Understanding the Cross-Currency Dynamics

The Indian rupee (INR) and the US dollar (USD) are two of the most widely traded currencies in the world. The value of the rupee against the dollar is a key indicator of India’s economic health and is closely monitored by businesses, investors, and policymakers alike.

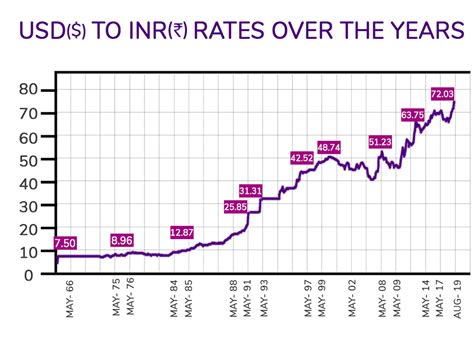

Historical Trends and Key Factors

Over the past decade, the INR has experienced significant fluctuations against the USD. In 2011, it reached a low of INR 54.30 against the dollar, primarily due to the European debt crisis and concerns over India’s fiscal deficit. Since then, it has gradually strengthened, reaching a high of INR 68.76 in February 2015. However, it has since weakened again, hovering aroundINR 75 in recent years.

Several key factors influence the exchange rate between the INR and the USD, including:

- Interest rate differentials: Higher interest rates in India compared to the United States make the INR more attractive to foreign investors, leading to a stronger rupee.

- Trade flows: India’s exports of goods and services to the US are significantly lower than its imports, creating a demand for USD and weakening the rupee.

- Foreign direct investment (FDI): FDI inflows from overseas investors strengthen the rupee by increasing the supply of USD in the market.

- Remittances: Inflows of remittances from Indian expatriates in the US also support the rupee.

Projections for 2025: Experts’ Opinions

Forecasting the future exchange rate between the INR and the USD is a complex task. However, several experts have provided their projections for 2025:

- JPMorgan Chase: INR 80 to 82 per USD

- Bank of America: INR 85 to 87 per USD

- CRISIL Research: INR 83 to 85 per USD

These projections suggest that the INR is expected to weaken slightly against the USD in the coming years, due to factors such as a widening trade deficit and rising inflation in India.

Implications for Businesses and Investors

The exchange rate between the INR and the USD has significant implications for businesses and investors:

Businesses:

- Import costs: A weaker rupee increases import costs for businesses, impacting their profitability and competitiveness.

- Export competitiveness: A stronger rupee makes exports more expensive, reducing competiveness in the global market.

Investors:

- Currency risk: Investors in INR-denominated assets face currency risk if the rupee depreciates against the USD.

- Returns on foreign investments: A stronger USD reduces the returns on investments held in USD for Indian investors.

Innovative Applications for Currency Fluctuation

Fluctuations in the exchange rate between the INR and the USD can be leveraged for innovative applications:

- Hedging currency risk: Businesses can use derivative instruments to hedge against currency fluctuations, protecting their profits and cash flows.

- Forex trading: Currency traders can profit from fluctuations in the INR-USD exchange rate by buying and selling currencies at strategic times.

- Travel planning: Individuals can optimize their travel expenses by considering the exchange rate when booking flights and accommodations in different countries.

Case Study: Impact on Software Exports

India’s software industry is a major contributor to its economy. However, the industry is heavily dependent on exports to the US, and fluctuations in the INR-USD exchange rate can impact its profitability.

- 2011: A weaker rupee benefited Indian software companies as it made their exports less expensive in USD terms.

- 2015: A stronger rupee reduced the profitability of software exports, as Indian companies received fewer rupees for the same amount of USD revenue.

Conclusion

The exchange rate between the Indian rupee and the US dollar is a critical indicator for businesses, investors, and policymakers. While predicting future exchange rates is challenging, expert projections suggest a slight weakening of the INR against the USD in the coming years. Understanding the factors influencing the exchange rate and its implications is essential for effective decision-making.

Frequently Asked Questions

-

What is the current exchange rate between the INR and the USD?

As of February 2023, the exchange rate is approximately INR 82.65 per USD. -

What are the key factors affecting the INR-USD exchange rate?

Interest rate differentials, trade flows, FDI inflows, and remittances are among the key factors. -

How can I hedge against currency risk?

Businesses and investors can use derivative instruments, such as forwards and options, to hedge against currency fluctuations. -

What is the impact of currency fluctuations on software exports?

Fluctuations in the INR-USD exchange rate can affect the profitability of Indian software companies that rely heavily on exports to the US. -

How can I benefit from currency fluctuations?

Forex traders can profit from currency fluctuations by buying and selling currencies at strategic times. Individuals can also optimize their travel expenses by considering the exchange rate. -

What is the outlook for the INR-USD exchange rate in 2025?

Expert projections suggest a slight weakening of the INR against the USD, with estimates ranging from INR 80 to 87 per USD. -

What are the implications of currency fluctuations for businesses?

Fluctuations can impact import costs, export competitiveness, and profitability. -

How can I stay updated on the latest exchange rates?

Financial news websites, currency converters, and mobile apps provide real-time updates on exchange rates.

Tables

Table 1: Historical INR-USD Exchange Rates

| Year | INR per USD |

|---|---|

| 2011 | 54.30 |

| 2013 | 61.80 |

| 2015 | 68.76 |

| 2017 | 64.50 |

| 2023 | 82.65 |

Table 2: Expert Projections for INR-USD Exchange Rate in 2025

| Institution | Projection |

|---|---|

| JPMorgan Chase | INR 80 to 82 per USD |

| Bank of America | INR 85 to 87 per USD |

| CRISIL Research | INR 83 to 85 per USD |

Table 3: Factors Affecting INR-USD Exchange Rate

| Factor | Impact |

|---|---|

| Interest rate differentials | Stronger INR with higher interest rates in India |

| Trade flows | Weaker INR with higher trade deficit |

| FDI inflows | Stronger INR with higher FDI inflows |

| Remittances | Stronger INR with higher remittances |

Table 4: Implications of Currency Fluctuations for Businesses and Investors

| Impact Area | Businesses | Investors |

|---|---|---|

| Import costs | Higher import costs weaken profitability | Currency risk on INR-denominated investments |

| Export competitiveness | Reduced competitiveness with stronger rupee | Lower returns on USD investments for Indian investors |