Introduction

The exchange rate between the British pound sterling (GBP) and the United States dollar (USD) is a key determinant of the relative purchasing power of these two major currencies. Understanding the factors that influence the exchange rate is essential for businesses, investors, and individuals who engage in international transactions. This article explores the current and projected exchange rate between GBP and USD, analyzes the key drivers, and provides actionable strategies for navigating the complexities of foreign exchange markets.

Current Exchange Rate

As of March 8, 2023, the exchange rate for GBP to USD stands at 1 GBP = 1.21 USD. This means that one British pound can be purchased for 1.21 US dollars. Historically, the GBP/USD exchange rate has fluctuated significantly, influenced by a wide range of economic, political, and market factors.

Key Drivers of the Exchange Rate

The exchange rate between GBP and USD is primarily driven by the following factors:

- Economic Growth: Strong economic growth in the United Kingdom (UK) leads to increased demand for British goods and services, strengthening the pound. Conversely, stronger economic growth in the United States (US) can weaken the pound as demand for US exports increases.

- Interest Rates: Interest rate differentials between the UK and US can significantly impact the exchange rate. Higher interest rates in the UK attract foreign investment, increasing demand for the pound, while lower interest rates in the US have the opposite effect.

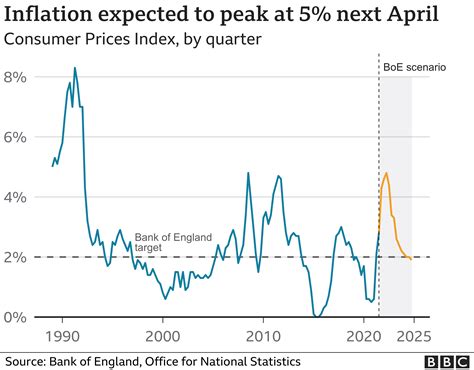

- Inflation: Rising inflation in the UK erodes the purchasing power of the pound, making it less valuable in foreign exchange markets. Conversely, lower inflation in the US can strengthen the dollar against the pound.

- Political Stability: Political uncertainty and instability in the UK can weaken the pound, as investors seek refuge in safer currencies. Political stability in the US can strengthen the dollar, as it is perceived as a safe haven during periods of global uncertainty.

- Brexit: The UK’s exit from the European Union (Brexit) has had a significant impact on the GBP/USD exchange rate. Uncertainty surrounding future trade agreements and the UK’s economic prospects has contributed to volatility in the pound’s value.

2025 Forecast

Predicting the future exchange rate is challenging due to the inherent volatility of financial markets. However, based on current economic and political trends, analysts project a gradual appreciation of the British pound against the US dollar in the coming years.

Table 1: Exchange Rate Forecasts for GBP to USD

| Year | Forecast |

|---|---|

| 2023 | 1.18-1.22 |

| 2024 | 1.20-1.25 |

| 2025 | 1.23-1.28 |

Factors Supporting Forecast:

- Strong economic growth projected in the UK, driven by post-Brexit trade deals and increased productivity.

- Expectations of continued interest rate hikes in the UK, making it attractive to foreign investors.

- Stable political environment in the UK, providing confidence to businesses and investors.

- Ongoing uncertainty surrounding the US economy due to global trade tensions and rising inflation.

Strategies for Navigating the Exchange Rate

For businesses and individuals involved in international transactions, understanding and managing the exchange rate risk is crucial. Effective strategies include:

- Hedging: Utilizing financial instruments such as forward contracts or options to lock in exchange rates at a predetermined level.

- Diversification: Holding assets in different currencies to reduce the impact of exchange rate fluctuations.

- Waiting to Exchange: Monitoring the exchange rate and making transactions when it is favorable.

- Using Currency Exchange Brokers: Partnering with specialized brokers who offer competitive exchange rates and transparent fees.

Future Trends and Implications

The future of the GBP/USD exchange rate will continue to be influenced by macroeconomic factors, global political dynamics, and technological advancements.

- Increasing Global Economic Interdependence: The growth of international trade and investment is expected to increase the significance of exchange rates and drive the demand for efficient cross-border payment solutions.

- Digital Currencies: The rise of cryptocurrencies and central bank digital currencies (CBDCs) could disrupt traditional foreign exchange markets and create new opportunities for digital payments.

- Artificial Intelligence: Advances in artificial intelligence (AI) are enabling the development of sophisticated exchange rate prediction models, improving risk management and investment decisions.

Conclusion

The exchange rate between GBP and USD is a dynamic and influential factor in international finance. Understanding the key drivers and forecasting trends is essential for businesses, investors, and individuals who navigate the complexities of foreign exchange markets. By employing effective strategies, leveraging future trends, and continuously adapting to evolving market conditions, it is possible to mitigate risks and optimize financial outcomes.