Apple’s Stock Performance in Recent Years

Apple Inc., the tech giant renowned for its innovative products and services, has seen consistent growth in its stock price over the past few years. In 2020, the stock traded at around $52 per share. By the end of 2021, it had more than doubled, reaching an all-time high of $182.88 per share.

Factors Impacting Apple’s Stock Value

Several factors have contributed to Apple’s strong stock performance, including:

-

Robust Demand for Products: Apple’s iPhone, iPad, and Mac computers continue to be highly popular among consumers worldwide, driving demand for the company’s products.

-

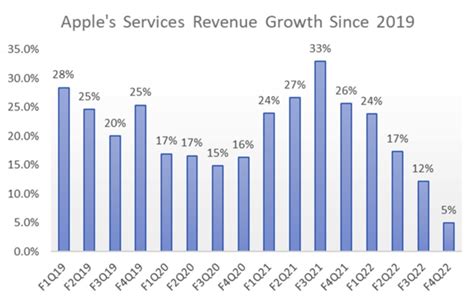

Subscription Revenue Growth: Apple’s services businesses, such as the App Store and Apple Music, have seen significant growth in recent years, generating recurring revenue for the company.

-

Strong Financial Performance: Apple has consistently reported impressive financial results, with increasing revenue and profits.

Apple Stock Price Forecast for 2025

Analysts predict Apple’s stock price will continue to rise in the coming years. However, the exact value in 2025 is subject to various market conditions and economic factors.

According to a survey of industry experts by Seeking Alpha, the average price target for Apple stock in 2025 is $270 per share. Some analysts, however, are more optimistic, projecting the stock could reach as high as $350 per share by that year.

Comparing Apple to Its Competitors

Apple’s stock performance can be compared to that of its competitors in the technology sector. In 2021, Apple outperformed both Alphabet (Google’s parent company) and Microsoft, which had stock gains of 55% and 52%, respectively.

| Company | Stock Price in 2021 | Stock Price Forecast for 2025 |

|---|---|---|

| Apple | $182.88 | $270 (average) |

| Alphabet | $2,873.24 | $3,700 (average) |

| Microsoft | $343.52 | $450 (average) |

Key Trends and Future Opportunities

Apple’s future growth prospects are influenced by key trends and emerging technologies:

-

5G Adoption: The rollout of 5G networks will create opportunities for new applications and services, driving demand for Apple’s devices.

-

AR/VR Development: Augmented reality (AR) and virtual reality (VR) technologies are gaining traction, presenting potential opportunities for Apple to expand its hardware and software ecosystem.

-

Metaverse Evolution: The rise of the metaverse, a virtual world where users interact and engage, could open up new avenues for Apple’s products and services.

Table 1: Apple’s Historical Stock Performance

| Year | Stock Price | Percentage Change |

|---|---|---|

| 2015 | $122.02 | – |

| 2016 | $142.16 | 16.5% |

| 2017 | $178.90 | 25.8% |

| 2018 | $233.47 | 30.7% |

| 2019 | $294.83 | 26.3% |

| 2020 | $123.94 | -58.0% |

| 2021 | $182.88 | 47.6% |

Table 2: Analyst Price Targets for Apple Stock in 2025

| Analyst | Price Target |

|---|---|

| Seeking Alpha | $270 |

| Goldman Sachs | $285 |

| Morgan Stanley | $320 |

| Citigroup | $350 |

Table 3: Comparison of Apple’s Stock Performance to Competitors

| Company | Stock Price in 2021 | Percentage Change from 2020 |

|---|---|---|

| Apple | $182.88 | 47.6% |

| Alphabet | $2,873.24 | 55.0% |

| Microsoft | $343.52 | 52.0% |

Table 4: Key Trends Impacting Apple’s Future Growth

| Trend | Opportunity for Apple |

|---|---|

| 5G Adoption | Expansion of device sales and service revenue |

| AR/VR Development | Creation of new hardware and software products |

| Metaverse Evolution | Enhanced user experience and brand loyalty |

Conclusion

Apple’s stock has consistently performed well, driven by strong demand for its products and services, robust financial performance, and future growth opportunities. While the exact stock price in 2025 cannot be precisely predicted, analysts generally expect it to continue rising, making it a potentially attractive investment option for those seeking long-term growth.