Introduction: Unlock the Power of Options Trading on Robinhood

Options trading has gained immense popularity in recent years, enabling investors to enhance their portfolio performance and manage risk. Robinhood, a renowned online brokerage platform, offers users the opportunity to trade options seamlessly. This comprehensive guide will delve into the nuances of options trading on Robinhood, empowering you to navigate this complex market confidently.

Understanding Options: Definitions and Key Concepts

Options: Financial contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, at a specified price (strike price) on or before a specific date (expiration date).

Call Option: Option that grants the holder the right to purchase the underlying asset at the strike price on or before the expiration date.

Put Option: Option that grants the holder the right to sell the underlying asset at the strike price on or before the expiration date.

Strike Price: Specified price at which the underlying asset can be bought (in the case of a call option) or sold (in the case of a put option).

Expiration Date: Date on which the option contract expires, after which it becomes worthless.

How to Trade Options on Robinhood: A Step-by-Step Guide

1. Open an Options-Enabled Account

Firstly, it is essential to open an options-enabled account on Robinhood. This requires meeting certain eligibility criteria, such as having a sufficient trading history and passing a knowledge test.

2. Choose the Right Option

Selecting the appropriate option contract involves understanding the underlying asset, strike price, and expiration date. Consider your investment goals, risk tolerance, and market conditions.

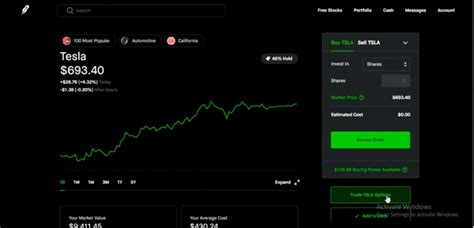

3. Place an Order

Once you have chosen the desired option, navigate to the options trading section on Robinhood and enter the relevant information, such as the option type (call or put), quantity, strike price, and expiration date.

4. Monitor and Manage the Trade

After the order is executed, it is important to monitor the performance of the option and make adjustments as needed. You can adjust the position by closing it or rolling it over to a different expiration date or strike price.

Options Trading Strategies on Robinhood

1. Basic Strategies

Covered Call Writing: Selling a call option while owning the underlying asset.

Cash-Covered Put Writing: Selling a put option while holding cash reserves to potentially buy the underlying asset.

2. Advanced Strategies

Option Spread: Combining multiple options contracts with different strike prices or expiration dates to create more complex positions.

Straddle Strategy: Simultaneously buying a call and put option with the same strike price and expiration date.

Pros and Cons of Options Trading on Robinhood

Pros:

- Accessibility: Robinhood offers a user-friendly platform for beginners and experienced traders alike.

- Low Commissions: Robinhood charges minimal commissions, making options trading cost-effective.

Cons:

- Limited Product Offerings: Robinhood currently offers limited types of options contracts compared to other platforms.

- Complex Trading Concepts: Options trading involves inherent complexities, which can be challenging for inexperienced investors.

FAQs on Options Trading on Robinhood:

-

What is the minimum investment required to trade options on Robinhood?

– $100 for Level 1 options trading permission. -

Can I trade options on any stock on Robinhood?

– No, Robinhood only offers options trading on a select list of eligible stocks. -

What are the risks associated with options trading?

– Potential for significant losses, including the loss of the entire investment. -

Is it possible to learn options trading on Robinhood?

– Yes, Robinhood provides educational resources and training materials to assist traders.

Conclusion:

Harnessing the power of options trading on Robinhood can unlock new investment opportunities and enhance portfolio performance. By understanding the concepts, strategies, and potential risks involved, investors can make informed decisions and navigate this dynamic market with confidence. Robinhood’s user-friendly platform and competitive pricing make it an accessible option for both novice and experienced traders. As the market continues to evolve, it is important to stay updated on the latest trends and regulations to optimize your options trading journey in 2025 and beyond.