Introduction

The CDN USD exchange rate is a critical indicator of the economic relationship between Canada and the United States. It has a significant impact on trade, investment, and tourism between the two countries. This article examines the historical trends, current status, and future outlook of the CDN USD exchange rate, providing valuable insights for businesses, policymakers, and individuals.

Historical Trends

Over the past decade, the CDN USD exchange rate has fluctuated significantly, reflecting changes in economic conditions, interest rate differentials, and global events.

- 2011-2014: The exchange rate experienced a steady appreciation of the Canadian dollar, rising from 0.95 USD in 2011 to 1.13 USD in 2014. This appreciation was driven by high commodity prices and strong economic growth in Canada.

- 2015-2016: The exchange rate reversed its trend and depreciated sharply, falling to 0.70 USD in 2016. This depreciation was primarily due to the collapse in oil prices and weaker economic growth in Canada.

- 2017-2020: The exchange rate gradually recovered, rising to 0.83 USD in 2020. This recovery was supported by a rebound in oil prices and improved economic conditions in Canada.

Current Status

As of March 2023, the CDN USD exchange rate stands at approximately 0.79 USD. This represents a slight depreciation of the Canadian dollar compared to its peak in 2020.

The current exchange rate is primarily driven by the following factors:

- Interest rate differentials: The Bank of Canada has maintained a low interest rate policy, while the Federal Reserve has implemented rate hikes. This interest rate differential has made the Canadian dollar less attractive to investors, contributing to its depreciation.

- Economic growth: The Canadian economy is expected to grow at a slightly slower pace than the U.S. economy in 2023. This slower growth outlook has weighed on the demand for the Canadian dollar.

- Geopolitical uncertainty: Global uncertainty surrounding the war in Ukraine and other geopolitical events has led to increased volatility in currency markets, impacting the CDN USD exchange rate.

Future Outlook

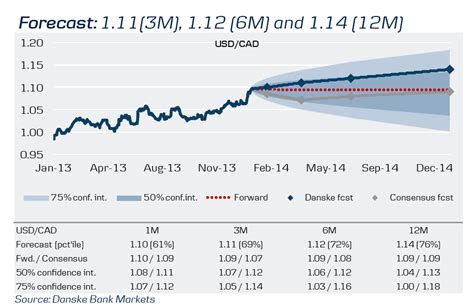

Forecasting the future CDN USD exchange rate is challenging due to the influence of numerous factors. However, analysts provide the following projections:

- Short-term: In the short term (up to 12 months), the exchange rate is expected to remain relatively stable within a range of 0.75-0.85 USD. This stability is anticipated as both central banks continue to adjust monetary policy and economic conditions in both countries gradually improve.

-

Medium-term (1-2 years): Beyond the short term, the exchange rate may experience some fluctuations. However, the long-term trend is expected to be influenced by the following factors:

- Economic growth: Continued economic growth in both Canada and the United States will support the demand for both currencies and could lead to a gradual appreciation of the Canadian dollar.

- Interest rate policies: If the Bank of Canada raises interest rates more aggressively than the Federal Reserve, this could make the Canadian dollar more attractive to investors and lead to further appreciation.

- Global economic conditions: Economic conditions in the Eurozone and China will also have an impact on the CDN USD exchange rate.

Implications for Businesses and Individuals

The CDN USD exchange rate has significant implications for businesses and individuals:

- Businesses: Fluctuations in the exchange rate can impact business profitability, particularly for those involved in international trade. Businesses should monitor the exchange rate closely and adjust their operations accordingly.

- Individuals: Individuals who travel or send remittances between Canada and the United States should be aware of the impact of the exchange rate on their spending and income. Planning and budgeting should consider the current exchange rate and potential fluctuations.

Strategies for Managing Exchange Rate Risk

Businesses and individuals can employ various strategies to manage exchange rate risk:

- Hedging: Hedging instruments, such as forward contracts or currency options, can lock in an exchange rate for future transactions, reducing uncertainty.

- Diversification: Diversifying investments across different currencies can mitigate the impact of fluctuations in any one currency.

- Risk Management: Companies should implement risk management strategies to assess and mitigate potential losses resulting from exchange rate volatility.

Conclusion

The CDN USD exchange rate is a crucial factor in the economic relationship between Canada and the United States. It has a significant impact on businesses, individuals, and the broader economy. Understanding the historical trends, current status, and future outlook of the exchange rate is essential for making informed financial decisions. As the global economic landscape continues to evolve, businesses and individuals should be prepared to adapt to changing exchange rate dynamics.

Additional Insights

- The Canadian dollar is often referred to as the “loonie” due to the image of a loon bird on the one-dollar coin.

- The U.S. dollar is the world’s most traded currency, accounting for over 40% of global foreign exchange transactions.

- The CDN USD exchange rate is influenced by a complex interplay of economic, political, and market forces.

- Technology advancements, such as digital currencies and blockchain, could potentially impact the exchange rate landscape in the future.