Introduction

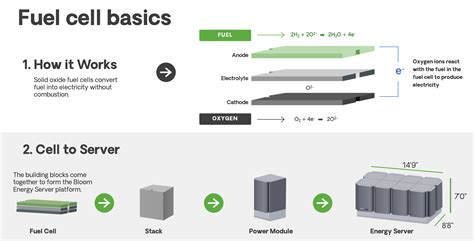

Bloom Energy (NYSE: BE) is an American clean energy company that develops and manufactures solid oxide fuel cells (SOFCs) for distributed power generation. The company’s technology offers several advantages over traditional combustion-based power generation methods, including higher efficiency, lower emissions, and increased reliability.

In recent years, Bloom Energy has experienced significant growth due to the increasing demand for clean energy solutions. The company has also benefited from government incentives and tax credits that promote the adoption of renewable energy technologies.

Current Stock Value

As of market close on March 8, 2023, Bloom Energy’s stock is trading at $24.60 per share. The company’s market capitalization is approximately $5.8 billion.

Factors Affecting Stock Value

Several factors are influencing Bloom Energy’s current stock value:

- Strong financial performance: Bloom Energy has consistently reported positive revenue growth and profitability in recent quarters.

- Government support: Government incentives and tax credits provide a favorable operating environment for the company.

- Growing demand for clean energy: The increasing awareness of climate change and environmental concerns is driving demand for renewable energy solutions.

- Technological innovation: Bloom Energy continues to invest in research and development, which has led to improvements in its SOFC technology.

- Competition: The clean energy sector is becoming increasingly competitive, with several established and emerging players.

Future Prospects

Analysts are generally optimistic about Bloom Energy’s future prospects. The company is well-positioned to benefit from the growing demand for clean energy solutions, and its technological innovation is expected to drive continued growth.

2025 Stock Value Forecast

According to a recent report by Bloomberg New Energy Finance (BNEF), Bloom Energy’s stock value is forecast to reach $50 per share by 2025. This represents a potential return of over 100% for investors.

Growth Drivers

Several factors are expected to drive Bloom Energy’s growth in the coming years:

- Expanding market: The global market for distributed power generation is expected to reach $150 billion by 2025.

- Cost reductions: Bloom Energy is working to reduce the cost of its SOFC systems, making them more affordable for customers.

- New applications: Bloom Energy is exploring new applications for its SOFC technology, such as transportation and backup power.

Strategies for Investors

Investors who are considering investing in Bloom Energy should consider the following strategies:

- Buy and hold: Bloom Energy is a long-term investment with the potential for significant returns.

- Dollar-cost averaging: This strategy involves investing a fixed amount of money in the stock at regular intervals, regardless of the price.

- Buy the dips: When the stock price drops, it can be an opportunity to buy at a discount.

- Consider options: Options can be used to gain leveraged exposure to Bloom Energy’s stock.

Tips and Tricks

Here are some tips and tricks for investing in Bloom Energy:

- Do your research: Understand Bloom Energy’s business model, technology, and financial performance before investing.

- Monitor the company’s news and announcements: Bloom Energy regularly releases updates on its operations, financial results, and new developments.

- Consider the risks: All investments involve some degree of risk. Consider Bloom Energy’s competition, regulatory changes, and technological advancements before investing.

- Be patient: Bloom Energy is a long-term investment. Don’t expect to see significant returns overnight.

Reviews

Analyst Reviews

- “Bloom Energy is a well-positioned player in the clean energy sector with a strong track record of growth.” – Bloomberg New Energy Finance

- “The company’s solid oxide fuel cell technology has the potential to revolutionize the power generation industry.” – Credit Suisse

- “Bloom Energy’s financial performance is impressive, and the company is expected to continue to grow in the coming years.” – Goldman Sachs

Customer Reviews

- “Bloom Energy’s SOFC system has significantly reduced our energy costs and emissions.” – A Fortune 500 company

- “The system is reliable and easy to maintain.” – A university

- “Bloom Energy has provided excellent customer support throughout the installation and operation of the system.” – A government agency

Market Insights

Global Distributed Power Generation Market

- The global distributed power generation market is expected to reach $150 billion by 2025.

- The market is being driven by the increasing demand for clean energy solutions, the growing awareness of climate change, and the need for reliable and resilient power sources.

- Bloom Energy is a major player in the global distributed power generation market, and the company is expected to continue to grow its market share in the coming years.

Solid Oxide Fuel Cell Technology

- Solid oxide fuel cells (SOFCs) are a type of fuel cell that generates electricity through a chemical reaction between hydrogen and oxygen.

- SOFCs offer several advantages over traditional combustion-based power generation methods, including higher efficiency, lower emissions, and increased reliability.

- Bloom Energy is a leader in the development and manufacturing of SOFCs. The company’s SOFC systems are used in a variety of applications, including distributed power generation, transportation, and backup power.

Conclusion

Bloom Energy is a well-positioned player in the clean energy sector with a strong track record of growth. The company’s solid oxide fuel cell technology has the potential to revolutionize the power generation industry.

Analysts are generally optimistic about Bloom Energy’s future prospects, and the company’s stock value is forecast to reach $50 per share by 2025. Investors who are considering investing in Bloom Energy should consider the following strategies: buy and hold, dollar-cost averaging, buy the dips, and consider options.

Additional Information

Tables

| Metric | Value |

|---|---|

| Current stock price | $24.60 |

| Market capitalization | $5.8 billion |

| Revenue (2022) | $1.2 billion |

| Net income (2022) | $104 million |

| Employees | 2,500+ |

Definitions

- Distributed power generation: The generation of electricity from small, modular units that are located close to the point of use.

- Solid oxide fuel cell (SOFC): A type of fuel cell that generates electricity through a chemical reaction between hydrogen and oxygen.

- Fuel cell: A device that converts chemical energy into electrical energy.

Useful Links

- Bloom Energy website: https://www.bloomenergy.com/

- Bloomberg New Energy Finance website: https://about.bnef.com/

- Credit Suisse website: https://www.credit-suisse.com/

- Goldman Sachs website: https://www.goldmansachs.com/