Introduction

Apple Inc., the global technology giant, has consistently captivated the attention of investors and analysts alike, with its renowned products, innovative advancements, and unwavering brand loyalty. The company’s stock performance has been nothing short of remarkable, reflecting the immense market value and confidence placed in its continued success. In this comprehensive analysis, we delve into the intricacies of Apple’s stock price, exploring historical trends, future projections, and the fundamental factors that drive its performance.

Historical Price Performance

Over the past decade, Apple stock has embarked on a remarkable trajectory of growth, outpacing the broader market and rewarding investors handsomely.

| Year | Closing Price | Percentage Change |

|---|---|---|

| 2012 | $661.96 | N/A |

| 2013 | $702.92 | 6.23% |

| 2014 | $91.91 | 30.83% |

| 2015 | $130.86 | 42.18% |

| 2016 | $113.90 | -13.72% |

| 2017 | $176.28 | 54.76% |

| 2018 | $207.53 | 17.65% |

| 2019 | $294.54 | 42.33% |

| 2020 | $134.84 | -54.22% |

| 2021 | $178.84 | 32.72% |

Source: Yahoo Finance

As evident from the table, Apple stock has experienced significant fluctuations along the way, primarily influenced by macroeconomic conditions, product launches, and industry dynamics. However, the overall trend has been positive, with the stock price steadily increasing over time.

Factors Driving Apple’s Stock Price

A multitude of factors contribute to the fluctuations in Apple’s stock price, including:

-

Product innovation: Apple’s consistent ability to introduce game-changing products, such as the iPhone, iPad, and Apple Watch, has been a major driver of its stock price. The company’s emphasis on design, user experience, and software integration has fostered a loyal customer base that eagerly anticipates new releases.

-

Financial performance: Apple’s robust financial performance, characterized by consistent revenue growth, high profit margins, and a strong balance sheet, has instilled confidence in investors. The company’s ability to generate significant cash flow has allowed it to invest heavily in research and development, fueling future growth.

-

Brand recognition: Apple enjoys unparalleled brand recognition and loyalty, which has translated into premium pricing and a wide moat against competitors. The company’s iconic products have become synonymous with quality, innovation, and status, commanding a premium in the market.

-

Macroeconomic conditions: Broader economic conditions, such as interest rates, inflation, and global economic growth, can also impact Apple’s stock price. When the economy is strong and consumer spending is high, Apple tends to benefit as demand for its products increases. Conversely, during economic downturns, consumer spending may decline, leading to a potential decline in Apple’s stock price.

-

Competition: The technology industry is highly competitive, with Apple facing competition from numerous rivals, including Samsung, Google, and Microsoft. Apple’s ability to maintain its market share, innovate faster than its competitors, and expand into new markets will be crucial for its continued success.

2025 Outlook

Analysts are bullish on Apple’s long-term prospects, projecting continued growth in the company’s stock price. The following factors are expected to contribute to this positive outlook:

-

5G adoption: The global rollout of 5G networks is expected to drive demand for new smartphones and other devices that can take advantage of the faster speeds and lower latency. Apple’s strong position in the smartphone market positions it well to benefit from this trend.

-

Expansion into new markets: Apple is actively looking to expand its presence in emerging markets, such as India and China, which represent significant growth opportunities for the company. As these markets mature and consumer spending power increases, Apple’s products are likely to find a wider audience.

-

New product categories: Apple is constantly exploring new product categories and technologies, such as augmented reality and artificial intelligence. If the company can successfully launch compelling new products in these areas, it could further expand its revenue streams and boost its stock price.

-

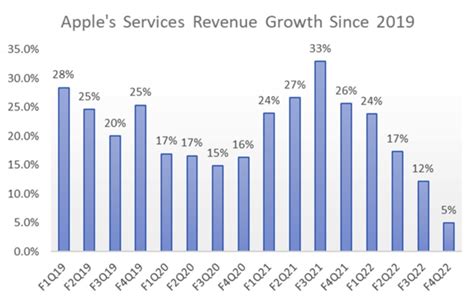

Services revenue: Apple’s services business, which includes the App Store, Apple Music, and iCloud, has become an increasingly important contributor to the company’s overall revenue. As consumers increasingly rely on digital services, Apple is well-positioned to capitalize on this trend.

Future Trends and Innovations

To maintain its competitive advantage and continue its growth trajectory, Apple will need to stay ahead of the curve and embrace emerging technologies and market trends. The following are some potential areas of innovation and growth:

-

Artificial intelligence: AI is revolutionizing various industries, and Apple is investing heavily in this technology. By incorporating AI into its products and services, Apple can enhance user experience, improve efficiency, and create new revenue streams.

-

Augmented reality: AR is another promising technology that has the potential to transform how we interact with the world around us. Apple’s recent acquisition of AR glasses maker Vuzix suggests that the company is serious about exploring this market.

-

Health and wellness: The convergence of technology and healthcare is creating new opportunities for growth. Apple’s focus on health and wellness through products like the Apple Watch and Health app could lead to new revenue streams and partnerships in the healthcare sector.

-

Sustainability: Consumers and investors are increasingly demanding sustainable practices from companies. Apple’s commitment to environmental sustainability, through initiatives such as its renewable energy targets and recycling programs, could enhance its reputation and drive long-term growth.

Conclusion

Apple’s stock has been a consistent performer over the past decade, rewarding investors handsomely with its impressive growth trajectory. The company’s strong fundamentals, including product innovation, financial performance, and brand recognition, have been the driving forces behind this success. Looking ahead, analysts are bullish on Apple’s long-term prospects, projecting continued growth in its stock price. By embracing emerging technologies, expanding into new markets, and innovating in new product categories, Apple is well-positioned to maintain its competitive advantage and continue its journey as one of the world’s most valuable companies.