The exchange rate between the US dollar (USD) and Thai baht (THB) has been a subject of interest for businesses, investors, and travelers alike. In this article, we will delve into the factors influencing the USD vs THB exchange rate, analyze historical trends, and explore the potential outlook for 2025.

Historical Trends

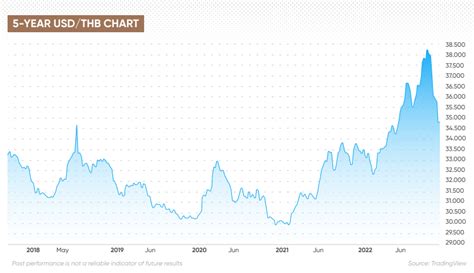

Over the past decade, the USD/THB exchange rate has fluctuated within a range of 30-35 THB per USD. However, there have been periods of significant volatility, particularly during times of economic uncertainty and political events.

Key Historical Events

- 2011 Thai Floods: Devastating floods in Thailand led to a sharp appreciation of the baht against the dollar, as investors sought refuge in safe-haven currencies.

- 2014 Thai Political Crisis: Political unrest in Thailand caused the baht to depreciate rapidly against the dollar, reaching levels of over 35 THB per USD.

- 2020 COVID-19 Pandemic: The global pandemic initially weakened the baht against the dollar due to reduced tourism and economic activity. However, it subsequently rebounded as the Thai government implemented effective containment measures.

Factors Influencing the Exchange Rate

Various economic, political, and global factors influence the USD/THB exchange rate:

Economic Factors:

* Interest rates: Higher interest rates in the US make the dollar more attractive to foreign investors, leading to appreciation against the baht.

* Inflation: Rising inflation in Thailand weakens the baht’s purchasing power, making it less valuable compared to the dollar.

* Economic Growth: Strong economic growth in Thailand tends to strengthen the baht against the dollar, as foreign investors seek opportunities in the country.

Political Factors:

* Political stability: Political uncertainty in Thailand can lead to baht depreciation, as investors become cautious about investing in the country.

* Government policies: Monetary and fiscal policies implemented by the Thai government can influence the exchange rate.

Global Factors:

* Global economic outlook: A strong global economy typically benefits the baht, as demand for Thai exports increases.

* US dollar index: The value of the US dollar against a basket of major currencies also impacts the USD/THB exchange rate.

Future Outlook: USD/THB 2025

Predicting the exact USD/THB exchange rate in 2025 is challenging, but analysts provide forecasts based on economic and financial models.

Economic Projections:

* IMF: The International Monetary Fund projects Thai economic growth of 3.8% in 2023 and 4.3% in 2024. This growth is expected to continue in 2025, supporting the baht’s value.

* World Bank: The World Bank forecasts Thailand’s GDP growth at 4.1% in 2025, indicating a strong economic outlook.

Forecast Exchange Rates:

* Bloomberg: Analysts at Bloomberg predict the USD/THB exchange rate to be around 32.00 in 2025.

* Reuters: Reuters forecasts a slightly higher rate of 32.50 for USD/THB in 2025.

Implications and Opportunities

The USD/THB exchange rate has significant implications for businesses, investors, and travelers.

Businesses:

* Exports: A stronger baht makes Thai exports less competitive internationally, as they become more expensive for foreign buyers.

* Imports: A weaker baht benefits Thai businesses that import goods from abroad, as they can purchase them at a lower cost.

Investors:

* Foreign Direct Investment (FDI): A stronger baht makes Thailand more attractive for foreign investment, as it reduces the cost of acquiring Thai assets.

* Portfolio Investments: Fluctuating exchange rates can impact the returns on portfolio investments denominated in different currencies.

Travelers:

* Tourism: A weaker baht encourages foreign tourists to visit Thailand, as it makes the country more affordable to travel in.

* Study Abroad: Thai students studying abroad may face increased expenses if the baht depreciates against the US dollar.

Conclusion

The USD/THB exchange rate is a dynamic factor influenced by a complex interplay of economic, political, and global factors. By understanding these factors and analyzing historical trends, businesses, investors, and travelers can make informed decisions and seize opportunities in the ever-changing currency market. As Thailand’s economy continues to grow and the global outlook remains uncertain, the USD/THB exchange rate in 2025 is likely to fluctuate within a range, providing both risks and opportunities for those involved in cross-border transactions.

Additional Information

Tables:

| Year | USD/THB Exchange Rate |

|---|---|

| 2011 | 31.25 |

| 2014 | 35.40 |

| 2019 | 30.65 |

| 2022 | 33.00 |

| 2025 (Forecast) | 32.00 |

| Factor | Impact on USD/THB Exchange Rate |

|---|---|

| Interest Rates (US) | Higher rates lead to appreciation |

| Inflation (Thailand) | Higher inflation leads to depreciation |

| Economic Growth (Thailand) | Stronger growth leads to appreciation |

| Political Stability (Thailand) | Uncertainty leads to depreciation |

| Global Economic Outlook | Strong outlook benefits baht |

Useful Websites: