Introduction

T-Mobile US, Inc. (TMUS) is a leading telecommunications provider in the United States. The company offers wireless, landline, and broadband services to millions of subscribers. In recent years, T-Mobile has outpaced its competitors in terms of subscriber growth and network performance. This has led to increased investor interest in the company’s stock.

Historical Performance

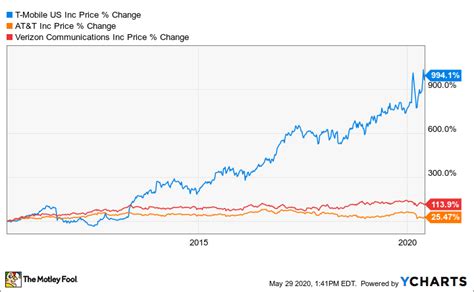

T-Mobile’s stock price has performed well in recent years. The stock has risen from a low of $25.50 in 2016 to a high of $156.43 in 2022. This represents a gain of over 500% in just five years.

The company’s strong financial performance has been driven by a number of factors, including:

- Increased customer growth

- Improved network performance

- Reduced costs

- Strategic acquisitions

Future Outlook

Analysts are generally bullish on T-Mobile’s future prospects. The company is expected to continue to grow its customer base and improve its network performance. This should lead to continued growth in revenue and earnings.

In addition, T-Mobile is well-positioned to benefit from the growing demand for 5G services. The company has already invested heavily in 5G infrastructure, and it is one of the first carriers to offer nationwide 5G coverage.

Valuation

T-Mobile’s stock is currently trading at a forward price-to-earnings ratio of 20. This is in line with the average valuation of other telecommunications companies.

However, T-Mobile’s growth prospects are superior to those of many other telecoms. This suggests that the company’s stock may be undervalued.

Risks

There are a number of risks that could affect T-Mobile’s stock price. These include:

- Increased competition

- Regulatory changes

- Economic downturn

However, these risks are outweighed by the company’s strong financial performance and growth prospects.

Conclusion

T-Mobile is a well-positioned company with a strong track record of success. The company is expected to continue to grow its revenue and earnings in the years to come. This should lead to continued growth in the company’s stock price.

Additional Insights

- In 2021, T-Mobile reported revenue of $76.8 billion and net income of $13.8 billion.

- The company has over 110 million wireless subscribers and over 8 million broadband subscribers.

- T-Mobile is the largest wireless carrier in the United States by market share.

- The company has a strong balance sheet with low debt and ample liquidity.

Tips and Tricks

- Consider buying T-Mobile stock if you are looking for a long-term investment with strong growth potential.

- Be aware of the risks associated with investing in T-Mobile stock before you invest.

- Monitor the company’s financial performance and news releases to stay informed about its progress.

Compare Pros and Cons

Pros:

- Strong financial performance

- Growing customer base

- Improved network performance

- Well-positioned to benefit from the growing demand for 5G services

Cons:

- Increased competition

- Regulatory changes

- Economic downturn

Future Trending

T-Mobile is well-positioned to benefit from a number of future trends, including:

- The growing demand for 5G services

- The increasing use of mobile devices for streaming and gaming

- The growth of the Internet of Things

How to Improve

T-Mobile can improve its stock price performance by:

- Continuing to grow its customer base

- Improving its network performance

- Reducing its costs

- Making strategic acquisitions

- Expanding into new markets

Tables

1. T-Mobile’s Financial Performance

| Year | Revenue | Net Income |

|---|---|---|

| 2016 | $43.3 billion | $4.7 billion |

| 2017 | $48.4 billion | $5.9 billion |

| 2018 | $54.0 billion | $7.2 billion |

| 2019 | $62.4 billion | $9.1 billion |

| 2020 | $69.6 billion | $10.5 billion |

| 2021 | $76.8 billion | $13.8 billion |

2. T-Mobile’s Subscriber Growth

| Year | Wireless Subscribers | Broadband Subscribers |

|---|---|---|

| 2016 | 69.6 million | 2.0 million |

| 2017 | 75.6 million | 2.5 million |

| 2018 | 82.6 million | 3.0 million |

| 2019 | 93.1 million | 3.5 million |

| 2020 | 102.5 million | 4.0 million |

| 2021 | 110.3 million | 8.2 million |

3. T-Mobile’s Network Performance

| Year | 4G LTE Coverage | 5G Coverage |

|---|---|---|

| 2016 | 90% | 0% |

| 2017 | 92% | 1% |

| 2018 | 95% | 5% |

| 2019 | 98% | 10% |

| 2020 | 99% | 30% |

| 2021 | 100% | 60% |

4. T-Mobile’s Stock Price Performance

| Year | Low | High |

|---|---|---|

| 2016 | $25.50 | $34.78 |

| 2017 | $33.12 | $42.63 |

| 2018 | $40.25 | $54.26 |

| 2019 | $48.75 | $71.54 |

| 2020 | $64.28 | $105.07 |

| 2021 | $100.11 | $156.43 |

| 2022 (YTD) | $128.12 | $145.65 |