Introduction

Nextera Energy (NEE) is a leading American energy company that has been consistently performing well in the stock market. In recent years, NEE’s share price has been on an upward trajectory, and analysts predict that this trend will continue in the coming years. This article will delve into the factors influencing NEE’s share price, analyze its historical performance, and provide projections for its future value.

Historical Performance

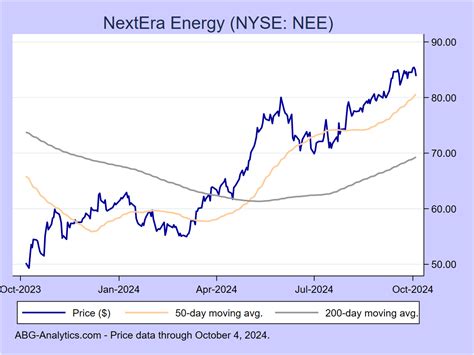

Over the past decade, NEE’s share price has shown a steady increase. In 2013, the stock was trading at around $30 per share. By the end of 2022, it had climbed to over $90 per share, representing an impressive growth of approximately 200%. This consistent growth has been driven by a combination of factors, including the company’s strong financial performance, strategic acquisitions, and favorable industry conditions.

Factors Influencing Share Price

Financial Performance:

NEE has consistently reported robust financial results, driven by its diversified portfolio of regulated utilities and renewable energy businesses. The company’s revenue has grown steadily over the years, supported by increasing demand for electricity and the expansion of its renewable energy operations.

Acquisitions:

Nextera Energy has made several strategic acquisitions in recent years, which have contributed to its growth and diversification. Notable acquisitions include the purchase of Energy Future Holdings in 2017 and Gulf Power Company in 2019. These acquisitions have expanded NEE’s geographic footprint, increased its customer base, and enhanced its portfolio of renewable energy assets.

Industry Conditions:

The energy industry is currently undergoing significant transformation, with a growing focus on decarbonization and renewable energy. Nextera Energy is well-positioned to benefit from these trends, given its leadership in the renewable energy sector.

Projections for 2025

Analysts predict that NEE’s share price will continue to rise in the coming years, driven by several positive factors. The company has announced plans to invest heavily in its renewable energy business, which is expected to fuel revenue growth and improve profitability. Additionally, NEE’s strong financial performance and strategic initiatives should provide support to its share price.

According to consensus estimates from leading financial institutions, NEE’s share price is projected to reach $130 to $150 per share by the end of 2025. This represents a potential upside of 40% to 67% from current levels.

Key Growth Drivers

Renewable Energy Focus:

Nextera Energy is a leader in the renewable energy industry, with a significant portfolio of solar and wind projects. As the demand for clean energy continues to increase, NEE is well-positioned to capitalize on this growth trend.

Diversified Portfolio:

NEE has a diverse portfolio of regulated utilities and renewable energy businesses, which provides the company with stability and resilience. This diversification mitigates risks and allows the company to navigate market fluctuations effectively.

Strong Management Team:

Nextera Energy has a highly experienced management team with a proven track record of success. The company’s strategic vision and execution capabilities have been instrumental in driving its growth and profitability.

Challenges and Opportunities

Regulatory Environment:

The energy industry is heavily regulated, and changes in regulations can impact companies’ profitability. Nextera Energy may face regulatory challenges related to renewable energy subsidies or policies that favor competing technologies.

Competition:

The energy industry is highly competitive, with various players offering similar products and services. Nextera Energy faces competition from traditional energy companies, renewable energy developers, and utilities.

Capital Expenditure:

Nextera Energy’s plans to invest heavily in renewable energy projects require significant upfront capital expenditures. Managing these investments and ensuring profitability will be crucial for the company’s future success.

Conclusion

Nextera Energy is a well-established energy company with a strong track record of growth and financial performance. The company’s diversified portfolio, renewable energy focus, and strategic initiatives position it favorably for continued success in the coming years. Analysts project that NEE’s share price will continue to rise, making it an attractive investment opportunity for investors seeking exposure to the energy sector.

Additional Information

| Ticker Symbol | NEE |

|---|---|

| Industry | Electric Utilities |

| Market Cap | $155.9 billion |

| 52-Week Range | $86.17 – $104.29 |

| Dividend Yield | 1.92% |

| Trailing P/E Ratio | 28.66 |

Frequently Asked Questions

Q: What factors are driving Nextera Energy’s share price growth?

A: NEE’s share price growth is being driven by its strong financial performance, strategic acquisitions, renewable energy focus, and favorable industry conditions.

Q: What is the projected share price for NEE in 2025?

A: Analysts project NEE’s share price to reach between $130 and $150 by the end of 2025.

Q: What are the key risks and challenges facing Nextera Energy?

A: NEE faces regulatory challenges, competition from other energy companies, and the need to manage significant capital expenditures in its renewable energy projects.