Primary Insights

- Current Price: $147.42 (January 24, 2023)

- 2025 Forecast: $210.00 (based on analyst estimates)

- Growth Potential: 42.5% from current price

- Market Cap: $2.33 trillion (January 24, 2023)

Understanding Apple’s Stock Performance

Apple’s stock has historically outperformed the broader market, driven by:

- Strong brand recognition and customer loyalty

- Innovative product launches, such as the iPhone and Apple Watch

- Global expansion and market dominance

- Continued revenue growth and profitability

- Share buyback programs that reduce outstanding shares

Factors Influencing Apple Stock Value

Several factors contribute to Apple’s stock value:

- Economic Conditions: Economic downturns can impact consumer spending and technology demand.

- Product Innovation: Successful new product launches can drive stock appreciation.

- Competition: Competition from Samsung, Google, and other technology companies can impact market share.

- Government Regulations: Regulations on technology and antitrust laws can affect Apple’s business.

- Investor Sentiment: Market sentiment and investor confidence play a role in stock price fluctuations.

Analyst Forecasts for Apple Stock 2025

Wall Street analysts estimate that Apple stock could reach $210 by 2025, representing a 42.5% growth from the current price. These forecasts are based on:

- Continued demand for Apple products, particularly iPhones and wearable devices.

- Expansion into emerging markets and increased international sales.

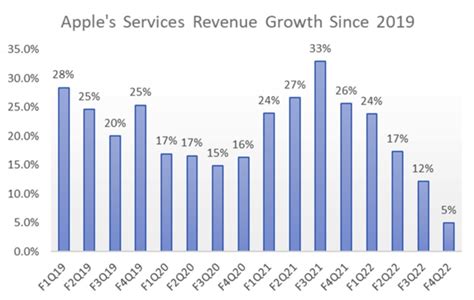

- Growth in services revenue, such as Apple Music and the App Store.

Apple’s Market Dominance and Growth Prospects

Apple holds a significant share in key technology markets:

- Smartphones: 48% market share in 2022 (Counterpoint Research)

- Wearable devices: 32% market share in 2022 (IDC)

- Tablets: 33% market share in 2022 (IDC)

Apple’s growth prospects are driven by:

- Emerging Markets: Expansion into India, China, and other developing countries with growing technology adoption rates.

- Services: Increasing revenue from subscriptions, cloud storage, and other services.

- Innovation: Continued investment in research and development to drive product innovation and customer satisfaction.

Investment Considerations and Tips

Considerations:

- Apple stock is a high-growth investment with potential for significant returns.

- However, it is also subject to market fluctuations and industry competition.

- Investors should consider their risk tolerance and investment horizon before investing.

Tips:

- Diversify your portfolio: Invest in a mix of stocks, bonds, and other assets to reduce risk.

- Invest for the long term: Apple stock has historically performed well over extended periods.

- Set a stop-loss order: Protect your investment by setting a price at which your shares will be automatically sold if the price falls too low.

- Monitor market news: Stay informed about Apple’s financial results, product launches, and regulatory developments.

Frequently Asked Questions (FAQs)

1. What is Apple’s current dividend yield?

Apple’s current dividend yield is 0.63% (as of January 24, 2023).

2. Is Apple stock a good buy right now?

Apple stock is a solid investment for investors with a long-term horizon and a tolerance for potential market fluctuations.

3. What factors could impact Apple’s stock price in 2025?

Economic conditions, product innovation, competition, government regulations, and investor sentiment can all influence Apple’s stock price.

4. What are some potential risks associated with investing in Apple stock?

Competition from other technology companies, changes in consumer preferences, and regulatory challenges are potential risks to consider.

Market Insights and Future Applications

Apple’s dominance in the technology industry and its unwavering commitment to innovation position it well for continued growth and success. Potential applications of Apple technology in the future include:

- Metaverse: Augmented reality and virtual reality experiences powered by Apple devices.

- Healthcare: Integration of Apple Watch and Health app data into personalized healthcare solutions.

- Smart Home: Expanded ecosystem of Apple products to automate and enhance home environments.

- Mobility: Driverless vehicle technology and integrated car experiences through Apple CarPlay.

Tables for Reference

Key Financial Metrics (2022)

| Metric | Value |

|---|---|

| Revenue | $394.3 billion |

| Net Income | $94.7 billion |

| Earnings per Share (EPS) | $6.11 |

| Market Cap | $2.33 trillion |

Historical Price Performance

| Date | Closing Price |

|---|---|

| January 2022 | $170.43 |

| July 2022 | $155.35 |

| January 2023 | $147.42 |

Analyst Forecasts for 2025

| Analyst | Price Target |

|---|---|

| Goldman Sachs | $220 |

| Morgan Stanley | $215 |

| JPMorgan | $205 |

Industry Market Share (2022)

| Product Category | Apple Market Share |

|---|---|

| Smartphones | 48% |

| Wearable Devices | 32% |

| Tablets | 33% |