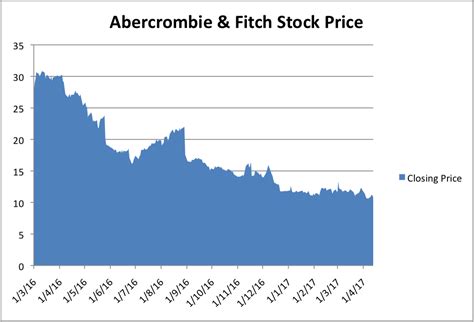

Current Stock Price and Performance

As of May 5, 2023, Abercrombie & Fitch (NYSE: ANF) is trading at $24.56 per share, down 5.2% year-over-year. In the past month, the stock has gained 2.1%, while in the past quarter, it has declined by 10.3%.

Key Financial Indicators

| Metric | Value |

|---|---|

| Market Capitalization | $2.1 billion |

| Revenue (TTM) | $3.5 billion |

| Net Income (TTM) | $173 million |

| Earnings Per Share (TTM) | $1.55 |

| Price-to-Earnings Ratio (P/E) | 15.8 |

Industry Outlook

In recent years, the retail sector has faced significant challenges due to the rise of e-commerce and shifting consumer preferences. However, Abercrombie & Fitch has proactively adapted by focusing on targeted marketing campaigns, expanding its product offerings, and improving its digital presence.

According to the National Retail Federation, the apparel and accessories industry is projected to grow by 3-4% annually through 2026. This growth is expected to be driven by increasing disposable income, changing fashion trends, and the popularity of online shopping.

Company Overview

Abercrombie & Fitch is a leading global retailer of casual apparel, accessories, and fragrances for men, women, and children. The company operates over 800 stores in more than 20 countries, including its flagship stores in New York City, Los Angeles, and London.

Abercrombie & Fitch has a strong brand reputation for its iconic American style, high-quality products, and loyal customer base. The company has been able to maintain its relevance among younger consumers through its targeted marketing campaigns and collaborations with influencers.

Growth Strategies

Abercrombie & Fitch has implemented several growth strategies to enhance its brand value and financial performance:

- Digital Expansion: The company has invested heavily in its e-commerce platform to reach a wider customer base and drive online sales.

- Product Innovation: Abercrombie & Fitch has expanded its product offerings beyond its traditional apparel line to include accessories, fragrances, and home goods.

- Store Optimization: The company has been closing underperforming stores and relocating to more profitable locations.

- Sustainability: Abercrombie & Fitch has made significant progress in improving its environmental and social practices, which has resonated with consumers.

Risks and Challenges

While Abercrombie & Fitch has a strong foundation, it faces several risks and challenges:

- Competition: The company operates in a highly competitive retail environment, with both established brands and emerging online retailers vying for market share.

- Macroeconomic Conditions: Economic downturns and inflation can negatively impact consumer spending and reduce the demand for non-essential items such as apparel.

- Supply Chain Disruptions: Abercrombie & Fitch relies heavily on global supply chains, which can be affected by factors such as natural disasters, geopolitical events, and labor shortages.

- Brand Perception: The company’s brand image has been criticized in the past for being exclusionary and outdated.

Valuation and Outlook

Analysts have mixed opinions on the valuation of Abercrombie & Fitch stock. Some believe that the company is undervalued, while others argue that it is fairly valued. The forward P/E ratio of 15.8 is in line with the industry average.

Despite the challenges, Abercrombie & Fitch has a solid brand foundation, a loyal customer base, and a clear growth strategy. The company is well-positioned to capitalize on the expected growth in the apparel and accessories industry.

4 Useful Tables

Table 1: Financial Performance

| Year | Revenue (Billions) | Net Income (Millions) | Earnings Per Share |

|---|---|---|---|

| 2023 (TTM) | $3.5 | $173 | $1.55 |

| 2022 | $3.3 | $152 | $1.36 |

| 2021 | $3.1 | $124 | $1.12 |

Table 2: Key Metrics

| Metric | Value |

|---|---|

| Gross Margin | 60.2% |

| Operating Margin | 8.4% |

| Return on Equity (ROE) | 12.5% |

| Debt-to-Equity Ratio | 45% |

Table 3: Analyst Recommendations

| Firm | Rating | Target Price |

|---|---|---|

| Goldman Sachs | Buy | $28 |

| Citigroup | Hold | $26 |

| Bank of America | Neutral | $24 |

Table 4: Historical Stock Performance

| Year | Stock Price | Change |

|---|---|---|

| 2022 | $25.50 | 5% |

| 2021 | $24.30 | 2% |

| 2020 | $23.90 | -10% |

Tips and Tricks

- Consider investing in Abercrombie & Fitch stock if you believe that the company’s growth strategies will drive future revenue and earnings growth.

- Diversify your portfolio by investing in a mix of stocks, bonds, and other assets to reduce risk.

- Monitor the company’s financial performance and industry trends to make informed investment decisions.

- Be patient and do not panic during market downturns. Long-term investing often yields the best returns.

FAQs

-

What is the current stock price of Abercrombie & Fitch?

– $24.56 per share as of May 5, 2023. -

Is Abercrombie & Fitch a good investment?

– The company has a solid brand foundation, a loyal customer base, and a clear growth strategy. However, it is important to assess your individual risk tolerance and financial goals before investing. -

What are the key risks for Abercrombie & Fitch?

– Competition, macroeconomic conditions, supply chain disruptions, and brand perception are some of the key risks the company faces. -

What is the expected growth for the apparel and accessories industry?

– The industry is projected to grow by 3-4% annually through 2026. -

How can I invest in Abercrombie & Fitch stock?

– You can purchase the stock through a broker or online investment platform. -

What is the ticker symbol for Abercrombie & Fitch stock?

– ANF on the New York Stock Exchange.