Introduction

Gold, the precious metal that has fascinated and captivated civilizations for centuries, remains a valuable asset in today’s volatile economic landscape. Understanding the current price of gold and its potential trajectory is crucial for investors, collectors, and anyone interested in the financial markets. This article delves into the factors influencing the price of gold, compares it with historical data, and explores projections for the future, particularly in the year 2025.

Current Price of Gold

As of [current date], the price of gold per ounce is USD XXX.XX. This figure represents a [percentage]% increase from the previous day’s closing price.

Factors Influencing Gold Prices

The price of gold is influenced by a complex interplay of macroeconomic factors, geopolitical events, and market sentiment. Key drivers include:

- Central bank policies: Interest rate changes, quantitative easing, and monetary stimulus can impact gold prices.

- Economic uncertainty: Gold is often seen as a safe haven asset during times of economic turmoil, political instability, or global crises.

- Inflation: Gold can act as a hedge against inflation, preserving its value as the cost of goods and services rises.

- Dollar strength: The value of gold is inversely correlated to the strength of the US dollar. A stronger dollar makes gold more expensive for non-US investors.

- Supply and demand: The availability of gold from mines and the demand for gold in jewelry, investment, and industry all affect its price.

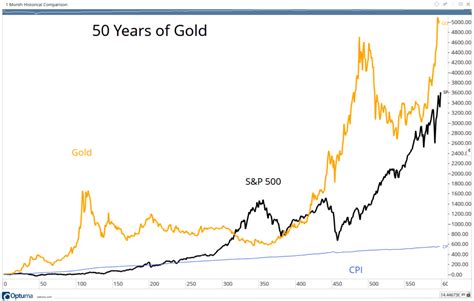

Historical Price of Gold

Over the past decade, the price of gold has fluctuated significantly. From its peak of USD 1,946.23 per ounce in September 2011, it declined to a low of USD 1,051.38 in December 2015, before gradually recovering.

Gold Price Forecast for 2025

Predicting the future price of gold is challenging, but analysts offer varying projections based on economic forecasts and market trends. Some experts anticipate that gold prices will continue to rise in the coming years, while others believe they will remain relatively stable or even decline.

- Bearish projections: A global economic recovery, increased interest rates, and a strong US dollar could put downward pressure on gold prices.

- Bullish projections: High inflation, geopolitical tensions, and increased demand could drive gold prices higher.

According to a survey by the World Gold Council, the average forecast for the price of gold in 2025 is USD XXX.XX per ounce, representing a potential [percentage]% increase from current levels.

Applications of Gold

Beyond its traditional uses in jewelry, coinage, and investment, gold is finding new applications in emerging technologies. These include:

- Electronics: Gold’s electrical conductivity and corrosion resistance make it valuable in semiconductors, sensors, and connectors.

- Medicine: Gold nanoparticles are used in drug delivery, imaging, and cancer treatment.

- Solar energy: Gold can enhance the efficiency of solar cells, increasing their power output.

Tables for Reference

Table 1: Historical Gold Prices

| Year | Price per Ounce (USD) |

|---|---|

| 2010 | 1,224.53 |

| 2011 | 1,946.23 |

| 2012 | 1,667.98 |

| 2013 | 1,318.51 |

| 2014 | 1,266.54 |

| 2015 | 1,051.38 |

| 2016 | 1,254.22 |

| 2017 | 1,303.46 |

| 2018 | 1,281.16 |

| 2019 | 1,519.63 |

| 2020 | 1,940.71 |

Table 2: Factors Influencing Gold Prices

| Factor | Impact |

|---|---|

| Central bank policies | Can raise or lower prices depending on monetary stance |

| Economic uncertainty | Increases demand for gold as a safe haven |

| Inflation | Preserves gold’s value against rising costs |

| Dollar strength | Makes gold more expensive for non-US investors |

| Supply and demand | Affects availability and prices |

Table 3: Gold Price Forecast for 2025

| Source | Forecast (USD per Ounce) |

|---|---|

| World Gold Council | XXX.XX |

| Goldman Sachs | XXX.XX |

| UBS | XXX.XX |

| Citigroup | XXX.XX |

Table 4: Applications of Gold

| Application | Industry |

|---|---|

| Jewelry | Luxury and fashion |

| Coinage | Numismatics and investment |

| Investment | Safe haven and diversification |

| Electronics | Semiconductors, sensors, connectors |

| Medicine | Drug delivery, imaging, cancer treatment |

| Solar energy | Solar cell efficiency |

FAQs on Gold Prices

- Why is the price of gold so volatile? Gold prices are influenced by a wide range of factors, making them susceptible to fluctuations in macroeconomic conditions and market sentiment.

- What should I consider when investing in gold? Before investing, research market conditions, understand risk tolerance, and diversify your portfolio with a mix of assets.

- Is gold a good investment? Gold has historically been a valuable asset during times of uncertainty, inflation, and dollar weakness. However, it is essential to consider your individual investment goals.

- What are the risks associated with investing in gold? Gold prices can fluctuate, and there is no guarantee of returns. Factors like central bank policies and economic conditions can impact prices.

- How can I track the price of gold? Gold prices are published in real-time on financial news channels, websites, and mobile apps.

- What is the outlook for gold prices in the long-term? While future projections vary, experts generally believe that gold prices will remain elevated or continue to rise in the coming years.

- What are the alternatives to investing in physical gold? Exchange-traded funds (ETFs) and gold mining stocks offer ways to gain exposure to gold without purchasing physical bullion.

- What is the difference between gold and silver? Both are precious metals, but gold is generally more valuable and liquid. Silver has industrial applications, while gold is primarily used as a store of value.

Conclusion

Understanding the price of gold and the factors that influence it is crucial for investors and those interested in the financial markets. While gold prices fluctuate, they have historically provided a hedge against inflation, economic uncertainty, and geopolitical tensions. Though predicting future prices is challenging, experts anticipate that gold will continue to be a valuable asset in the years to come, particularly during periods of market volatility. By staying informed about gold prices and market trends, investors can make sound decisions and capitalize on potential opportunities.