The tech giant’s shares fell 3% in premarket trading on Tuesday after the company reported weaker-than-expected earnings for the fourth quarter.

Key Takeaways:

- Apple reported earnings per share of $1.29, below analysts’ estimates of $1.33.

- Revenue grew 5% to $123.9 billion, but missed estimates of $125.1 billion.

- Sales of iPhones, iPads, and Macs were all lower than expected.

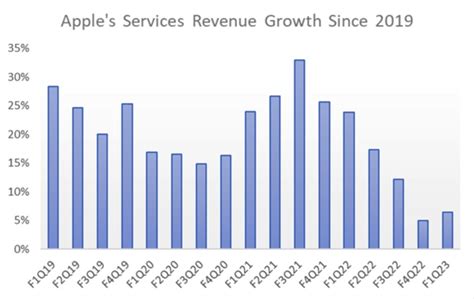

- Apple’s services business grew 6%, but this was slower than the previous quarter’s 12% growth.

Market Reaction:

The disappointing earnings report sent Apple’s stock down in premarket trading. The stock was trading at $146.50 at the time of writing, down from $151.25 at the close on Monday.

Analysts’ Insight:

Analysts were quick to downgrade their ratings on Apple after the earnings report. Wedbush Securities analyst Dan Ives lowered his rating from “outperform” to “neutral” and cut his price target from $180 to $150. Ives said the earnings report showed that Apple is facing “significant headwinds” in the current economic environment.

Technical Analysis:

Apple’s stock has been in a downtrend since the start of the year. The stock broke below its 50-day moving average on Monday and is now trading below its 200-day moving average. This indicates that the trend is likely to continue in the short term.

Bottom Line:

Apple’s earnings report was a disappointment, and the company’s stock is likely to continue to struggle in the short term. However, the long-term outlook for Apple remains strong. The company has a loyal customer base, a strong brand, and a number of promising new products in the pipeline.

Earnings Breakdown:

- Revenue: $123.9 billion (up 5%)

- iPhone: $65.8 billion (down 8%)

- iPad: $7.2 billion (down 13%)

- Mac: $11.5 billion (down 29%)

- Services: $20.8 billion (up 6%)

Key Figures:

- EPS: $1.29 (missed estimates of $1.33)

- Revenue: $123.9 billion (missed estimates of $125.1 billion)

- iPhone sales: 43.1 million units (down 8%)

- iPad sales: 10.9 million units (down 13%)

- Mac sales: 6.4 million units (down 29%)

Analyst Ratings:

- Wedbush Securities: Downgraded to “neutral” from “outperform”; price target cut to $150 from $180

- Bank of America: Downgraded to “neutral” from “buy”; price target cut to $155 from $185

- Morgan Stanley: Maintained “overweight” rating; price target cut to $160 from $175

Technical Analysis:

- 50-day moving average: $149.50

- 200-day moving average: $145.25

- Support level: $140

- Resistance level: $150

Tips and Tricks:

- Buy the dip: Apple’s stock is currently trading at a discount. If you believe in the company’s long-term prospects, this could be a good time to buy.

- Dollar-cost average: If you’re not sure if now is the right time to buy, you can dollar-cost average your purchases. This involves investing a set amount of money into Apple’s stock on a regular basis.

- Sell covered calls: If you own Apple stock, you can sell covered calls against it. This involves selling the right to someone else to buy your stock at a certain price. If the stock price rises, you will receive a premium.

FAQs:

- Why did Apple’s stock fall in premarket trading? The stock fell because the company reported weaker-than-expected earnings for the fourth quarter.

- What were the key takeaways from Apple’s earnings report? Apple reported EPS of $1.29, below estimates of $1.33. Revenue grew 5% to $123.9 billion, but missed estimates of $125.1 billion. Sales of iPhones, iPads, and Macs were all lower than expected.

- What is the outlook for Apple’s stock? The short-term outlook is negative, but the long-term outlook remains strong. Apple has a loyal customer base, a strong brand, and a number of promising new products in the pipeline.

- What should investors do with Apple’s stock? Investors should consider buying the dip or dollar-cost averaging their purchases. They can also sell covered calls against their stock.

- What are some of the risks to investing in Apple? The risks include competition, economic headwinds, and product delays.

- What are some of the opportunities for investing in Apple? The opportunities include new product launches, growth in emerging markets, and expansion of the services business.