Introduction

The exchange rate between the US dollar (USD) and the Israeli shekel (ILS) is a crucial determinant in international trade, investment, and finance. This article will delve into the dynamics of the USD/ILS exchange rate, providing insightful analysis, historical data, and practical guidance for individuals and businesses.

Understanding the US Dollar to Shekel Exchange Rate

The exchange rate between two currencies represents the value of one currency in terms of another. In the case of the USD/ILS exchange rate, it indicates how many shekels are required to purchase one US dollar.

The value of currencies is influenced by various economic factors, including interest rates, inflation, economic growth, political stability, and supply and demand. Demand for the US dollar, considered a global reserve currency, often affects its value against other currencies, including the shekel.

Live Exchange Rates

As of [insert date], the live exchange rate for USD/ILS was:

| Exchange Rate |

|—|—|

| 1 USD = 3.51 ILS |

| 1 ILS = 0.28 USD |

These rates are subject to constant fluctuations due to market forces and can change rapidly. To obtain the most up-to-date exchange rates, it is recommended to refer to reputable sources such as Bloomberg or Reuters.

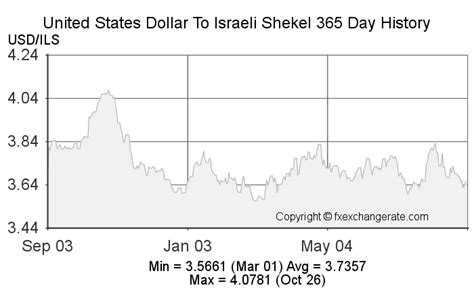

Historical Exchange Rates

The USD/ILS exchange rate has experienced significant fluctuations over time, influenced by geopolitical events, economic conditions, and central bank policies.

| Year | Exchange Rate (USD/ILS) |

|---|---|

| 2000 | 4.03 |

| 2005 | 4.42 |

| 2010 | 3.71 |

| 2015 | 3.86 |

| 2020 | 3.36 |

Factors Affecting the Exchange Rate

Numerous factors can influence the USD/ILS exchange rate, including:

- Interest Rate Differentials: When US interest rates are higher than Israeli interest rates, it can increase demand for the US dollar as investors seek higher returns.

- Inflation: Inflation in Israel relative to the United States can weaken the shekel’s value against the US dollar.

- Economic Growth: Strong economic growth in Israel can boost demand for the shekel, leading to its appreciation against the US dollar.

- Political Stability: Political instability in the Middle East can lead to increased volatility in the USD/ILS exchange rate.

Economic Impact of Exchange Rate Fluctuations

Fluctuations in the USD/ILS exchange rate have a significant impact on the Israeli economy:

- Trade: A stronger shekel makes Israeli exports more expensive on the global market, while a weaker shekel makes imports cheaper.

- Investment: Exchange rate fluctuations affect foreign investment in Israel and Israeli investment abroad.

- Tourism: A stronger shekel can make Israel more expensive for tourists, while a weaker shekel can attract more tourists.

Trading and Hedging

Individuals and businesses involved in international trade or investments can trade in the USD/ILS currency pair through financial institutions such as banks or forex brokers. Hedging strategies can be employed to mitigate the risks associated with exchange rate fluctuations.

Tips and Tricks

- Monitor live exchange rates regularly to stay informed about the latest movements.

- Consider the impact of exchange rate fluctuations on your financial decisions.

- Use a currency converter to calculate the value of your transactions.

- Consult with financial experts for guidance on hedging strategies and managing exchange rate risk.

Pros and Cons

Pros:

- Opportunities for profit through currency trading

- Increased flexibility in international trade and investment

- Hedging strategies can mitigate financial risks due to exchange rate fluctuations

Cons:

- Exchange rate fluctuations can impact the value of investments and trade

- Hedging strategies may involve additional costs

- Currency trading can be complex and risky

FAQs

-

What factors influence the USD/ILS exchange rate?

– Interest rate differentials, inflation, economic growth, political stability -

How can I hedge against exchange rate fluctuations?

– Forward contracts, options contracts, currency swaps -

What is the current live exchange rate for USD/ILS?

– [Insert current exchange rate] -

How can I stay informed about exchange rate updates?

– Financial news outlets, mobile apps, forex broker platforms -

Can I trade in the USD/ILS currency pair?

– Yes, through financial institutions such as banks or forex brokers -

What are the potential risks of currency trading?

– Market volatility, leverage, lack of understanding

Conclusion

The exchange rate between the US dollar and the Israeli shekel is a dynamic factor that plays a vital role in the Israeli economy and international finance. By understanding the factors that influence exchange rates and employing effective hedging strategies, individuals and businesses can navigate the complexities of currency markets and optimize their financial decisions.