Introduction

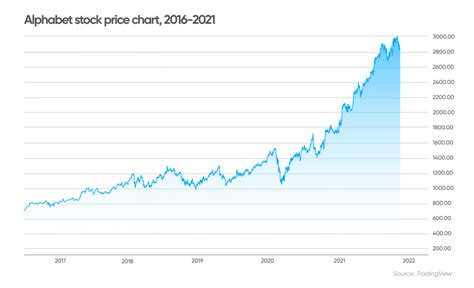

Alphabet Inc. (GOOGL, GOOG) is the parent company of Google, YouTube, and other tech giants. It’s one of the most valuable companies in the world, with a market cap of over $1.5 trillion. In recent years, Alphabet’s stock price has soared, fueled by strong growth in advertising revenue, cloud computing, and artificial intelligence.

Factors Affecting Alphabet’s Stock Price

Several factors could affect Alphabet’s stock price in the coming years, including:

- Advertising revenue: Alphabet’s primary source of revenue is advertising. The company’s ability to maintain and grow its market share in the digital advertising market will be critical to its future financial performance.

- Cloud computing: Alphabet’s cloud computing platform, Google Cloud, is one of the fastest-growing businesses in the company. The continued growth of Google Cloud could drive significant revenue and profit growth for Alphabet.

- Artificial intelligence: Alphabet is a leader in the field of artificial intelligence. The company’s investments in AI could lead to the development of new products and services that could drive future growth.

Alphabet Stock Price Forecast 2025

Analysts are generally optimistic about Alphabet’s stock price forecast for 2025. Many believe that the company’s continued growth in advertising, cloud computing, and AI will drive strong financial performance in the coming years.

According to a recent report from Bank of America, Alphabet’s stock price could reach $3,500 by 2025. This would represent a significant increase from the current price of around $3,000.

Other analysts are also bullish on Alphabet’s stock. Morgan Stanley recently set a price target of $3,200 for Alphabet by 2025.

Factors That Could Impact Alphabet’s Stock Price

While the consensus is generally optimistic, there are a few factors that could impact Alphabet’s stock price in the coming years. These include:

- Competition: Alphabet faces competition from other tech giants such as Amazon, Apple, and Microsoft. Increased competition could pressure Alphabet’s margins and slow its growth.

- Regulation: Alphabet is facing increased regulatory scrutiny over its privacy practices and market power. New regulations could impact the company’s business and profitability.

- Economic downturn: An economic downturn could lead to decreased advertising spending by businesses, which could impact Alphabet’s revenue and profits.

How to Invest in Alphabet

There are several ways to invest in Alphabet, including:

- Buying Alphabet stock: You can buy Alphabet stock directly through a brokerage account.

- Investing in an ETF that includes Alphabet: There are several ETFs that include Alphabet stock, such as the SPDR Technology Select Sector ETF (XLK) and the iShares Core S&P 500 ETF (IVV).

- Investing in a mutual fund that includes Alphabet: There are several mutual funds that include Alphabet stock, such as the Fidelity Contrafund (FCNTX) and the Vanguard Total Stock Market Index Fund (VTI).

Tips for Investing in Alphabet

Here are a few tips for investing in Alphabet:

- Do your research: Before investing in Alphabet, it is crucial to research the company and its business model.

- Consider your investment goals: Determine your investment goals and how Alphabet fits into your overall portfolio.

- Diversify your investments: Don’t put all your eggs in one basket. Consider diversifying your investments by investing in other stocks and asset classes.

- Monitor your investments: Once you’ve invested in Alphabet, it is crucial to monitor your investments regularly. This will help you stay on top of the company’s performance and make any necessary adjustments to your portfolio.

Conclusion

Alphabet is a well-established company with a strong track record of growth. The company’s leadership in advertising, cloud computing, and AI positions it well for continued success in the coming years.