Introduction

The exchange rate between the US dollar (USD) and the Mexican peso (MXN) is a crucial factor in international trade, tourism, and investment. Understanding the historical trends, current dynamics, and future projections of this currency pair is essential for businesses, individuals, and policymakers. This comprehensive guide provides an in-depth analysis of the dollar-to-peso exchange rate, exploring its past behavior, present factors, and potential trajectory.

Historical Trends: A Rollercoaster Ride

The dollar-to-peso exchange rate has exhibited significant volatility over the years, reflecting economic conditions, political events, and global market fluctuations.

- 1990-2000: Stability and Appreciation

During this period, the peso remained relatively stable against the dollar, hovering around 3-5 MXN per USD. Mexico’s economic reforms and increased exports contributed to this stability.

- 2001-2010: Depreciation and Fluctuations

The peso underwent a period of depreciation, weakening to over 10 MXN per USD due to economic slowdowns, political instability, and a global financial crisis.

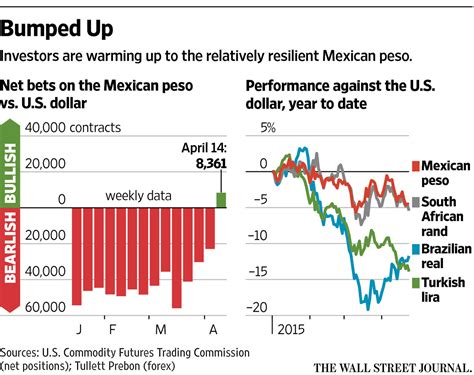

- 2011-2015: Appreciation and Stability

A combination of favorable economic conditions, a surging oil market, and reforms led to a peso appreciation, strengthening to around 12-15 MXN per USD.

- 2016-2020: Volatility and Depreciation

The peso experienced sharp fluctuations and a general depreciation trend due to political uncertainty, trade tensions, and the COVID-19 pandemic.

Current Dynamics: Influential Factors

The current exchange rate between the dollar and the peso is shaped by a complex interplay of economic, political, and market forces.

- Economic Growth and Inflation

Mexico’s economic growth rate and inflation levels directly impact the peso’s value. Strong economic growth leads to currency appreciation, while high inflation weakens it.

- Interest Rates

The difference in interest rates between the US and Mexico affects the exchange rate. Higher interest rates in the US attract foreign capital, increasing demand for the peso.

- Trade and Remittances

Mexico’s trade surplus with the US and the significant remittances sent by Mexican workers abroad contribute to peso strength.

- Political Risk and Uncertainty

Political events and policy shifts can significantly influence the exchange rate. Uncertainty and instability tend to weaken the peso.

Future Forecast: Medium-Term Outlook

Predicting the future of the dollar-to-peso exchange rate is challenging, but analysts offer some insights:

- Gradual Appreciation

The Mexican peso is expected to gradually appreciate against the dollar in the medium term (2021-2025). This is supported by expected economic growth, stable inflation, and a more favorable political climate.

- Exchange Rate Volatility

However, the exchange rate is likely to remain volatile, influenced by global economic events, interest rate fluctuations, and political developments.

- Factors to Watch

Key factors to monitor include US interest rate policy, Mexican economic growth, oil prices, and global market conditions.

Tips and Tricks: Maximizing Value

For individuals and businesses dealing with currency exchange, understanding the factors influencing the dollar-to-peso exchange rate is crucial. Here are some practical tips:

- Track Exchange Rates

Regularly monitor exchange rate trends to identify favorable times for transactions.

- Shop Around for Best Rates

Compare exchange rates offered by different institutions to secure the most competitive deals.

- Use Currency Conversion Tools

Utilize online tools or apps to calculate accurate currency conversions and identify potential savings.

- Consider Forward Contracts

If you plan a future currency exchange, locking in the exchange rate today with a forward contract can protect you against adverse market movements.

How to Convert Dollars to Mexican Pesos

Converting dollars to Mexican pesos is a straightforward process that can be completed through various channels:

- Banks and Exchange Bureaus

Banks and exchange bureaus offer currency exchange services at established rates.

- Online Currency Exchanges

Numerous online platforms provide convenient and competitive currency exchange options.

- Foreign Exchange Brokers

Specialized foreign exchange brokers can offer tailored solutions for large-scale currency transactions.

- ATMs

ATMs at Mexican banks and designated locations allow you to withdraw pesos directly using your US dollar-denominated card.

Comparison: USD vs. MXN

When evaluating the relative strength of the US dollar and the Mexican peso, consider several key factors:

- Purchasing Power Parity

This concept suggests that currencies should have equal purchasing power across borders. Despite the exchange rate difference, the cost of goods and services is generally lower in Mexico than in the US.

- Inflation Rates

Mexico historically experiences higher inflation than the US, making the peso susceptible to depreciation over time.

- Economic Outlook

The long-term economic outlook for both countries influences their currencies’ relative value.

Future Trends: Embracing Innovation

The world of currency exchange is evolving rapidly, with technological advancements shaping the industry. Here are some future-oriented trends:

- Blockchain and Cryptocurrency

Blockchain technology and cryptocurrencies offer potential alternatives to traditional currency exchange systems, promising greater transparency and lower transaction costs.

- Artificial Intelligence

AI algorithms are being leveraged to analyze exchange rate data and provide personalized recommendations for currency traders.

- Mobile Payments and FinTech

Mobile payment apps and innovative financial technology solutions are simplifying currency exchange for individuals and businesses alike.

Conclusion

The dollar-to-peso exchange rate is a dynamic and complex indicator that reflects global economic conditions, political events, and market fluctuations. By understanding the historical trends, current factors, and future projections, businesses, individuals, and policymakers can make informed decisions regarding currency exchange and cross-border transactions. As the industry embraces cutting-edge technologies, new possibilities for currency exchange will continue to emerge, offering greater convenience, efficiency, and transparency.

Tables

Table 1: Historical Exchange Rates (1990-2020)

| Year | Exchange Rate (MXN per USD) |

|---|---|

| 1990 | 2.94 |

| 1995 | 5.31 |

| 2000 | 9.54 |

| 2005 | 10.42 |

| 2010 | 12.73 |

| 2015 | 15.50 |

| 2020 | 21.12 |

Table 2: Economic Indicators Impacting Exchange Rate

| Indicator | Impact on MXN |

|---|---|

| Economic Growth | Appreciation |

| Inflation | Depreciation |

| Interest Rates | Appreciation (higher US rates) |

| Trade Surplus | Appreciation |

| Remittances | Appreciation |

| Political Risk | Depreciation |

Table 3: Future Exchange Rate Forecast (2021-2025)

| Year | Exchange Rate Range (MXN per USD) |

|---|---|

| 2021 | 19.50 – 21.00 |

| 2022 | 18.50 – 20.00 |

| 2023 | 17.50 – 19.00 |

| 2024 | 16.50 – 18.50 |

| 2025 | 15.50 – 17.50 |

Table 4: Currency Exchange Channels

| Channel | Advantages | Disadvantages |

|---|---|---|

| Banks and Exchange Bureaus | Established rates | Limited availability, higher fees |

| Online Currency Exchanges | Competitive rates, convenience | Transaction limits, security concerns |

| Foreign Exchange Brokers | Tailored solutions, large transactions | Higher fees, limited accessibility |

| ATMs | Direct withdrawals | Lower exchange rates, ATM fees |