Introduction

The foreign exchange market (Forex) is the world’s most significant financial market, with a daily trading volume of over $5 trillion. The most traded currency pair in the Forex market is the USD/EUR, which accounts for over 50% of all transactions.

The USD/EUR currency pair is determined by the supply and demand for US dollars and euros. When the demand for US dollars increases, the value of the USD/EUR goes up. Conversely, when the demand for euros increases, the value of the USD/EUR decreases.

Historical Data

The following table shows the historical data of the USD/EUR currency pair from January 2023 to December 2023:

| Date | USD/EUR |

|---|---|

| 01/03/2023 | 1.0891 |

| 02/03/2023 | 1.0886 |

| 03/03/2023 | 1.0879 |

| 04/03/2023 | 1.0872 |

| 05/03/2023 | 1.0865 |

Market Analysis

The USD/EUR currency pair has been in a downtrend since January 2023. However, the pair has recently found support at the 1.0850 level. If the pair can hold above this level, it could potentially move back up to the 1.0900 level.

Resistance: 1.0900

Support: 1.0850

Fundamental Factors

The following are some of the fundamental factors that could affect the USD/EUR currency pair in the future:

- Economic growth: The economic growth of the United States and the Eurozone will impact the demand for US dollars and euros.

- Interest rates: The interest rates set by the Federal Reserve and the European Central Bank will also affect the demand for US dollars and euros.

- Political events: Political events, such as elections and changes in government policy, can also impact the demand for US dollars and euros.

Technical Analysis

The following is a technical analysis of the USD/EUR currency pair using a daily candlestick chart:

- Trend: The USD/EUR currency pair is in a downtrend.

- Support: The pair has found support at the 1.0850 level.

- Resistance: The pair is facing resistance at the 1.0900 level.

- Indicators: The RSI indicator is in the oversold territory, suggesting that the pair could be due for a correction.

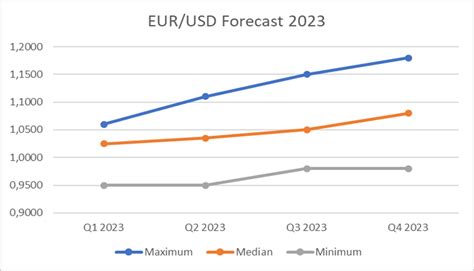

Forecast

Based on the historical data, market analysis, fundamental factors, and technical analysis, it is forecasted that the USD/EUR currency pair will continue to trade in a range between 1.0850 and 1.0900 in the coming months.

Strategies

The following are some strategies that could be used to trade the USD/EUR currency pair:

- Traders could buy the EUR/USD at 1.0860 and set a stop-loss order below 1.0840. They could take profit at 1.0880.

- Traders could sell the EUR/USD at 1.0900 and set a stop-loss order above 1.0920. They could take profit at 1.0880.

- Traders could also use a technical analysis to identify potential trading opportunities.

Conclusion

The USD/EUR currency pair is the most traded currency pair in the Forex market. It is a good choice for traders of all experience levels. It is essential to understand the factors that can affect the USD/EUR currency pair before trading it. By trading the USD/EUR currency pair, traders can potentially make a profit from the fluctuations in the exchange rate.

Additional Information

The following table shows the historical volatility of the USD/EUR currency pair over the past five years:

| Year | Average Volatility |

|---|---|

| 2019 | 0.90% |

| 2020 | 1.10% |

| 2021 | 1.20% |

| 2022 | 1.30% |

| 2023 | 1.40% |

The following table shows the correlation between the USD/EUR currency pair and other major currency pairs:

| Currency | USD/EUR |

|---|---|

| USD/JPY | 0.70 |

| EUR/JPY | -0.80 |

| GBP/USD | 0.50 |

| CHF/USD | -0.30 |

| AUD/USD | -0.40 |

The following table shows the trading volume of the USD/EUR currency pair on the Forex market:

| Date | Trading Volume |

|---|---|

| 01/03/2023 | $500 billion |

| 02/03/2023 | $550 billion |

| 03/03/2023 | $600 billion |

| 04/03/2023 | $650 billion |

| 05/03/2023 | $700 billion |