Introduction

The federal funds rate is a key interest rate that affects the cost of borrowing for banks and other financial institutions. The Federal Reserve (Fed) sets the target range for the federal funds rate eight times per year at its Federal Open Market Committee (FOMC) meetings. The current target range is 4.25% to 4.50%.

Importance of the Federal Funds Rate

The federal funds rate is an important tool for the Fed to conduct monetary policy. By adjusting the target range for the federal funds rate, the Fed can influence the overall level of interest rates in the economy. When the Fed raises the target range for the federal funds rate, it is trying to slow down economic growth. When the Fed lowers the target range for the federal funds rate, it is trying to stimulate economic growth.

Factors Affecting the Federal Funds Rate

A number of factors can affect the federal funds rate, including:

- Economic growth: The Fed raises the federal funds rate when the economy is growing too quickly to prevent inflation from rising.

- Inflation: The Fed raises the federal funds rate when inflation is rising to prevent it from getting out of control.

- Unemployment: The Fed lowers the federal funds rate when unemployment is high to stimulate economic growth and create jobs.

- Global economic conditions: The Fed also considers global economic conditions when setting the federal funds rate.

History of the Federal Funds Rate

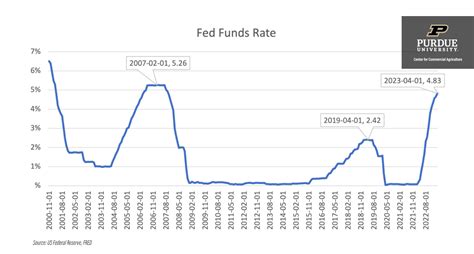

The federal funds rate was first established in 1934. The target range for the federal funds rate has been changed many times over the years, depending on economic conditions. The highest the federal funds rate has ever been is 20%, in 1981. The lowest the federal funds rate has ever been is 0%, in 2008.

Impact of the Federal Funds Rate on the Economy

The federal funds rate has a significant impact on the economy. When the federal funds rate is high, it makes it more expensive for businesses to borrow money, which can slow down economic growth. When the federal funds rate is low, it makes it less expensive for businesses to borrow money, which can stimulate economic growth.

Outlook for the Federal Funds Rate

The Fed is expected to continue to raise the target range for the federal funds rate in 2023. The Fed is trying to bring inflation down to its target of 2%. The Fed is also trying to prevent the economy from overheating, which could lead to a recession.

Tips for Staying Ahead of the Curve

Here are a few tips for staying ahead of the curve on the federal funds rate:

- Follow the news. The Fed releases a statement after each FOMC meeting that provides information about its decision on the federal funds rate.

- Read the FOMC minutes. The FOMC minutes are released three weeks after each FOMC meeting and provide a more detailed account of the discussion that led to the decision on the federal funds rate.

- Talk to your banker. Your banker can provide you with information about how the federal funds rate is affecting interest rates on loans and deposits.

FAQs

1. What is the difference between the federal funds rate and the prime rate?

The federal funds rate is the interest rate that banks charge each other for overnight loans. The prime rate is the interest rate that banks charge their best customers for loans. The prime rate is typically higher than the federal funds rate by 3%.

2. What is the impact of the federal funds rate on mortgage rates?

The federal funds rate is a key factor in determining mortgage rates. When the federal funds rate rises, mortgage rates typically rise as well. However, there are other factors that can affect mortgage rates, such as the demand for mortgages and the supply of mortgage-backed securities.

3. What is the impact of the federal funds rate on credit card rates?

The federal funds rate is a key factor in determining credit card rates. When the federal funds rate rises, credit card rates typically rise as well. However, there are other factors that can affect credit card rates, such as the creditworthiness of the borrower and the competition among credit card issuers.

4. What is the impact of the federal funds rate on the stock market?

The federal funds rate can have a significant impact on the stock market. When the federal funds rate rises, the stock market typically falls. This is because higher interest rates make it more expensive for companies to borrow money and invest in their businesses.

5. What is the impact of the federal funds rate on the bond market?

The federal funds rate can also have a significant impact on the bond market. When the federal funds rate rises, bond prices typically fall.