Introduction

In the world of finance, two crucial terms that often come up are Annual Percentage Rate (APR) and Annual Percentage Yield (APY). These concepts play a significant role in determining the cost of borrowing or the return on savings. Understanding the differences between APR and APY is essential for making informed financial decisions.

Definition of APR and APY

Annual Percentage Rate (APR)

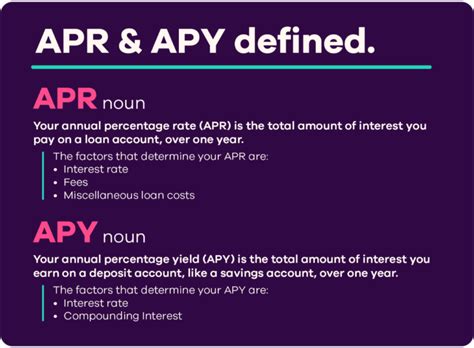

APR is the interest rate charged on a loan annually. It represents the cost of borrowing money, including interest, fees, and other charges. APR is typically expressed as a percentage and is used to compare the cost of different loans.

Annual Percentage Yield (APY)

APY is the effective annual interest rate earned on a savings account or investment. It takes into account the compounding of interest over time, providing a more accurate representation of the actual return. APY is also expressed as a percentage and is used to compare the returns on different savings and investment options.

Key Differences between APR and APY

| Feature | APR | APY |

|---|---|---|

| Purpose | Cost of borrowing | Return on savings |

| Calculation | Interest and fees | Compounded interest |

| Impact of compounding | Not included | Included |

| Accuracy | May not reflect actual cost | More accurate representation |

| Use for comparison | Different loans | Different savings and investment options |

Impact of Compounding on APY

Compounding is a key factor that differentiates APR from APY. Compounding refers to the process where interest earned is added to the principal balance, and the new balance then earns interest in subsequent periods. This effect can significantly increase the overall return over time.

For example, if you deposit $1,000 in a savings account with an APY of 3%, you would earn $30 in interest in the first year. In the second year, you would earn interest not only on the initial $1,000 but also on the $30 of interest earned in the first year, resulting in a total of $30.90. This compounding effect continues year after year, leading to a higher overall return compared to APR.

Significance of APR vs. APY for Consumers

Understanding APR and APY is crucial for consumers when making financial decisions. When borrowing money, a higher APR means a higher cost of borrowing, so it is important to compare APRs from different lenders to find the best deal.

On the other hand, when saving money, a higher APY means a higher return on savings. Comparing APYs from different financial institutions can help consumers maximize their earnings. It is worth noting that APY can vary depending on factors such as the type of account, the deposit amount, and the term length.

Tips and Tricks for Maximizing Returns

- Choose high-yield savings accounts: Seek out savings accounts that offer competitive APYs. Research and compare different institutions to find the best rates.

- Increase deposit amounts: The more you deposit into a savings account, the more interest you will earn over time. Consider consolidating savings from multiple accounts.

- Maximize compounding: Allow interest to compound over longer periods by choosing accounts with shorter compounding intervals, such as daily or monthly.

- Use a savings calculator: Utilize online savings calculators to project the potential earnings based on different APYs and deposit amounts.

- Monitor APY fluctuations: APYs can change over time, so periodically review your accounts and adjust your savings strategy as needed.

Current Status and Future Trends

According to the Federal Deposit Insurance Corporation (FDIC), the average APY on savings accounts in the United States is currently around 0.06%. However, there are institutions offering APYs as high as 1% or more for high-yield savings accounts.

As the financial landscape evolves, we may see continued fluctuations in APYs. Economic factors, such as interest rate changes, can impact the returns offered by financial institutions. It is important to stay informed about these changes and adjust your savings strategy accordingly.

Conclusion

APR and APY are essential concepts in finance that play a crucial role in understanding the cost of borrowing and the return on savings. By comprehending the differences between these two rates, consumers can make informed decisions that maximize their financial gains and minimize their costs. Regular monitoring of APYs and implementing smart savings strategies can help individuals achieve their financial goals.