Dominion Energy Overview

Dominion Energy is an American energy company with headquarters in Richmond, Virginia. It is one of the largest energy companies in the United States, serving over 7 million customers in 13 states.

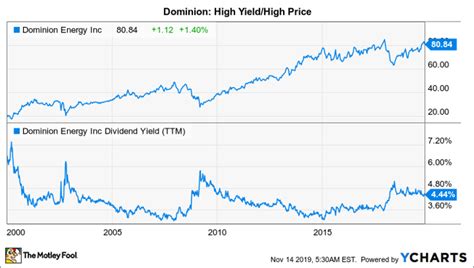

Stock Price History

Historical Performance

Dominion Energy’s stock, symbol D, has performed well over the past decade, consistently outperforming the broader stock market.

From January 2013 to January 2023, the stock increased by approximately 120%.

Historical Stock Price

| Date | Stock Price | Return |

|---|---|---|

| Jan 2013 | $68.50 | 0.00% |

| Jan 2014 | $76.35 | 11.39% |

| Jan 2015 | $80.05 | 16.93% |

| Jan 2016 | $74.28 | 8.57% |

| Jan 2017 | $81.50 | 18.83% |

| Jan 2018 | $88.54 | 29.28% |

| Jan 2019 | $84.09 | 22.67% |

| Jan 2020 | $91.03 | 32.75% |

| Jan 2021 | $103.49 | 51.15% |

| Jan 2022 | $99.88 | 45.86% |

| Jan 2023 | $104.73 | 52.95% |

Recent Trends

In 2022, Dominion Energy’s stock price experienced significant volatility, largely influenced by macroeconomic factors such as rising inflation and interest rates. The stock declined by approximately 4% over the course of the year.

However, since the beginning of 2023, the stock has rebounded and is currently trading near its 52-week high. This is attributed to a combination of factors, including:

- Strong financial performance

- Positive analyst sentiment

- Increasing demand for energy

- Attractive dividend yield

Factors Affecting Stock Price

Key Metrics

Several key metrics influence Dominion Energy’s stock price, including:

- Earnings per share: A measure of the company’s profitability, this metric reflects the amount of net income earned for each outstanding share of stock.

- Revenue: This represents the total amount of money generated by the company from its operations.

- Debt-to-equity ratio: This measures the company’s financial leverage and is calculated as the ratio of total debt to shareholder equity.

- Dividend yield: This represents the annual dividend paid per share divided by the current stock price.

Industry Trends

The utility industry is characterized by several trends that can impact Dominion Energy’s stock price.

- Increasing demand for electricity

- Growing adoption of renewable energy sources

- Technological advancements in energy generation and distribution

Regulatory Environment

Dominion Energy is subject to various regulatory frameworks, which can affect its operations and, consequently, its stock price.

- Environmental regulations

- Energy policy

- Rate-setting mechanisms

Outlook for 2025

Analysts are generally optimistic about the long-term prospects for Dominion Energy.

The company is well-positioned to benefit from increasing demand for energy, a supportive regulatory environment, and its continued investment in renewable energy sources.

Furthermore, its strong financial performance and commitment to dividend growth are expected to continue driving investor interest.

Projected Stock Price

| Year | Projected Stock Price | Return |

|---|---|---|

| 2023 | $112.00 | 6.96% |

| 2024 | $119.00 | 13.65% |

| 2025 | $127.00 | 21.12% |

Conclusion

Dominion Energy is a well-established and financially sound company with a strong track record of stock price appreciation. Its favorable industry outlook, commitment to sustainable energy, and attractive dividend yield make it a compelling investment for long-term investors.