What’s the Difference?

When you sell an asset like stocks, bonds, or property, you may owe taxes on the profit you make. The type of tax you owe depends on how long you held the asset.

- Short-term capital gains tax: If you hold an asset for one year or less, any profit you make is considered a short-term capital gain. This tax rate is the same as your ordinary income tax rate, which can be as high as 37%.

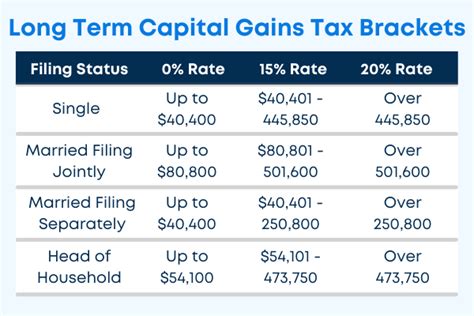

- Long-term capital gains tax: If you hold an asset for more than one year, any profit you make is considered a long-term capital gain. This tax rate is lower than the short-term capital gains tax rate, ranging from 0% to 20%.

Quick Reference Table

| Holding Period | Tax Rate |

|---|---|

| ≤ 1 Year | Up to 37% |

| > 1 Year | 0%, 15%, or 20% |

Which Tax Rate Applies to Me?

The tax rate that applies to you depends on your taxable income and filing status. Use the table below to find your tax bracket and the corresponding long-term capital gains tax rate.

| Taxable Income (Single) | Tax Bracket | Long-Term Capital Gains Tax Rate |

|---|---|---|

| ≤ $41,675 | 10% or 12% | 0% |

| $41,676 – $45,975 | 15% | 0% |

| $45,976 – $50,200 | 22% | 15% |

| $50,201 – $55,625 | 24% | 15% |

| $55,626 – $86,375 | 32% | 15% |

| $86,376 – $164,925 | 35% | 20% |

| ≥ $164,926 | 37% | 20% |

Tips and Tricks

- Hold your investments for more than a year. This is the easiest way to qualify for the lower long-term capital gains tax rate.

- Use tax-loss harvesting. If you have some losing investments, you can sell them to offset your capital gains. This can reduce your overall tax bill.

- Consider investing in a Roth IRA. Contributions to a Roth IRA are taxed upfront, but withdrawals are tax-free, including any capital gains.

Pros and Cons

Short-Term Capital Gains Tax

- Pros: None

- Cons: Higher tax rate

Long-Term Capital Gains Tax

- Pros: Lower tax rate, can be avoided entirely in some cases

- Cons: Requires holding investments for more than a year

FAQs

1. What if I sell an asset I inherited?

The holding period for inherited assets begins when the original owner acquired them. So, if you inherit an asset that was held for more than one year before the original owner’s death, you will qualify for the long-term capital gains tax rate.

2. Are there any exceptions to the one-year holding period?

Yes, there are a few exceptions. For example, if you sell an asset due to a natural disaster or other casualty, you may be able to qualify for the long-term capital gains tax rate even if you held the asset for less than one year.

3. How do I calculate my capital gains tax?

To calculate your capital gains tax, you need to subtract the cost basis of the asset from the sale price. The cost basis is the amount you paid for the asset, plus any expenses you incurred while owning it, such as commissions or closing costs.

4. What if I have a capital loss?

If you have a capital loss, you can deduct it from your capital gains. If your capital losses are greater than your capital gains, you can deduct up to $3,000 of losses from your ordinary income.

5. What if I sell an asset outside the United States?

The rules for capital gains taxes on assets sold outside the United States can be complex. You should consult with a tax professional to determine your tax liability.

6. Can I avoid paying capital gains tax?

There are a few ways to avoid paying capital gains tax, such as by holding your investments for more than one year or by contributing to a Roth IRA. However, it is important to note that there are always exceptions and limitations to these rules.