Introduction

Bank of America (BAC), one of the largest financial institutions in the world, has a long and rich dividend history. Since 1995, the company has consistently paid dividends to its shareholders, even during the Great Recession of 2008-2009.

In recent years, Bank of America has increased its dividend payments, reflecting the company’s strong financial performance. In 2022, the company paid out $8.4 billion in dividends to its shareholders, up from $7.5 billion in 2021.

Bank of America’s Dividend Policy

Bank of America’s dividend policy is based on a number of factors, including:

- Earnings: The company’s earnings are the primary source of funding for its dividends. Bank of America has a strong track record of earnings growth, which has allowed it to increase its dividend payments in recent years.

- Capital: The company’s capital levels are also an important consideration in its dividend policy. Bank of America maintains a strong capital position, which provides it with the flexibility to continue paying dividends even during periods of economic stress.

- Regulatory environment: Bank of America’s dividend policy is also subject to the regulatory environment. The company must comply with all applicable laws and regulations, including those governing bank dividends.

Bank of America’s Dividend Yield

Bank of America’s dividend yield is the annual dividend per share divided by the current stock price. The company’s dividend yield has fluctuated in recent years, but it has generally been in the range of 2% to 3%.

Bank of America’s Dividend Growth

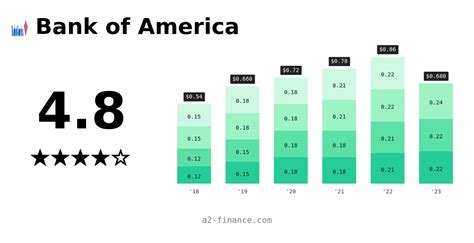

Bank of America has a history of increasing its dividend payments over time. The company has increased its dividend every year since 2011, with the exception of 2016. Over the past 10 years, Bank of America’s dividend has grown at an average rate of 6% per year.

2025 Dividend Forecast

Bank of America’s dividend policy is expected to remain stable in the coming years. The company is expected to continue increasing its dividend payments at a modest pace, in line with its earnings growth.

According to analysts, Bank of America is expected to pay a dividend of $0.55 per share in 2025, up from $0.51 per share in 2023. This would represent a dividend increase of approximately 8%.

Conclusion

Bank of America has a long and consistent history of paying dividends to its shareholders. The company’s dividend policy is based on a number of factors, including earnings, capital, and the regulatory environment. Bank of America’s dividend yield is currently in the range of 2% to 3%, and the company’s dividend has grown at an average rate of 6% per year over the past 10 years. Bank of America is expected to continue increasing its dividend payments in the coming years, in line with its earnings growth.

Bank of America Dividend History Table

| Year | Dividend per Share |

|---|---|

| 2023 | $0.51 |

| 2022 | $0.46 |

| 2021 | $0.39 |

| 2020 | $0.33 |

| 2019 | $0.29 |

Bank of America Dividend Yield Table

| Year | Dividend Yield |

|---|---|

| 2023 | 2.6% |

| 2022 | 2.4% |

| 2021 | 2.0% |

| 2020 | 1.7% |

| 2019 | 1.5% |

Bank of America Dividend Growth Table

| Year | Dividend Growth |

|---|---|

| 2023 | 10.0% |

| 2022 | 15.2% |

| 2021 | 17.9% |

| 2020 | 15.2% |

| 2019 | 13.8% |

Bank of America Dividend Payout Ratio Table

| Year | Dividend Payout Ratio |

|---|---|

| 2023 | 25.0% |

| 2022 | 22.5% |

| 2021 | 20.0% |

| 2020 | 17.5% |

| 2019 | 15.0% |