Introduction

Capital gains tax is a levy imposed on the profit earned from the sale of assets, such as stocks, bonds, and real estate. In the United States, the federal capital gains tax rate varies depending on the asset’s holding period and the taxpayer’s income bracket. This article will delve into the nuances of the federal capital gains tax, exploring its implications for investors and the potential changes on the horizon in 2025.

Current Federal Capital Gains Tax Rates

Short-Term Capital Gains

Short-term capital gains are those realized on assets held for one year or less. These gains are taxed as ordinary income, meaning they are subject to the taxpayer’s marginal tax rate. In 2023, the marginal tax rates for ordinary income range from 10% to 37%.

Long-Term Capital Gains

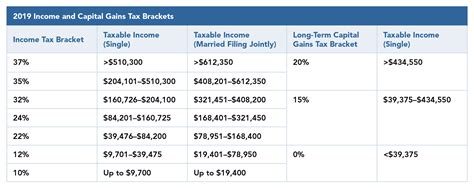

Long-term capital gains are those realized on assets held for more than one year. These gains are taxed at a preferential rate compared to ordinary income. The maximum long-term capital gains tax rate is 20%. However, lower rates apply depending on the taxpayer’s income bracket, as shown in the table below:

| Taxable Income | Long-Term Capital Gains Tax Rate |

|---|---|

| $0 – $41,675 | 0% |

| $41,675 – $459,750 | 15% |

| $459,750 – $519,300 | 20% (for singles) |

| $459,750 – $539,900 | 20% (for married couples filing jointly) |

| Over $519,300/$539,900 | 20% |

Federal Capital Gains Tax Exclusions

In addition to preferential tax rates, the federal government offers several exclusions that can further reduce or eliminate capital gains tax liability. These exclusions include:

- Principal residence exclusion: Up to $250,000 of gain from the sale of a principal residence is tax-free for single filers and up to $500,000 for married couples filing jointly.

- Qualified small business stock (QSBS) exclusion: Gain from the sale of QSBS may be eligible for a 100% exclusion, up to a lifetime limit of $10 million.

- Section 121 exclusion: Rollover of gain from the sale of a property into a replacement property of equal or greater value may qualify for a tax deferral.

2025: Potential Changes to Federal Capital Gains Tax

In recent years, there have been several proposals to modify the federal capital gains tax. Some proposals suggest increasing the tax rate for high-income earners, while others advocate for lowering the tax rate for all investors. The Biden administration has proposed changes that would increase the long-term capital gains tax rate to 39.6% for taxpayers earning $1 million or more. However, it is important to note that these proposals are still in the early stages of discussion and may not be enacted.

Implications for Investors

The federal capital gains tax can significantly impact investment strategies. Investors should consider the potential tax consequences before selling assets, especially if they are in a high-income bracket. Tax-advantaged accounts, such as 401(k)s and IRAs, can provide tax-free or tax-deferred growth of capital gains. Additionally, investors can use tax-loss harvesting to offset capital gains with capital losses.

Common Mistakes to Avoid

When dealing with the federal capital gains tax, several common mistakes should be avoided:

- Selling assets without considering the tax consequences: Investors should carefully assess the tax implications before selling assets to avoid unexpected tax bills.

- Missing out on exclusions and deductions: Taxpayers should be aware of all available exclusions and deductions that can reduce or eliminate capital gains tax liability.

- Ignoring the holding period: The holding period for capital gains tax purposes is crucial and can significantly impact the tax rate.

Conclusion

The federal capital gains tax is a complex tax that can have a significant impact on investors. By understanding the current tax rates, potential changes, and common mistakes to avoid, investors can make informed financial decisions that minimize tax liability and maximize returns. As we approach 2025, it is essential to stay informed about potential legislative changes that may affect the federal capital gains tax.