What is APR (Annual Percentage Rate)?

Annual Percentage Rate (APR) is a comprehensive measure of the cost of borrowing or saving money, expressed as a yearly percentage. It incorporates not only the nominal interest rate but also additional fees and charges associated with the loan or savings account.

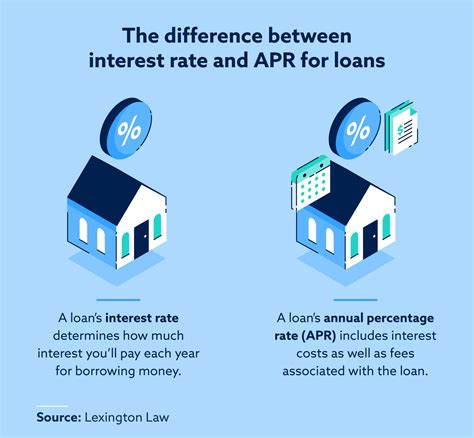

APR vs. Interest Rate: A Comparative Analysis

APR and the nominal interest rate are often confused, but they differ significantly. The interest rate represents the base cost of borrowing or saving, while the APR accounts for all costs over the life of the loan or account.

APR: A Comprehensive View

APR captures all fees and expenses associated with the loan or savings account over its duration. These charges may include loan origination fees, application fees, annual membership fees, and other costs.

Interest Rate: The Base Cost

The interest rate, on the other hand, is the fixed percentage applied to the principal amount of the loan or savings account over a specific period. It does not include any additional fees or charges.

Calculating APR: A Step-by-Step Guide

Calculating the APR is essential to understand the true cost of borrowing or saving. The formula for APR is:

APR = (Total Finance Charges / Principal Amount) * (365 / Loan Term) * 100

Where:

- Total Finance Charges: Sum of all fees and charges associated with the loan or savings account

- Principal Amount: Original amount of money borrowed or deposited

- Loan Term: Duration of the loan or savings account in days

APR in Practice: Examples and Implications

APR plays a crucial role in financial decision-making. Here are two examples to illustrate its impact:

Example 1: Loan with APR

A customer obtains a loan of $10,000 for 5 years. The nominal interest rate is 5%, and the loan origination fee is $500. The APR is:

APR = (500 / 10,000) * (365 / 1825) * 100 = 6.02%

Example 2: Savings Account with APR

A customer deposits $5,000 in a savings account that offers an interest rate of 1%. However, there is a $10 monthly maintenance fee. The APR is:

APR = (10 * 12 / 5,000) * (365 / 365) * 100 = 2.92%

Common Mistakes to Avoid: Demystifying APR

To accurately assess the cost of borrowing or saving, it is important to avoid common APR-related mistakes:

- Comparing APRs without considering fees: APR is more comprehensive than the nominal interest rate, so it should be used as a benchmark for comparison.

- Assuming that a lower APR is always better: A lower APR may not always be the best option if the loan term or other factors differ.

- Ignoring APR fluctuations: APR can change over time, so borrowers and savers should regularly monitor their rates.

Apr vs. Interest Rate – Recent Trends and Future Outlook

The APR landscape is constantly evolving. Here are some key trends to watch:

- Increasing APRs for loans: With rising interest rates, APRs for loans are also expected to increase.

- Stable APRs for savings accounts: Despite inflationary pressures, APRs for savings accounts have remained relatively stable.

- Government regulations: Governments may implement regulations to protect consumers from predatory APRs.

Expanding Market Insights: Applications of APR

APR has applications beyond traditional lending and saving. Here are a few examples:

- Credit card debt management: APR is a key factor in calculating the cost of credit card debt.

- Auto leasing: APR determines the cost of leasing a vehicle.

- Student loans: APR impacts the affordability of student loans.

Conclusion: Unveiling the APR Advantage

APR is an indispensable tool for financial decision-making. By understanding the difference between APR and interest rate, consumers can make informed choices and optimize their financial strategies. By staying abreast of APR trends and regulations, individuals can mitigate risks and maximize their financial well-being.