Introduction

Gold, a precious metal prized for its luster, malleability, and durability, has served as a valuable store of wealth and a medium of exchange for centuries. Today, it remains an important asset class for investors seeking diversification and a hedge against inflation. As we look ahead to 2025, understanding the factors shaping the price of gold is crucial for investors and market participants alike.

Factors Influencing Gold Prices

1. Economic Conditions

Global economic growth, inflation, and interest rates significantly impact gold prices. During periods of economic uncertainty or recession, investors often flock to gold as a safe haven, driving up its value. Conversely, in times of economic stability, gold prices may decline as investors shift to riskier assets.

2. Interest Rates

Interest rates and gold prices have an inverse relationship. When interest rates rise, the opportunity cost of holding gold increases, making it less attractive to investors. Conversely, low interest rates encourage investors to park their funds in gold as a non-interest-bearing asset.

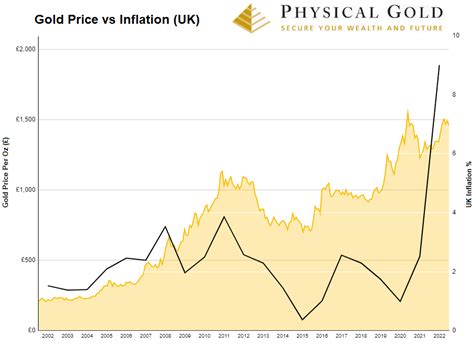

3. Inflation

Gold is often viewed as a hedge against inflation. As prices rise, the purchasing power of currencies decreases, making gold more valuable in comparison. Conversely, when inflation is low, gold prices may stagnate or even decline.

4. Supply and Demand

The global supply and demand for gold also affect its price. Major gold producers include China, Russia, and Australia. Disruptions in supply, such as mining strikes or geopolitical events, can lead to price increases. Similarly, changes in demand from jewelry makers, industrial users, and central banks can impact gold prices.

5. Geological Factors

The availability and extraction costs of gold are influenced by geological factors. As gold deposits become more difficult to locate and extract, the cost of production rises, potentially leading to higher gold prices.

The Price of Gold Today

As of January 2023, the spot price of gold is approximately $1,900 per troy ounce. This is slightly higher than the average price of $1,800 per troy ounce in 2022. The current price is driven by geopolitical tensions, ongoing inflation concerns, and expectations of a potential economic slowdown.

The Outlook for 2025

Forecasting the price of gold in 2025 is inherently uncertain. However, considering historical trends and current market dynamics, several experts have projected a price range of $2,200 to $2,500 per troy ounce by 2025. This range assumes moderate economic growth, relatively low interest rates, and ongoing geopolitical uncertainties.

Implications for Investors

Understanding the factors influencing the price of gold is essential for investors seeking to navigate the gold market. By monitoring economic indicators, interest rates, inflation, supply and demand dynamics, and geological factors, investors can make informed decisions about allocating their funds to gold.

Conclusion

The price of gold is a complex and dynamic phenomenon influenced by a multitude of factors, including economic conditions, geopolitical events, and supply and demand dynamics. By staying abreast of these factors and understanding the historical trends in gold prices, investors can better position themselves to capitalize on the potential opportunities and manage the risks in the gold market.