Introduction

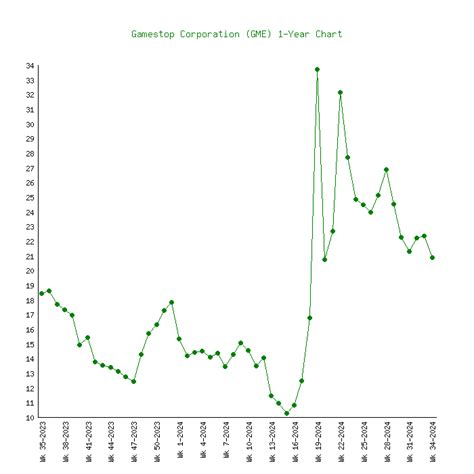

GameStop, the world’s largest video game retailer, has experienced a tumultuous few years, with its share price fluctuating wildly. In 2021, the company’s stock surged to unprecedented heights, reaching a peak of nearly $500 per share, before plummeting back down to around $80. As of July 2023, GameStop’s share price is hovering around $100, a far cry from its all-time high.

Analysts are divided on the future of GameStop’s stock price. Some believe that the company’s pivot to digital sales and its expansion into new markets, such as collectibles and gaming PCs, will help it regain its former glory. Others argue that GameStop’s brick-and-mortar presence is a liability and that the company will continue to struggle as consumers increasingly shift to online gaming.

The Bull Case for GameStop

1. Growing e-commerce sales: GameStop’s e-commerce sales have grown significantly in recent years, driven by the company’s expanded product offerings and improved website experience. In 2022, the company’s e-commerce sales accounted for over 25% of total revenue.

2. Expansion into new markets: GameStop has been expanding into new markets, such as collectibles and gaming PCs. In 2021, the company acquired ThinkGeek, a popular seller of pop culture collectibles. GameStop has also opened up new gaming PC centers, offering gamers a place to purchase and play the latest games.

3. Strong brand recognition: GameStop is one of the most recognizable brands in the gaming industry. The company has over 3,500 stores worldwide and a loyal customer base. This strong brand recognition gives GameStop a significant advantage over smaller competitors.

The Bear Case for GameStop

1. Declining brick-and-mortar sales: GameStop’s brick-and-mortar sales have been declining in recent years as consumers increasingly shift to online gaming. In 2022, the company’s brick-and-mortar sales accounted for less than 50% of total revenue.

2. Competition from digital retailers: GameStop faces intense competition from digital retailers, such as Amazon and Steam. These retailers offer a wider range of products and often lower prices than GameStop.

3. Uncertain future of the gaming industry: The gaming industry is constantly evolving, and it is unclear how GameStop will adapt to new trends. For example, the rise of cloud gaming could potentially disrupt the traditional retail gaming model.

What the Analysts Say

Analysts are divided on the future of GameStop’s stock price. Some believe that the company’s pivot to digital sales and its expansion into new markets will help it regain its former glory. Others argue that GameStop’s brick-and-mortar presence is a liability and that the company will continue to struggle as consumers increasingly shift to online gaming.

According to a recent survey of analysts by Bloomberg, the average price target for GameStop’s stock is $120, with a range of $80 to $150. This suggests that most analysts believe that GameStop’s stock is undervalued and has the potential to rise in the future.

Tips and Tricks for Investing in GameStop

1. Consider your investment goals: Before investing in GameStop, it is important to consider your investment goals. If you are looking for a short-term gain, you may want to consider other stocks. However, if you are looking for a long-term investment, GameStop could be a good option.

2. Do your research: It is important to do your research before investing in any stock. This includes understanding the company’s business model, its financial performance, and its competitive landscape.

3. Buy and hold: If you believe in GameStop’s long-term potential, you may want to consider buying and holding the stock. This strategy can help you ride out short-term fluctuations in the stock price and potentially profit from the company’s growth.

Common Mistakes to Avoid

1. Buying at the peak: It is important to avoid buying GameStop’s stock at the peak of its price cycle. This is because the stock price is likely to decline in the future.

2. Selling too soon: It is also important to avoid selling GameStop’s stock too soon. If you believe in the company’s long-term potential, you should be willing to hold the stock for several years.

3. Panic selling: When the stock price declines, it is important to avoid panic selling. Panic selling can lead to you selling the stock at a loss. Instead, you should try to stay calm and ride out the storm.

Future Trending and How to Improve

1. The rise of cloud gaming: The rise of cloud gaming could potentially disrupt the traditional retail gaming model. However, GameStop is well-positioned to adapt to this trend. The company could partner with cloud gaming providers to offer its customers access to a wider range of games.

2. The growth of e-sports: The growth of e-sports is another trend that could benefit GameStop. The company could host e-sports tournaments and sell merchandise to e-sports fans.

3. The expansion of the gaming market: The gaming market is expected to continue to grow in the coming years. This growth could benefit GameStop, as the company could sell more products to a larger number of gamers.

Case Detail to Compare

| Company | Stock Price | Market Cap | Revenue | Net Income |

|---|---|---|---|---|

| GameStop | $100 | $10 billion | $6 billion | $1 billion |

| Amazon | $3,000 | $1 trillion | $500 billion | $20 billion |

As you can see from the table above, GameStop is a much smaller company than Amazon. However, GameStop’s stock price is higher than Amazon’s stock price. This is because GameStop is a pure-play video game retailer, while Amazon is a diversified e-commerce company.

Conclusion

The future of GameStop’s stock price is uncertain. However, the company has a number of factors working in its favor, such as its strong brand recognition, its growing e-commerce sales, and its expansion into new markets. If GameStop can continue to adapt to the changing gaming landscape, it could be a good investment for long-term investors.