Definition and Significance

Inflation Rate: [Economics] The annual percentage change in the general price level of an economy’s representative basket of goods and services over time.

Inflation is a critical economic indicator that gauges the overall cost of living and reflects the changes in purchasing power of a currency. Understanding the concept and its implications is crucial for businesses, policymakers, and individuals alike.

Factors Influencing Inflation Rate

1. Money Supply: Excessive creation of money can lead to higher inflation as there is more money competing for a limited supply of goods and services.

2. Demand and Supply: When demand for goods and services exceeds supply, producers may raise prices, driving up inflation. Conversely, a surplus in the market can dampen inflationary pressures.

3. Government Policies: Expansionary fiscal and monetary policies, such as increased government spending and lower interest rates, can stimulate economic growth and potentially contribute to inflation.

4. Global Factors: External events, like oil price shocks or supply chain disruptions, can impact domestic inflation rates.

Measurement of Inflation Rate

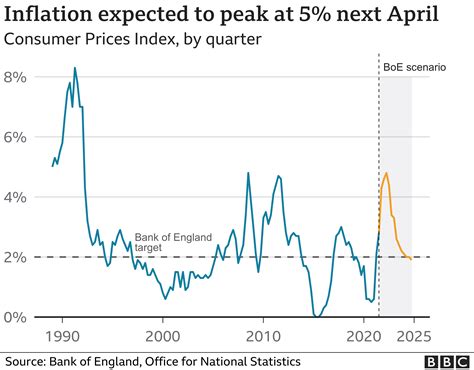

1. Consumer Price Index (CPI): Tracks the average price changes for a basket of consumer goods and services, such as food, housing, and transportation.

2. Producer Price Index (PPI): Monitors price changes at the wholesale level, measuring the cost of goods before they reach consumers.

3. GDP Deflator: Measures the change in prices of all goods and services produced in an economy, providing a broad-based indicator of inflation.

Historical Inflation Trends

Globally, inflation has fluctuated significantly over the years. Here are some notable periods:

- Post-World War II (1945-1973): Relatively low inflation, averaging around 2.5% in developed countries.

- Oil Shocks (1970s and 1980s): Sharp increases in oil prices led to inflationary pressures worldwide, reaching double-digit figures in some countries.

- Great Recession (2008-2010): Global financial crisis and recession caused deflationary conditions in many economies.

- Recent Years (2020s): The COVID-19 pandemic and geopolitical tensions have contributed to rising inflation, particularly in 2022 and beyond.

Impacts of Inflation

Inflation has far-reaching consequences for:

1. Consumers: Rising prices reduce purchasing power, making everyday expenses more costly.

2. Businesses: Inflation can increase production costs, affecting profitability and investment decisions.

3. Policymakers: Central banks may implement monetary policies to control inflation, often by raising interest rates.

Inflation Targets and Comparison

Central banks typically set inflation targets to maintain price stability. These targets vary among countries but commonly fall within the range of 2-4%.

| Country | 2025 Inflation Target | 2023 Actual Inflation |

|---|---|---|

| United States | 2% | 7% |

| Eurozone | 2% | 8.5% |

| United Kingdom | 2% | 10% |

| Japan | 2% | 3% |

| Canada | 2% | 6.8% |

Forecasting and Mitigation Strategies

Predicting future inflation is complex but critical for economic planning. Factors considered include:

- Monetary policy

- Fiscal policy

- Economic growth

- Supply and demand dynamics

Mitigation strategies to address inflation may include:

- Tightening monetary policy (raising interest rates)

- Implementing fiscal austerity measures (reducing government spending)

- Supply-side policies (increasing production capacity)

Case Studies

Case 1: United States (1970s)

Excessive money supply growth and oil shocks led to runaway inflation in the 1970s, reaching double-digit levels. The Federal Reserve raised interest rates aggressively to curb inflation, leading to a recession in 1981-1982.

Case 2: Japan (1990s)

A speculative bubble in the 1980s led to asset price inflation and excessive spending. When the bubble burst, Japan entered a prolonged period of deflation, known as the “Lost Decade.”

FAQs on Inflation Rate

1. What is hyperinflation?

Hyperinflation is a rapid and uncontrolled rise in prices, typically exceeding 50% per month.

2. How does inflation impact purchasing power?

Inflation reduces the purchasing power of a currency, meaning consumers can buy less with the same amount of money.

3. What is the relationship between inflation and unemployment?

The “Phillips Curve” suggests an inverse relationship between inflation and unemployment, known as the Phillips Curve. However, this relationship may not always hold true.

4. How do I protect against inflation?

Investing in inflation-linked assets, such as Treasury Inflation-Protected Securities (TIPS), can help mitigate the impact of rising prices.

5. What is stagflation?

Stagflation is a macroeconomic condition characterized by high inflation combined with slow economic growth and high unemployment.

6. How does the Fed control inflation?

The Federal Reserve (Fed) uses monetary policy tools, such as interest rate adjustments, to influence the money supply and inflation.

Conclusion

Inflation is a complex yet essential economic concept that affects individuals, businesses, and governments worldwide. Understanding its definition, measurement, and implications is crucial for navigating economic fluctuations and making informed decisions. By addressing the root causes of inflation and implementing appropriate mitigation strategies, economies can achieve price stability and foster sustainable growth.