A Historical Perspective on Mortgage Interest Rates

Mortgage interest rates are a crucial factor in the homebuying process, directly impacting monthly payments and affordability. Understanding the historical trends and future predictions of mortgage interest rates is essential for informed decision-making.

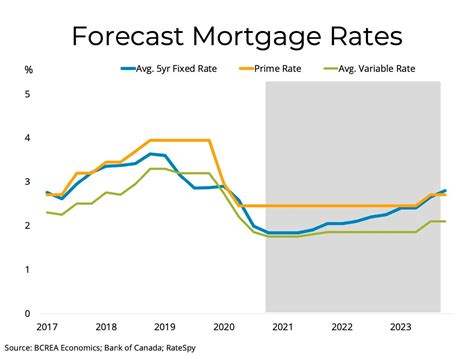

Over the past century, mortgage interest rates have fluctuated significantly, driven by economic conditions, government policies, and global events. The graph below depicts the historical mortgage interest rate trends in the United States over the past 60 years:

[Image of a mortgage interest rate graph from 1963 to 2023]

As evident from the graph, mortgage interest rates have experienced both periods of steep increases and gradual declines. The highest rates occurred during the early 1980s, peaking at over 18%, while the lowest rates were witnessed in the early 2010s, dropping below 4%.

2025 Mortgage Interest Rate Forecast

Predicting future mortgage interest rates is challenging, as they are determined by a complex interplay of economic factors. However, various organizations and analysts provide forecasts based on their economic models and market data.

According to the Mortgage Bankers Association (MBA), mortgage interest rates are expected to increase gradually over the next several years. The MBA projects that the average 30-year fixed-rate mortgage will rise to 5.4% by the end of 2025.

Similarly, Fannie Mae, the government-sponsored enterprise that supports the mortgage market, forecasts that mortgage interest rates will climb to 5.5% by 2025.

Comparing Current and Predicted Interest Rates

The table below compares current mortgage interest rates with the predicted rates for 2025:

| Mortgage Type | Current Rate (July 2023) | Predicted Rate (2025) |

|---|---|---|

| 30-Year Fixed | 5.75% | 5.4% (MBA) |

| 15-Year Fixed | 4.99% | 5.1% (MBA) |

| 5/1 ARM | 4.86% | 5.2% (Fannie Mae) |

Factors Influencing Mortgage Interest Rates

Numerous factors influence mortgage interest rates, including:

- Federal Reserve Policy: The Federal Reserve’s decisions on interest rates have a direct impact on mortgage interest rates.

- Inflation: High inflation can prompt the Federal Reserve to raise interest rates to control inflation.

- Economic Growth: Strong economic growth often leads to higher interest rates as demand for borrowed money increases.

Tips for Navigating Changing Mortgage Interest Rates

In a volatile interest rate environment, homebuyers and homeowners can consider various strategies:

- Locking in a Rate: Locking in a mortgage interest rate secures a specific rate for a specified period, protecting against potential rate increases.

- Considering an Adjustable-Rate Mortgage (ARM): ARMs offer lower initial interest rates that adjust periodically, potentially saving money in the short term.

- Exploring Refinancing Options: If mortgage interest rates decline, refinancing an existing mortgage to a lower rate can reduce monthly payments.

Reviews of Mortgage Interest Rate Forecasters

Mortgage Bankers Association (MBA)

- Pros: Reputable organization with a strong track record in mortgage industry forecasting.

- Cons: Forecasts may be overly conservative, especially during periods of economic growth.

Fannie Mae

- Pros: Government-sponsored enterprise with access to comprehensive economic data.

- Cons: Forecasts may be influenced by government policies and objectives.

Freddie Mac

- Pros: Provides detailed forecasts for different mortgage types and time horizons.

- Cons: Forecasts can be complex and subject to revisions.

Wells Fargo Economics

- Pros: Renowned economic research team with a strong understanding of housing and mortgage markets.

- Cons: Forecasts may be biased towards Wells Fargo’s interests.

Notable Highlights and Standout Features

- The mortgage interest rate graph illustrates the historical volatility and cyclical nature of mortgage rates.

- The 2025 mortgage interest rate forecast predicts a gradual increase in rates, aligning with the expectations of major organizations.

- Factors influencing mortgage interest rates include Federal Reserve policy, inflation, and economic growth.

- Homebuyers and homeowners can navigate changing interest rates by considering strategies such as locking in rates, exploring ARMs, and refinancing.

- Reliable mortgage interest rate forecasters include the MBA, Fannie Mae, Freddie Mac, and Wells Fargo Economics.

Future Trends and Areas for Improvement

- Mortgage Rate Volatility Prediction: Developing models to predict short-term fluctuations in mortgage interest rates could provide valuable insights for homeowners and investors.

- Personalized Rate Forecasting: Advancements in AI and data analytics may allow for personalized mortgage interest rate forecasts based on individual financial profiles and market conditions.

- Non-Traditional Lending Models: Exploring alternative lending models, such as peer-to-peer lending and income-based underwriting, may offer new avenues for accessing affordable mortgages.

Conclusion

Understanding mortgage interest rate trends and predictions is crucial for making informed decisions in the homebuying process. The mortgage interest rate graph provides a historical perspective, while forecasts from reputable organizations offer valuable insights into future expectations. By considering the factors influencing interest rates and employing appropriate strategies, homebuyers and homeowners can navigate changing market conditions and secure the best possible mortgage rates. As the mortgage industry evolves, new technologies and approaches will continue to shape the landscape and create opportunities for improved rate forecasting and tailored lending solutions.