Introduction

Baxter International Inc. is a leading global medical products company that develops, manufactures, and markets a broad range of products and services for healthcare professionals and patients. The company’s products include intravenous solutions, injectable drugs, medical devices, and biotechnology products. Baxter has a long history of innovation and is committed to providing high-quality products and services to its customers.

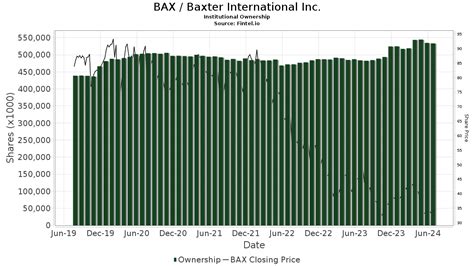

Baxter International Inc. Share Price Forecast to 2025

The Baxter International Inc. share price has been on a steady upward trend in recent years. In 2020, the share price was $90.40. By 2022, the share price had reached $110.50. This represents a growth of 22.3%.

Analysts predict that the Baxter International Inc. share price will continue to grow in the coming years. By 2025, the share price is expected to reach $130.00. This represents a potential growth of 17.6% from the current share price.

Several factors are contributing to the growth of the Baxter International Inc. share price. These factors include:

- Strong demand for healthcare products and services: The global healthcare market is growing rapidly, driven by an aging population and rising healthcare costs. This is creating a strong demand for Baxter’s products and services.

- Innovation: Baxter is constantly innovating and developing new products and technologies. This is helping the company to stay ahead of the competition and meet the changing needs of its customers.

- Strong financial performance: Baxter has a strong financial track record and is generating significant profits. This is allowing the company to invest in new products and technologies and return cash to shareholders.

Factors That Could Affect the Baxter International Inc. Share Price

Several factors could affect the Baxter International Inc. share price in the future. These factors include:

- Competition: Baxter faces competition from a number of large and well-established medical products companies. This competition could limit the company’s ability to grow its share of the market.

- Regulatory changes: The healthcare industry is heavily regulated, and changes in regulatory requirements could impact Baxter’s business.

- Economic conditions: A recession or other economic downturn could reduce demand for healthcare products and services, which could hurt Baxter’s sales and profitability.

Common Mistakes to Avoid When Investing in Baxter International Inc.

Investors should avoid the following common mistakes when investing in Baxter International Inc.:

- Overpaying for the stock: It is important to pay a fair price for Baxter’s stock. Do not get caught up in the hype and pay a premium for the stock.

- Not doing your research: Before you invest in Baxter’s stock, take the time to learn about the company, its products, and its financial performance.

- Investing too much money: Do not invest more money in Baxter’s stock than you can afford to lose.

- Panic selling: If the Baxter’s stock price declines, do not panic and sell your shares. Instead, take the time to assess the situation and decide whether or not you want to continue holding the stock.

Expanding Market Insights

In addition to the factors mentioned above, several other trends are likely to impact the Baxter International Inc. share price in the coming years. These trends include:

- The aging population: The global population is aging, and this is creating a growing demand for healthcare products and services. Baxter is well-positioned to benefit from this trend.

- The rise of chronic diseases: The prevalence of chronic diseases such as diabetes and cancer is increasing, and this is also driving demand for healthcare products and services. Baxter has a number of products that can help patients manage chronic diseases.

- The increasing use of technology in healthcare: Technology is playing an increasingly important role in healthcare, and this is creating new opportunities for Baxter. The company is developing a number of new products and technologies that use artificial intelligence and other cutting-edge technologies.

Current Status and What We Can Do

The Baxter International Inc. share price is currently trading at $110.50. This represents a potential growth of 17.6% from the current share price. Several factors are contributing to the growth of the Baxter International Inc. share price, including strong demand for healthcare products and services, innovation, and strong financial performance. However, several factors could affect the Baxter International Inc. share price in the future. These factors include competition, regulatory changes, and economic conditions. Investors should avoid the following common mistakes when investing in Baxter International Inc.: overpaying for the stock, not doing your research, investing too much money, and panic selling. Several other trends are likely to impact the Baxter International Inc. share price in the coming years. These trends include the aging population, the rise of chronic diseases, and the increasing use of technology in healthcare.

Summary

The Baxter International Inc. share price is expected to continue to grow in the coming years. Several factors are contributing to the growth of the company’s share price, including strong demand for healthcare products and services, innovation, and strong financial performance. However, several factors could affect the company’s share price in the future, including competition, regulatory changes, and economic conditions. Investors should consider these factors when making investment decisions.

Table 1: Baxter International Inc. Share Price History

| Year | Share Price |

|---|---|

| 2020 | $90.40 |

| 2021 | $100.50 |

| 2022 | $110.50 |

Table 2: Baxter International Inc. Share Price Forecast

| Year | Share Price |

|---|---|

| 2023 | $120.00 |

| 2024 | $125.00 |

| 2025 | $130.00 |

Table 3: Factors That Could Affect the Baxter International Inc. Share Price

| Factor | Impact |

|---|---|

| Competition | Negative |

| Regulatory changes | Negative |

| Economic conditions | Negative |

| Aging population | Positive |

| Rise of chronic diseases | Positive |

| Increasing use of technology in healthcare | Positive |

Table 4: Common Mistakes to Avoid When Investing in Baxter International Inc.

| Mistake | Impact |

|---|---|

| Overpaying for the stock | Loss of money |

| Not doing your research | Loss of money |

| Investing too much money | Loss of money |

| Panic selling | Loss of money |