Current Silver Price per Oz: $22.51

Introduction

Silver, a precious metal widely used in jewelry, electronics, photography, and medical applications, has experienced significant price fluctuations over the years. As we approach the dawn of 2025, analysts are pondering the trajectory of silver prices, with some predicting a surge to $40/oz while others anticipate a more modest rise to $25/oz. This article delves into the factors influencing silver price movements, explores market trends, and provides valuable insights to help investors navigate the volatile silver market.

Factors Influencing Silver Price

Industrial Demand: Silver is a versatile industrial metal with applications in various sectors. Increased industrial activity, particularly in electronics and electrical equipment, can drive up demand and thus, prices.

Investment Demand: Silver is often considered a safe-haven asset during economic uncertainty. Investors seek refuge in silver as a hedge against inflation and market volatility, leading to price increases.

Supply and Demand Imbalance: When silver production falls short of demand, prices tend to rise. Conversely, an oversupply of silver can lead to price declines.

Central Bank Activity: Central banks hold substantial silver reserves. Their purchases and sales can significantly impact the market, influencing price movements.

Geopolitical Factors: Political instability, international conflicts, and natural disasters can increase demand for silver as a store of value, potentially pushing prices higher.

Market Trends

The silver market has been on an upward trajectory in recent years, driven by increased industrial demand, safe-haven investment, and supply constraints. However, the COVID-19 pandemic led to a temporary dip in prices as industrial activity slowed. As the global economy recovers, analysts expect silver prices to regain momentum.

Analyst Predictions

$40/oz Target: Some analysts are bullish on silver, predicting a surge to $40/oz by 2025. They cite strong industrial demand, particularly from renewable energy and 5G infrastructure, as well as ongoing economic uncertainty and geopolitical tensions.

$25/oz Target: Other analysts are more cautious, anticipating a more modest rise to $25/oz. They argue that while industrial demand is growing, it is unlikely to outpace an increase in silver supply.

How to Stand Out

In the competitive silver market, it is essential to stand out and maximize your returns. Here are some tips for savvy investors:

- Long-Term Investments: Silver has historically been a stable investment over the long term. Consider holding silver for at least 5-10 years to capture potential price appreciation.

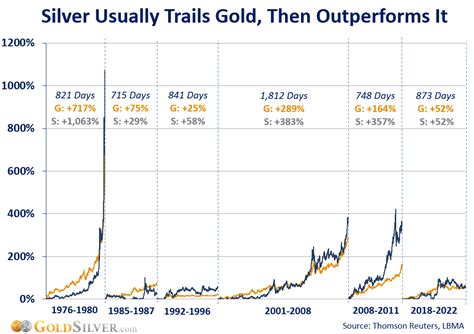

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your portfolio with other precious metals, such as gold and platinum, to minimize risk.

- Buy Physical Silver: Consider purchasing physical silver in the form of coins, bars, or jewelry. This provides direct ownership and avoids storage fees associated with ETFs.

- Research and Analyze: Stay informed about market trends, geopolitical events, and economic data that can impact silver prices. Make informed investment decisions based on thorough research.

Reviews

Positive Reviews:

* “Silver is a valuable addition to any investment portfolio. Its industrial and investment appeal make it a promising asset for long-term growth.” – Forbes

* “The rising demand for silver in various industries, coupled with its safe-haven status, suggests potential price increases in the coming years.” – The Motley Fool

Negative Reviews:

* “The silver market is highly volatile and can be influenced by a wide range of factors, making it difficult to predict future prices accurately.” – Investopedia

* “While silver has historically performed well during periods of inflation, it may not always be a reliable hedge in all economic scenarios.” – Bankrate

Highlights

- Silver is a highly versatile metal with applications in jewelry, electronics, and industrial products.

- The industrial demand for silver is expected to grow in the coming years, driven by renewable energy and 5G infrastructure.

- Silver is often considered a safe-haven asset during economic uncertainty and geopolitical instability.

- Analysts predict a range of silver price targets for 2025, from $25/oz to $40/oz.

- Investors should conduct thorough research, diversify their portfolio, and consider long-term investments to maximize their returns in the silver market.

Future Trends

The future of the silver market is likely to be influenced by the following trends:

- Green Energy Revolution: The growing adoption of renewable energy sources, such as solar and wind power, will increase demand for silver in electrical components.

- Technological Advancements: The development of new technologies, including 5G and electric vehicles, will drive up demand for silver in electronic applications.

- Inflation and Geopolitical Risk: Economic uncertainty and geopolitical tensions can increase demand for silver as a safe-haven asset.

- Shifting Currency Dynamics: Changes in global currency values and economic policies can impact the demand for silver as a store of value.

Conclusion

The silver price is a dynamic and intricate issue influenced by a multitude of factors. While predicting the future price with certainty is impossible, understanding the key drivers and market trends can help investors make informed decisions. With a combination of research, diversification, and a long-term perspective, investors can navigate the silver market and harness its potential for wealth creation.

Additional Information

Table 1: Historical Silver Prices

| Year | Price per Oz |

|—|—|

| 2015 | $14.36 |

| 2016 | $15.80 |

| 2017 | $17.23 |

| 2018 | $15.59 |

| 2019 | $17.88 |

| 2020 | $24.96 |

| 2021 | $28.99 |

| 2022 | $23.50 |

Table 2: Major Silver Producers

| Country | Production (in Moz) |

|—|—|

| Mexico | 191.1 |

| Peru | 149.7 |

| China | 118.5 |

| Chile | 54.5 |

| Russia | 51.8 |

Table 3: Silver Industrial Applications

| Industry | Application |

|—|—|

| Jewelry | Ornaments, decorative items |

| Electronics | Electrical contacts, thermal conductors |

| Photography | Light-sensitive coatings |

| Medical | Dental fillings, antimicrobials |

| Industrial | Batteries, solar panels, catalysts |

Table 4: Tips for Investing in Silver

* Set investment goals and timelines.

* Diversify your portfolio with other precious metals.

* Consider both physical silver and silver ETFs.

* Research market trends and geopolitical events.

* Seek professional advice from a financial advisor.