Introduction

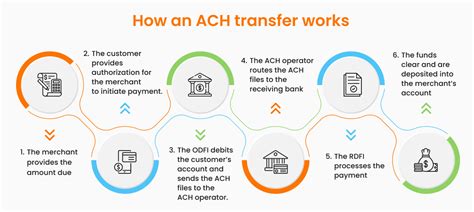

Automated Clearing House (ACH) is an electronic network that facilitates the transfer of funds between bank accounts. In recent years, ACH has emerged as a popular alternative to traditional paper checks, offering faster, more efficient, and more secure payment processing. This article explores the advantages, applications, and future potential of ACH, particularly within the context of Bank of America’s operations.

Advantages of ACH

1. Speed: ACH payments are processed within 1-2 business days, significantly faster than paper checks, which can take several days to clear. This speed is particularly beneficial for businesses that need to receive or disburse funds quickly, such as payroll payments or invoice settlements.

2. Cost-Effectiveness: ACH transactions are generally less expensive than paper checks, as they eliminate the need for physical check processing, postage, and manual labor. According to the Federal Reserve, the average cost of an ACH transaction is $0.24, while the average cost of a paper check is $0.56.

3. Security: ACH transactions are highly secure, as they are processed through encrypted networks and comply with industry-standard security protocols. This reduces the risk of fraud and unauthorized access to funds.

Applications of ACH

ACH has a wide range of applications, including:

1. Direct Deposit: ACH is commonly used for direct deposit of salaries, government benefits, and other recurring payments, ensuring timely and secure delivery of funds.

2. Electronic Bill Payment: ACH allows customers to pay bills online or via mobile banking, eliminating the need for writing and mailing checks. This automation streamlines bill payment processes and reduces the risk of late payments.

3. Electronic Funds Transfer (EFT): ACH facilitates the transfer of funds between different bank accounts, making it a convenient and cost-effective way to send and receive money between individuals and businesses.

ACH vs. Other Payment Methods

1. ACH vs. Paper Checks: As discussed earlier, ACH is faster, more cost-effective, and more secure than paper checks. Additionally, ACH eliminates the need for physical mail delivery, which can be subject to delays or errors.

2. ACH vs. Wire Transfers: While wire transfers are faster than ACH payments, they are also significantly more expensive. Wire transfers typically cost $20-$30, while ACH transactions are typically less than $1.

3. ACH vs. Credit Cards: ACH payments are typically less expensive than credit card payments, which can incur processing fees and interest charges. However, credit cards offer the convenience of revolving credit and rewards programs.

Future of ACH in Bank of America

Bank of America has made significant investments in its ACH platform to enhance speed, security, and accessibility. The bank’s 2025 strategic plan includes several key initiatives focused on leveraging ACH to meet the evolving needs of its customers:

1. Real-Time Payments: Bank of America is exploring the implementation of real-time ACH payments, which would allow funds to be transferred between accounts in a matter of seconds. This would revolutionize the speed of payment processing and benefit businesses and individuals alike.

2. Increased Transaction Limits: The bank is also considering increasing the transaction limits for ACH payments, which would enable larger amounts to be transferred more efficiently. This would address the needs of businesses and individuals who regularly make high-value payments.

3. Enhanced Security Measures: Bank of America is committed to continuously enhancing the security of its ACH platform by implementing the latest fraud detection and risk management technologies. This will ensure the safety of customer funds and protect against unauthorized transactions.

Strategies for Effective ACH Implementation

To effectively implement ACH and maximize its benefits, businesses and individuals should consider the following strategies:

1. Partnership with a Financial Institution: Choose a financial institution that offers reliable and efficient ACH services. Ensure that the institution has a strong track record of security and provides timely and responsive support.

2. Establish Clear Payment Policies: Develop clear guidelines for ACH payments, including the types of transactions that will be processed through ACH, the frequency of payments, and the authorization process. This will streamline the process and reduce errors.

3. Invest in Automation: Utilize automation tools to streamline ACH processing and reduce manual effort. This can improve efficiency, reduce costs, and enhance accuracy.

Tips and Tricks for Using ACH

1. Verify Account Details: Always double-check the account number and routing number of the recipient before initiating an ACH payment. Incorrect information can result in delays or errors.

2. Use Recurring Payments for Convenience: Set up recurring ACH payments for regular expenses, such as rent or utilities, to ensure timely payments and avoid late fees.

3. Monitor Account Activity: Regularly review your bank statements to monitor ACH transactions and identify any unauthorized activity. This will help you detect and address potential fraudulent transactions promptly.

Common Mistakes to Avoid with ACH

1. Exceeding Transaction Limits: Be aware of the transaction limits imposed by your financial institution and avoid exceeding them. Exceeding limits can result in delays or rejected payments.

2. Unauthorized Transactions: Never initiate ACH payments to unfamiliar or untrustworthy recipients. If you suspect fraudulent activity, contact your financial institution immediately.

3. Insufficient Funds: Ensure that your account has sufficient funds to cover ACH payments. Insufficient funds can result in failed transactions and potential fees.

Conclusion

ACH is a powerful and versatile payment processing tool that offers numerous advantages over traditional methods. By leveraging the latest advancements in technology and embracing innovative applications, Bank of America is well-positioned to drive the future of faster payments and revolutionize the way we manage our finances. By understanding the advantages, applications, and best practices of ACH, businesses and individuals can harness its potential to streamline financial operations, reduce costs, and enhance security.