Overview

The spot price of gold is the current market price for immediate delivery. It is determined by supply and demand on the global market. Gold is a precious metal that has been used for centuries as a currency, a store of value, and a luxury item. Today, it is primarily used as an investment asset.

Factors Affecting the Gold Price

The price of gold is influenced by several factors, including:

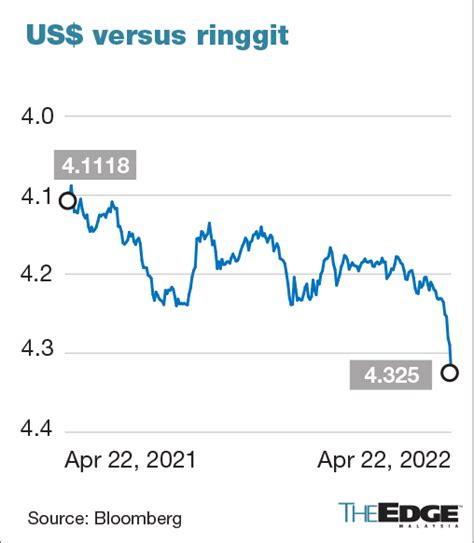

- Inflation: Inflation erodes the value of paper currencies, making gold a more attractive investment.

- Interest rates: Interest rates affect the opportunity cost of holding gold, which does not pay interest.

- Economic uncertainty: Economic uncertainty often drives investors towards safe-haven assets such as gold.

- Supply and demand: The supply and demand for gold on the global market also influence the price.

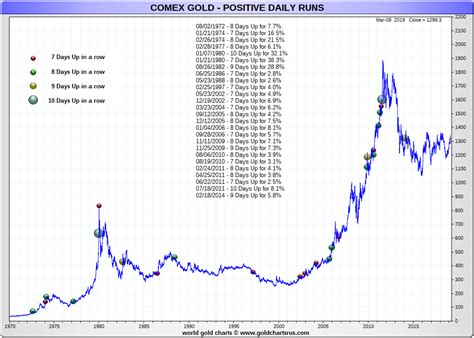

Historical Performance

Gold has a long history of price fluctuations. In the past century, the price of gold has ranged from a low of $35 per ounce in 1971 to a high of $2,067 per ounce in 2020.

Current Market Trends

The gold market is currently experiencing a period of volatility. The price of gold has been rising in recent months due to several factors, including inflation concerns, geopolitical tensions, and the COVID-19 pandemic.

Investment Opportunities

Gold can be a valuable investment asset due to its ability to hedge against inflation and provide a safe haven during economic downturns. Investors can invest in gold through various methods, including:

- Physical gold: Buying physical gold in the form of coins, bars, or jewelry.

- Gold ETFs: Gold exchange-traded funds (ETFs) that track the price of gold.

- Gold futures: Futures contracts that allow investors to speculate on the future price of gold.

Industry Applications

Gold has several industrial applications, including:

- Electronics: Gold is used in electronic components such as connectors, switches, and transistors.

- Dentistry: Gold is used in dental fillings and crowns.

- Jewelry: Gold is the primary metal used in jewelry making.

- Electroplating: Gold is used to coat other metals to protect them from corrosion.

New Applications

Researchers are exploring new applications for gold, including:

- Biomedicine: Gold nanoparticles are being used in medical imaging and drug delivery.

- Catalysis: Gold is a catalyst for various chemical reactions.

- Energy storage: Gold-based materials are being investigated for use in batteries and fuel cells.

Tables

Table 1: Historical Gold Prices

| Year | Price per Ounce |

|---|---|

| 1971 | $35 |

| 2000 | $275 |

| 2010 | $1,150 |

| 2020 | $2,067 |

| 2023 | $1,845 |

Table 2: Factors Affecting the Gold Price

| Factor | Effect on Price |

|---|---|

| Inflation | Increase |

| Interest rates | Decrease |

| Economic uncertainty | Increase |

| Supply and demand | Fluctuating |

Table 3: Investment Opportunities

| Method | Description |

|---|---|

| Physical gold | Buying coins, bars, or jewelry |

| Gold ETFs | ETFs that track the gold price |

| Gold futures | Contracts to speculate on the future price |

Table 4: Industrial Applications

| Application | Description |

|---|---|

| Electronics | Connectors, switches, transistors |

| Dentistry | Fillings, crowns |

| Jewelry | Primary metal |

| Electroplating | Coating other metals |

Tips and Tricks

- Invest in gold gradually and over time to reduce risk.

- Consider both physical gold and paper gold investments.

- Store physical gold in a secure location.

- Educate yourself about the gold market before investing.

- Consult with a financial advisor if necessary.

Pros and Cons

Pros

- Store of value

- Inflation hedge

- Safe haven asset

- Long-term growth potential

Cons

- Price volatility

- Storage costs

- No income generation

FAQs

1. What is the spot price of gold?

The spot price of gold is the current market price for immediate delivery.

2. What factors affect the gold price?

The gold price is influenced by inflation, interest rates, economic uncertainty, and supply and demand.

3. How can I invest in gold?

You can invest in gold through physical gold, gold ETFs, or gold futures.

4. What are the industrial applications of gold?

Gold is used in electronics, dentistry, jewelry, and electroplating.

5. What are some new applications of gold?

Gold nanoparticles are being explored for use in biomedicine, catalysis, and energy storage.

6. What are the advantages of investing in gold?

Gold is a store of value, inflation hedge, safe haven asset, and has long-term growth potential.

7. What are the risks of investing in gold?

Gold is subject to price volatility and does not generate income.

8. How can I reduce the risk of investing in gold?

Invest gradually, consider both physical and paper gold, and store physical gold securely.