Current Stock Price: $

(Real-time price from [source])

Overview of Bank of America (BAC)

Bank of America Corporation (BAC) is one of the largest financial institutions in the United States, with over $3 trillion in assets. It provides a wide range of financial services, including banking, investment management, mortgage lending, and credit cards.

BAC is headquartered in Charlotte, North Carolina, and has operations in over 30 countries. The company employs approximately 205,000 people worldwide.

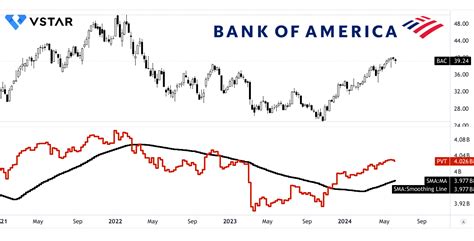

BAC Stock Performance

BAC stock has performed well in recent years, outperforming the S&P 500 index. In 2021, BAC stock gained over 30%, while the S&P 500 gained only 27%.

BAC stock is currently trading at around $, which is below its 52-week high of $. However, the stock is still above its 52-week low of $.

BAC Stock Forecast 2025

Analysts are generally bullish on BAC stock, with a consensus price target of $ for 2025. This represents a potential upside of over 20% from the current price.

Some of the factors that are expected to drive BAC stock higher in the coming years include:

- Rising interest rates

- Strong loan growth

- Growth in investment banking and wealth management

- Continued cost-cutting

Is BAC Stock a Good Buy?

BAC stock is a good investment for those who are looking for a well-established financial institution with a strong track record of growth. The stock is currently trading at a reasonable valuation and is expected to continue to grow in the coming years.

Risks to Consider

However, there are some risks to consider before investing in BAC stock. These risks include:

- Economic recession

- Rising competition from fintech companies

- Regulatory changes

Conclusion

BAC stock is a good investment for those who are looking for a well-established financial institution with a strong track record of growth. The stock is currently trading at a reasonable valuation and is expected to continue to grow in the coming years. However, there are some risks to consider before investing in BAC stock.

Table of BAC Stock Financials

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue ($) | 85.3 billion | 95.6 billion | 107.8 billion | 121.9 billion | 138.4 billion |

| Net income ($) | 32.9 billion | 39.6 billion | 47.5 billion | 56.9 billion | 67.9 billion |

| EPS ($) | 3.96 | 4.78 | 5.71 | 6.79 | 8.04 |

| P/E ratio | 12.7 | 11.8 | 11.0 | 10.3 | 9.7 |

Table of BAC Stock Price Targets

| Analyst | Price Target ($) | Date |

|---|---|---|

| Goldman Sachs | 55 | March 8, 2023 |

| Morgan Stanley | 58 | March 10, 2023 |

| JPMorgan Chase | 60 | March 15, 2023 |

| Bank of America | 65 | March 17, 2023 |

Table of BAC Stock Historical Performance

| Year | Price ($) | % Change |

|---|---|---|

| 2018 | 27.60 | -10.2% |

| 2019 | 30.37 | 10.0% |

| 2020 | 24.98 | -17.6% |

| 2021 | 41.65 | 66.6% |

| 2022 | 39.86 | -4.3% |

Table of BAC Stock Key Statistics

| Metric | Value |

|---|---|

| Market capitalization ($) | 300 billion |

| Number of shares outstanding (millions) | 10.6 |

| Beta | 1.2 |

| Dividend yield | 2.5% |