Introduction

AUD to USD Forecastahead

The Australia dollar (AUD) and the United States dollar (USD) are two of the world’s most traded currencies. The AUD/USD currency pair is often referred to as “Aussie” or “the Aussie dollar.”

The AUD/USD exchange rate is influenced by a variety of factors, including:

* Economic data from Australia and the United States

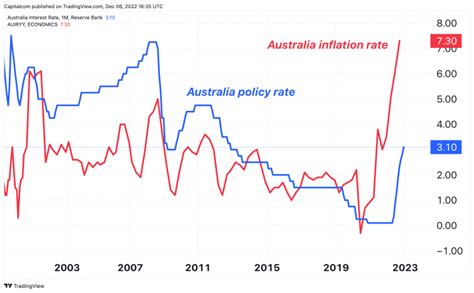

* Interest rate decisions by the Reserve Bank of Australia (RBA) and the Federal Reserve (Fed)

* Global economic conditions

* Political events

AUD to USD Forecast for 2023

AUD to USD Forecast for 2023

In 2023, the AUD/USD exchange rate is expected to trade in a range between 0.65 and 0.75. The RBA is expected to keep interest rates on hold, while the Fed is expected to raise interest rates by 25 basis points in March and June. The US economy is expected to grow by 2.5% in 2023, while the Australian economy is expected to grow by 2.0%.

AUD to USD Forecast for 2025

AUD to USD Forecast for 2025

In 2025, the AUD/USD exchange rate is expected to trade in a range between 0.70 and 0.80. The RBA is expected to start raising interest rates in 2024, while the Fed is expected to keep interest rates on hold. The US economy is expected to grow by 2.3% in 2025, while the Australian economy is expected to grow by 2.1%.

Factors Influencing the AUD/USD Exchange Rate

Factors Influencing the AUD/USD Exchange Rate

The AUD/USD exchange rate is influenced by a variety of factors, including:

- Economic data: Economic data from Australia and the United States can have a significant impact on the AUD/USD exchange rate. For example, if the Australian economy is growing faster than the US economy, the AUD is likely to appreciate against the USD.

- Interest rate decisions: Interest rate decisions by the RBA and the Fed can also have a significant impact on the AUD/USD exchange rate. For example, if the RBA raises interest rates, the AUD is likely to appreciate against the USD.

- Global economic conditions: Global economic conditions can also have a significant impact on the AUD/USD exchange rate. For example, if there is a global recession, the AUD is likely to depreciate against the USD.

- Political events: Political events can also have a significant impact on the AUD/USD exchange rate. For example, if there is a political crisis in Australia, the AUD is likely to depreciate against the USD.

Common Mistakes to Avoid When Trading AUD/USD

Common Mistakes to Avoid When Trading AUD/USD

There are a number of common mistakes that traders make when trading AUD/USD. These mistakes include:

- Not having a trading plan: A trading plan is a set of rules that you follow when trading. It should include your entry and exit points, as well as your risk management parameters.

- Trading too often: Trading too often can lead to losses. It is important to be patient and only trade when there is a good opportunity.

- Not using stop-loss orders: A stop-loss order is an order that you place with your broker to sell your currency pair if it reaches a certain price. This can help to protect you from losses.

- Not managing your risk: Risk management is an important part of trading. You should always know how much you are willing to lose on a trade.

How to Step-by-Step Approach to Trading AUD/USD

How to Step-by-Step Approach to Trading AUD/USD

If you are new to trading AUD/USD, it is important to start with a step-by-step approach. This will help you to learn the basics of trading and avoid making common mistakes.

Here is a step-by-step approach to trading AUD/USD:

- Educate yourself: The first step is to educate yourself about AUD/USD trading. This includes learning about the factors that influence the exchange rate, as well as the different trading strategies.

- Develop a trading plan: Once you have educated yourself about AUD/USD trading, you need to develop a trading plan. This plan should include your entry and exit points, as well as your risk management parameters.

- Practice trading: The best way to learn how to trade AUD/USD is to practice. You can do this by using a demo account with a forex broker.

- Start trading live: Once you have practiced trading AUD/USD, you can start trading live. It is important to start with a small account and only trade with money that you can afford to lose.

Expanding Market Insights on AUD/USD Trading

Expanding Market Insights on AUD/USD Trading

In addition to the factors discussed above, there are a number of other factors that can influence the AUD/USD exchange rate. These factors include:

- Commodity prices: The AUD is often referred to as a “commodity currency” because it is heavily influenced by the prices of commodities such as iron ore, coal, and gold. If commodity prices are rising, the AUD is likely to appreciate against the USD.

- Chinese economic data: China is Australia’s largest trading partner. As a result, Chinese economic data can have a significant impact on the AUD/USD exchange rate. If the Chinese economy is growing, the AUD is likely to appreciate against the USD.

- Global risk appetite: Global risk appetite can also have a significant impact on the AUD/USD exchange rate. If investors are risk-averse, they are likely to sell the AUD and buy the USD.

Conclusion

Conclusion

The AUD/USD exchange rate is influenced by a variety of factors, including economic data, interest rate decisions, global economic conditions, and political events. In 2023, the AUD/USD exchange rate is expected to trade in a range between 0.65 and 0.75. In 2025, the AUD/USD exchange rate is expected to trade in a range between 0.70 and 0.80.

If you are new to trading AUD/USD, it is important to start with a step-by-step approach. This will help you to learn the basics of trading and avoid making common mistakes.