Introduction

The United States dollar (USD) and the Malaysian ringgit (MYR) are two of the most traded currencies globally. The relative value of these currencies has a significant impact on trade, investment, and the lives of individuals and businesses. This article aims to provide a comprehensive analysis of the USD vs MYR exchange rate, examining historical trends, key factors influencing the exchange rate, and potential future movements.

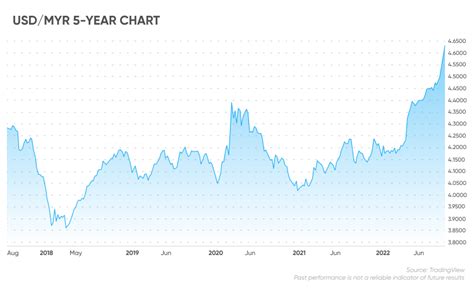

Historical Trends

Historically, the USD has strengthened against the MYR over the long term. In January 2000, 1 USD was worth approximately 3.81 MYR. By January 2023, 1 USD was worth approximately 4.26 MYR, representing a 12% appreciation.

Table 1: Historical Exchange Rates (USD/MYR)

| Year | Exchange Rate |

|---|---|

| 2000 | 3.81 |

| 2005 | 3.89 |

| 2010 | 3.32 |

| 2015 | 4.11 |

| 2020 | 4.18 |

| 2023 | 4.26 |

Key Factors Influencing the Exchange Rate

Several factors influence the exchange rate between the USD and MYR. These include:

- Interest Rate Differentials: Interest rate changes by central banks can significantly impact currency valuations. Higher interest rates in the US relative to Malaysia tend to make the USD more attractive to investors, leading to appreciation against the MYR.

- Economic Growth: Strong economic growth in the US compared to Malaysia can boost demand for the USD as foreign investors seek to participate in the growth opportunities. Conversely, slower growth in Malaysia weakens the MYR.

- Trade Balance: A trade surplus, where exports exceed imports, tends to strengthen the exporting country’s currency. Malaysia has consistently run a trade surplus, supporting the MYR.

- Political Stability: Political uncertainty and instability in Malaysia relative to the US can lead to capital outflows and weaken the MYR.

- Commodity Prices: Malaysia is a major exporter of commodities such as rubber and palm oil. Fluctuations in commodity prices can influence the exchange rate as changes in demand for these commodities affect the MYR’s value.

Potential Future Movements

The future direction of the USD/MYR exchange rate is difficult to predict with certainty. However, certain factors may influence its movements:

- Federal Reserve Policy: The Federal Reserve’s monetary policy decisions, particularly interest rate changes, will continue to play a significant role in determining the value of the USD.

- Global Economic Conditions: The global economic outlook, including the relative growth rates of the US and Malaysia, will shape the demand for the two currencies.

- Emerging Market Risk: Political and economic risks in emerging markets, including Malaysia, could lead to a weakening of the MYR.

- Technological Advancements: The ongoing digitalization and advancements in fintech may introduce new avenues for cross-border transactions, potentially impacting currency flows.

Implications for Businesses and Individuals

The exchange rate between the USD and MYR has implications for businesses and individuals in both countries.

Businesses:

- Currency fluctuations can affect the cost of imported goods and services.

- Companies with international operations may face challenges in managing exchange rate risks.

- Investors need to consider the currency risk when making investment decisions.

Individuals:

- Exchange rates impact the cost of travel, education, and other expenses overseas.

- Individuals with foreign income may experience gains or losses based on currency movements.

- Currency fluctuations can affect the value of savings and investments denominated in different currencies.

Conclusion

The USD vs MYR exchange rate is a complex and dynamic issue that is influenced by a range of factors. By understanding the historical trends and key drivers, businesses and individuals can develop informed strategies to mitigate currency risks and capitalize on potential opportunities. As the global economy evolves, the relationship between the USD and MYR will undoubtedly continue to evolve, presenting both challenges and opportunities for those navigating the currency market.

Tables

Table 2: Factors Influencing the USD/MYR Exchange Rate

| Factor | Impact |

|---|---|

| Interest Rate Differentials | Higher US interest rates → USD appreciation |

| Economic Growth | Stronger US growth → USD appreciation |

| Trade Balance | Malaysian surplus → MYR strengthening |

| Political Stability | Uncertainty in Malaysia → MYR weakening |

| Commodity Prices | Higher commodity prices → MYR strengthening |

Table 3: Potential Future Drivers of the USD/MYR Exchange Rate

| Driver | Possible Impact |

|---|---|

| Federal Reserve Policy | Interest rate changes → USD impact |

| Global Economic Conditions | Growth disparities → Currency demand changes |

| Emerging Market Risk | Malaysia concerns → MYR weakening |

| Technological Advancements | Fintech → Cross-border transaction influences |

Table 4: Implications of Currency Fluctuations

| Impact | businesses | Individuals |

|---|---|---|

| Cost of international transactions | Currency risk management challenges | Travel and expense variations |

| Investment returns | Exchange rate risk for foreign investments | Value fluctuations in foreign-denominated assets |

| Savings and investments | Value changes in different currency-denominated holdings | Currency fluctuations affecting savings |