a rich history, has always captivated the curiosity of investors and economists alike. Its value and price fluctuations have been influenced by various factors, including inflation, economic conditions, and global events. With the year 2025 approaching, many are speculating about the future of gold prices and how they will be affected by the ongoing battle against inflation. This article delves into a comprehensive analysis of gold price forecasts for 2025, examining the interplay between gold and inflation, while exploring investment strategies and future trends.

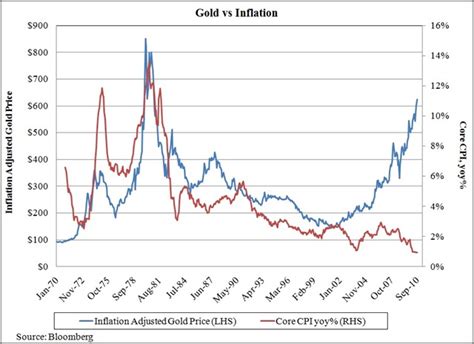

Gold vs Inflation: A Historical Perspective

Historically, gold has been perceived as a hedge against inflation, as its value often rises when the purchasing power of fiat currencies diminishes. When inflation erodes the value of money, investors turn to gold as a haven asset due to its intrinsic value and scarcity. This relationship is supported by data from the World Gold Council, which indicates that the price of gold has exhibited a positive correlation with inflation rates over the past decades.

Factors Influencing Gold Prices

Apart from inflation, several other factors can influence gold prices, including:

- Economic Growth: Strong economic growth typically leads to increased demand for gold as an investment and jewelry.

- Interest Rates: Rising interest rates can reduce the attractiveness of gold as it is a non-interest-bearing asset.

- Geopolitical Events: Uncertainty and geopolitical tensions can drive up gold prices as investors seek safe-haven assets.

- Supply and Demand: Changes in gold production and demand from various sectors (e.g., jewelry, central banks) affect its price.

- Currency Fluctuations: Gold is often influenced by fluctuations in the value of major currencies, particularly the U.S. dollar.

Gold Price Forecasts for 2025

Various industry experts and financial institutions have provided forecasts for the gold price in 2025. Here are some of the key predictions:

- Goldman Sachs: Predicts a gold price of $2,500 per ounce by 2025, citing expectations of rising inflation and geopolitical uncertainty.

- Bank of America: Forecasts a gold price range of $1,900-$2,200 per ounce in 2025, based on moderate inflation and a gradual economic recovery.

- World Gold Council: Projects a gold price of $2,000 per ounce by 2025, assuming a continuation of the current economic and inflationary trends.

Investment Strategies for Gold in 2025

Given the forecasts for 2025, investors may consider the following strategies:

- Physical Gold: Purchasing physical gold bars or coins offers a direct way to invest, providing a tangible asset with intrinsic value.

- Exchange-Traded Funds (ETFs): Gold ETFs track the price of gold and allow investors to buy and sell shares on stock exchanges.

- Gold Mining Stocks: Investing in gold mining companies can provide indirect exposure to gold price movements.

- Diversification: Allocating a portion of an investment portfolio to gold can help diversify and potentially hedge against inflation.

However, investors should remember that gold investments carry risks and should conduct thorough research and consult financial professionals before making decisions.

Future Trends and Innovations in Gold

Technology continues to drive new applications for gold, expanding its use beyond traditional jewelry and investments:

- Nanotechnology: Gold nanoparticles are being used in medical advancements, such as drug delivery and cancer treatment.

- Electronics: Gold is finding applications in flexible electronics and as a conductor in high-performance devices.

- Sustainable Mining: Innovations in mining techniques aim to reduce environmental impact and improve sustainability.

- Virtual Gold: Emerging technologies like blockchain and NFTs are exploring new ways to own and trade digital representations of gold.

Tips and Tricks for Investors

When investing in gold, consider these tips:

- Set Realistic Expectations: Gold prices fluctuate, and it’s unrealistic to expect consistent returns.

- Diversify: Include gold in a balanced portfolio to reduce risk and maximize potential gains.

- Monitor Market Conditions: Keep up with economic and geopolitical events that may impact gold prices.

- Consider a Long-Term Horizon: Gold investments tend to perform well over extended periods, mitigating short-term volatility.

- Store Gold Safely: Choose secure storage options for physical gold or allocate investments to reputable custodians.

Conclusion

As we approach 2025, the gold price is expected to remain influenced by a complex interplay of inflation, economic conditions, and geopolitical factors. Understanding the historical relationship between gold and inflation, as well as the various factors that affect its price, is crucial for investors seeking to navigate the ever-changing financial landscape. By considering the forecasts, investment strategies, and future trends discussed in this article, investors can make informed decisions and potentially capitalize on the opportunities presented by gold in the years to come. Remember, due diligence, financial advice, and a long-term perspective are key to successful gold investment.