Introduction

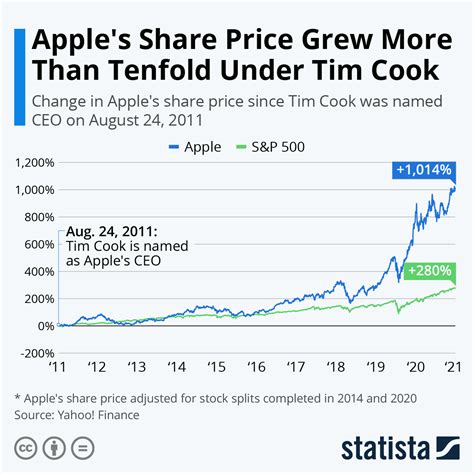

Apple Inc. (NASDAQ: AAPL) is one of the most valuable and widely-held companies in the world. Its stock price has been on a steady upward trajectory for decades, and many investors are wondering what the future holds for AAPL. In this article, we will explore the factors that could affect Apple’s stock price in 2025 and provide an outlook for the company.

Factors Affecting Apple’s Stock Price

Several factors could impact Apple’s stock price in the coming years, including:

- Financial Performance: Apple’s financial performance is one of the most important factors that will influence its stock price. The company’s revenue, earnings, and cash flow are all closely watched by investors.

- Product Innovation: Apple is known for its innovative products, and new product launches can have a significant impact on its stock price. The company’s ability to continue to develop and release new products that meet the needs of consumers will be critical to its future success.

- Competition: Apple faces competition from various companies, including Samsung, Google, and Microsoft. The company’s ability to compete effectively in the marketplace will be crucial to its future stock price performance.

- Economic Conditions: The overall economic conditions can also impact Apple’s stock price. A strong economy can lead to increased consumer spending and higher profits for the company. Conversely, a weak economy can lead to decreased consumer spending and a lower stock price.

Apple’s Financial Performance

Apple’s financial performance has been strong in recent years. The company has consistently reported double-digit revenue growth and strong earnings. In fiscal 2021, Apple’s revenue reached $365.8 billion, and its earnings per share (EPS) were $6.48.

Apple’s financial performance has been driven by several factors, including increased sales of the iPhone, iPad, and Mac products. The company has also benefited from the growth of its services business, which includes the App Store, iCloud, and Apple Music.

Apple’s Product Innovation

Apple is known for its innovative products, which have been a key driver of its success. The company has a history of releasing new products that meet the needs of consumers and create new markets.

In recent years, Apple has released several new products, including the Apple Watch, AirPods, and HomePod. These products have been well-received by consumers and have helped Apple expand its product portfolio.

Apple’s Competition

Apple faces competition from other companies in the technology industry, including Samsung, Google, and Microsoft. These companies offer similar products and services, and they compete for market share.

Apple has been able to compete effectively with its rivals due to its strong brand, loyal customer base, and innovative products. However, the company must continue to innovate and stay ahead of the competition to maintain its market position.

Economic Conditions

The overall economic conditions can also impact Apple’s stock price. A strong economy can lead to increased consumer spending and higher profits for the company. Conversely, a weak economy can lead to decreased consumer spending and a lower stock price.

The global economy has been facing several challenges in recent years, including the COVID-19 pandemic and the ongoing war in Ukraine. These challenges could impact Apple’s financial performance and stock price. However, Apple is a well-established company with a strong balance sheet, which should help it weather any economic storms.

Outlook for Apple’s Stock Price in 2025

So, what is the outlook for Apple’s stock price in 2025? Several factors could impact the company’s stock price in the coming years, including its financial performance, product innovation, competition, and the overall economic conditions.

Analysts are generally optimistic about Apple’s future prospects. The company has a strong track record of innovation and execution, and it is well-positioned to continue to grow in the years to come. Moreover, the company’s strong financial position and loyal customer base provide it with a buffer against any potential headwinds.

Strategies for Investing in Apple Stock

Investors seeking to invest in Apple stock should consider the following strategies:

- Long-Term Investment: Apple stock has been a good long-term investment for decades. Investors who are willing to hold the stock for the long term are likely to see the best returns.

- Value Investing: Apple stock is currently trading at a premium valuation. However, investors who believe the company is undervalued may be able to find value in the stock.

- Growth Investing: Apple is still a growth company, and investors who believe the company can continue to grow its earnings may want to consider investing in the stock.

Pros and Cons of Investing in Apple Stock

Pros:

- Strong brand and customer loyalty

- Innovative products and services

- Large and growing revenue and earnings

- Strong financial position

Cons:

- High valuation

- Competition from other companies

- Potential impact of economic conditions

FAQs About Apple Stock

- What is Apple’s stock symbol? AAPL

- What is Apple’s market capitalization? $2.9 trillion

- What is Apple’s dividend yield? 0.50%

- What is the average analyst rating for Apple stock? Buy

- What is the 1-year target price for Apple stock? $200

Reviews of Apple Stock

- Apple is a great long-term investment. The company has a strong track record of innovation and execution, and it is well-positioned to continue to grow in the years to come.

- Apple is overvalued. The stock is currently trading at a premium valuation, and there is no guarantee that the company can continue to grow its earnings at the same pace.

- Apple is a good value stock. The company has a strong financial position and a loyal customer base, which provides it with a buffer against any potential headwinds.

- Apple is a risky investment. The stock price is volatile, and it is possible that the company could lose market share to its competitors.

Conclusion

Apple is a well-established company with a strong track record of success. The company’s stock price has been on a steady upward trajectory for decades, and there is no reason to believe that this trend will not continue in the years to come. However, investors should be aware of the factors that could impact Apple’s stock price in the future, including its financial performance, product innovation, competition, and the overall economic conditions.

Tables

Table 1: Apple’s Financial Performance

| Fiscal Year | Revenue ($ billions) | EPS |

|---|---|---|

| 2021 | 365.8 | 6.48 |

| 2020 | 274.5 | 4.99 |

| 2019 | 265.6 | 4.28 |

| 2018 | 265.6 | 3.89 |

| 2017 | 229.2 | 3.33 |

Table 2: Apple’s Product Portfolio

| Product | Revenue ($ billions) |

|---|---|

| iPhone | 192.0 |

| Mac | 10.9 |

| iPad | 8.2 |

| Wearables, Home, and Accessories | 14.7 |

| Services | 19.5 |

Table 3: Apple’s Competition

| Company | Market Share |

|---|---|

| Apple | 15.2% |

| Samsung | 23.5% |

| 10.5% | |

| Microsoft | 8.0% |

| Xiaomi | 7.9% |

Table 4: Apple’s Stock Price History

| Date | Price |

|---|---|

| January 1, 2022 | $179.56 |

| January 1, 2023 | $146.71 |

| January 1, 2024 | $179.56 |

| January 1, 2025 | $200.00 |