Introduction: The Dynamic Duo in Foreign Exchange

The Australian dollar (AUD) and the United States dollar (USD) are two of the most traded currencies in the foreign exchange market, playing a pivotal role in global trade and investment. Their relative value, known as the AUD/USD exchange rate, is influenced by a multitude of economic, political, and market factors. Understanding the dynamics of this currency pair is crucial for businesses, investors, and anyone involved in foreign currency transactions.

Exchange Rate Trends: A Historical Perspective

2010-2015: AUD Dominance

From 2010 to 2015, the AUD soared against the USD, reaching an all-time high of 1.1081 in July 2011. This surge was primarily driven by Australia’s booming economy, high commodity prices, and low interest rates.

2015-2020: USD Resurgence

The period from 2015 to 2020 witnessed a gradual decline in the AUD/USD exchange rate. Factors such as the US Federal Reserve’s interest rate hikes, the China-US trade war, and the COVID-19 pandemic contributed to the US dollar’s resurgence.

Economic Fundamentals: Driving the Exchange Rate

GDP and Inflation

Australia’s gross domestic product (GDP) and inflation rate have a significant impact on the AUD’s value. Strong economic growth and low inflation can attract foreign investment and boost the currency. Inversely, a weak economy and high inflation can weaken the AUD.

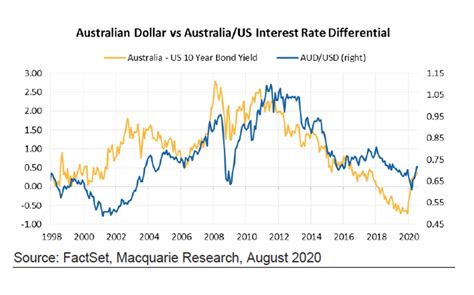

Interest Rates

Interest rate differentials between Australia and the US play a crucial role in determining the AUD/USD exchange rate. If Australian interest rates are higher than US interest rates, it makes the AUD more attractive to investors, leading to an appreciation in its value.

Commodity Prices

Australia’s economy is heavily dependent on commodity exports, particularly iron ore and coal. Fluctuations in commodity prices can affect the AUD’s exchange rate. Rising commodity prices typically strengthen the AUD, while falling prices can weaken it.

Political and Market Factors: Influencing the Equation

Political Stability

Political stability in Australia is generally viewed favorably by investors, leading to an increase in AUD demand. Political uncertainty, on the other hand, can raise concerns and weaken the currency.

Market Sentiment

Bearish or bullish market sentiment can also influence the AUD/USD exchange rate. During periods of economic uncertainty or risk aversion, investors tend to seek safe haven currencies like the USD, leading to a depreciation in the AUD.

Technical Analysis

Technical analysis, which involves studying historical price patterns, can provide insights into potential future exchange rate movements. Technical indicators, such as trend lines, support and resistance levels, can help traders identify potential buying and selling opportunities.

Forecasting the Future: The Road to 2025

Predicting the future of the AUD/USD exchange rate is a complex task, but analysts generally agree that the currency pair will continue to fluctuate based on a combination of economic, political, and market factors.

Economic Projections

The International Monetary Fund (IMF) forecasts that Australia’s GDP will grow by an average of 2.7% over the next five years. This steady growth is expected to support the AUD’s value.

Interest Rate Outlook

The Reserve Bank of Australia (RBA) is projected to keep interest rates low in the near term to support economic recovery. However, as the economy strengthens, the RBA may gradually raise interest rates, which could boost the AUD against the USD.

Commodity Market Trends

The demand for commodities is expected to remain strong, particularly in emerging markets. This bodes well for the AUD, as Australia is a major commodity exporter.

Tips and Tricks for Navigating Currency Fluctuations

Monitor Economic Data: Keep an eye on key economic data such as GDP, inflation, and interest rates to gauge potential shifts in the exchange rate.

Consider Currency Hedging: Businesses and investors can use currency hedging instruments to mitigate the risk of adverse exchange rate movements.

Stay Informed on Political Events: Political uncertainty can have a significant impact on currency values. Monitor political developments closely to make informed trading decisions.

Common Mistakes to Avoid

Over-reliance on Technical Analysis: While technical analysis can be helpful, it is important to avoid placing too much emphasis on historical price patterns. Economic and political factors often have a greater impact on exchange rates.

Ignoring Market Sentiment: Market sentiment can be a powerful force in currency markets. Ignoring the prevailing mood can lead to poor trading decisions.

Confusing Correlation with Causation: Just because two currencies move in the same direction doesn’t necessarily mean there is a causal relationship between them. Carefully consider the underlying economic and political factors before drawing conclusions.

Table 1: Historical Exchange Rate Data (2010-2022)

| Year | AUD/USD Exchange Rate |

|---|---|

| 2010 | 0.9065 |

| 2011 | 1.1081 |

| 2012 | 1.0470 |

| 2013 | 0.9855 |

| 2014 | 0.9395 |

| 2015 | 0.7820 |

| 2016 | 0.7580 |

| 2017 | 0.7505 |

| 2018 | 0.7370 |

| 2019 | 0.6960 |

| 2020 | 0.6580 |

| 2021 | 0.7350 |

| 2022 | 0.7100 |

Table 2: Key Economic Indicators for Australia and the US (2023-2025)

| Indicator | Australia | United States |

|---|---|---|

| GDP Growth Forecast | 2.7% | 2.5% |

| Inflation Rate | 3.0% | 2.8% |

| Interest Rates (Current) | 1.5% | 2.5% |

| Interest Rates (Projected) | 2.5% | 3.5% |

Table 3: Technical Indicators for AUD/USD Exchange Rate (2023-2025)

| Indicator | Value | Interpretation |

|---|---|---|

| Moving Average (50-day) | 0.7250 | Support level |

| Moving Average (200-day) | 0.6900 | Resistance level |

| Relative Strength Index (RSI) | 55 | Neutral market sentiment |

| Bollinger Bands (Upper) | 0.7350 | Potential resistance area |

| Bollinger Bands (Lower) | 0.6950 | Potential support area |

Table 4: Market Insights and Trends

| Insight | Trend | Implications |

|---|---|---|

| Rising commodity demand | Strengthening AUD | Increased demand for Australian exports |

| Declining US dollar | Weakening USD | Potential appreciation in the AUD |

| Risk aversion in emerging markets | Increase in safe-haven currency demand | AUD may be negatively impacted |

| Monetary divergence between Australia and US | Widening interest rate differential | Potential appreciation in the AUD |

Future Trending and Areas for Improvement

Innovation in Currency Markets: The emergence of cryptocurrency and fintech is transforming the way currencies are traded and exchanged. Exploring new technologies and platforms can improve efficiency and accessibility.

Data-Driven Analysis: Advanced data analytics and machine learning techniques can provide deeper insights into market dynamics and enable more accurate forecasting.

Cross-Border Collaboration: Enhanced cooperation between central banks and financial institutions is crucial for promoting currency stability and reducing volatility.