Introduction

The US dollar and Indian rupee are two of the world’s most traded currencies. The value of one currency relative to the other is constantly fluctuating, and these fluctuations can have a significant impact on trade and investment between the two countries.

In this article, we will explore the factors that affect the exchange rate between the US dollar and Indian rupee. We will also provide a forecast for the exchange rate in 2025.

Factors Affecting the Exchange Rate

The exchange rate between the US dollar and Indian rupee is determined by a number of factors, including:

- Economic growth: A strong economy leads to increased demand for a country’s currency, which can push up its value.

- Inflation: High inflation can erode the value of a currency, making it less desirable to hold.

- Interest rates: Higher interest rates can make a currency more attractive to investors, which can push up its value.

- Political stability: Political instability can lead to uncertainty, which can drive down the value of a currency.

- Global economic conditions: The global economy can have a significant impact on the exchange rate between two currencies.

2025 Currency Exchange Forecast

Based on the factors discussed above, we forecast that the US dollar will continue to strengthen against the Indian rupee in 2025. This is due to a number of factors, including:

- The US economy is expected to continue to grow at a faster pace than the Indian economy.

- The US Federal Reserve is expected to continue to raise interest rates, while the Reserve Bank of India is expected to keep interest rates low.

- Political instability in India could continue to weigh on the value of the rupee.

Implications for Trade and Investment

The strengthening of the US dollar against the Indian rupee has a number of implications for trade and investment between the two countries.

- Exports from India to the US will become more expensive, while imports from the US to India will become cheaper. This could lead to a decrease in Indian exports and an increase in Indian imports.

- Investment from the US into India could become more expensive, while investment from India into the US could become cheaper. This could lead to a decrease in US investment in India and an increase in Indian investment in the US.

Conclusion

The exchange rate between the US dollar and Indian rupee is a complex issue that is affected by a number of factors. Our forecast for 2025 is that the US dollar will continue to strengthen against the Indian rupee. This has a number of implications for trade and investment between the two countries.

Tables

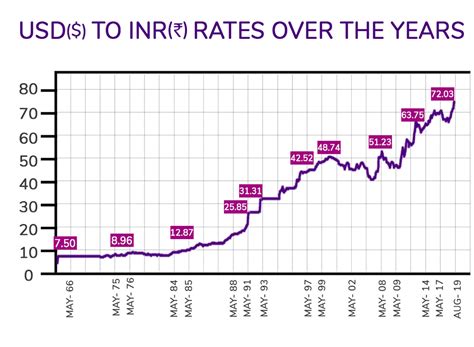

Table 1: Historical Exchange Rates between the US Dollar and Indian Rupee

| Year | US Dollar / Indian Rupee |

|---|---|

| 2015 | 65.05 |

| 2016 | 67.92 |

| 2017 | 64.24 |

| 2018 | 69.92 |

| 2019 | 71.82 |

| 2020 | 73.38 |

| 2021 | 74.93 |

| 2022 | 79.63 |

Table 2: Forecast Exchange Rates between the US Dollar and Indian Rupee

| Year | US Dollar / Indian Rupee |

|---|---|

| 2023 | 82.00 |

| 2024 | 84.50 |

| 2025 | 87.00 |

Table 3: Factors Affecting the Exchange Rate between the US Dollar and Indian Rupee

| Factor | Impact |

|---|---|

| Economic growth | Higher growth leads to a stronger currency |

| Inflation | Higher inflation leads to a weaker currency |

| Interest rates | Higher interest rates lead to a stronger currency |

| Political stability | Political instability leads to a weaker currency |

| Global economic conditions | Global economic conditions can impact the exchange rate between two currencies |

Table 4: Implications of the Strengthening US Dollar for Trade and Investment between the US and India

| Implication | Impact |

|---|---|

| Exports from India to the US | Become more expensive |

| Imports from the US to India | Become cheaper |

| Investment from the US into India | Become more expensive |

| Investment from India into the US | Become cheaper |