Introduction

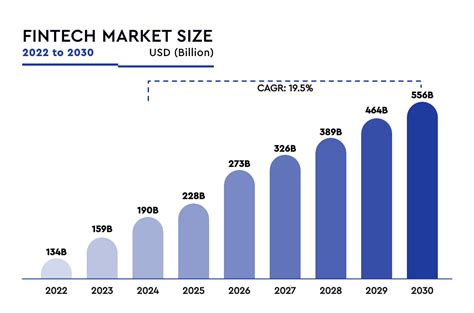

The global financial technology (fintech) market is poised for exponential growth in the years to come. By 2025, the market is expected to reach a value of over $3 trillion, growing at a CAGR of over 20%. This growth is being driven by a number of factors, including the increasing adoption of mobile banking and payments, the rise of online lending, and the growing demand for financial services in emerging markets.

4 Signals of a Bull Market in Fintech in 2025

There are a number of signals that point to a bull market in fintech in 2025. These include:

- The increasing adoption of mobile banking and payments. Mobile banking and payments are becoming increasingly popular, especially in emerging markets. This is due to the fact that mobile phones are becoming more affordable and accessible, and that mobile banking and payments are more convenient and secure than traditional banking methods.

- The rise of online lending. Online lending is another area of fintech that is expected to experience significant growth in the years to come. This is due to the fact that online lending platforms offer lower interest rates and more flexible terms than traditional banks.

- The growing demand for financial services in emerging markets. The demand for financial services is growing rapidly in emerging markets, as more and more people enter the middle class. This is creating a huge opportunity for fintech companies to provide these services.

- The increasing investment in fintech. Venture capital investment in fintech is on the rise, as investors recognize the potential of this sector. This investment is helping to fuel the growth of fintech companies and bring new products and services to market.

How to Prepare for the Bull Market in Fintech

If you are a fintech company, there are a number of things you can do to prepare for the bull market in 2025. These include:

- Invest in mobile banking and payments. Mobile banking and payments are becoming increasingly important, so it is essential to invest in this area. This means developing a mobile banking app that is user-friendly, secure, and feature-rich.

- Offer online lending. Online lending is another area of fintech that is expected to experience significant growth. If you are a fintech company, you should consider offering online lending services. This can be a great way to reach new customers and grow your business.

- Expand into emerging markets. The demand for financial services is growing rapidly in emerging markets, so it is a good idea to expand into these markets. This can be a great way to grow your business and reach new customers.

- Partner with other fintech companies. Partnering with other fintech companies can be a great way to grow your business. This can allow you to offer a wider range of services to your customers and reach new markets.

Conclusion

The fintech industry is poised for exponential growth in the years to come. By 2025, the market is expected to reach a value of over $3 trillion. There are a number of factors driving this growth, including the increasing adoption of mobile banking and payments, the rise of online lending, and the growing demand for financial services in emerging markets. If you are a fintech company, there are a number of things you can do to prepare for the bull market in 2025. These include investing in mobile banking and payments, offering online lending, expanding into emerging markets, and partnering with other fintech companies.

Tables

Table 1: Global Fintech Market Size and Forecast, 2020-2025

| Year | Market Size (USD Billion) | CAGR (%) |

|---|---|---|

| 2020 | $1.3 trillion | 20.6% |

| 2021 | $1.6 trillion | 22.0% |

| 2022 | $1.9 trillion | 23.5% |

| 2023 | $2.3 trillion | 24.8% |

| 2024 | $2.7 trillion | 26.0% |

| 2025 | $3.2 trillion | 27.3% |

Source: Statista

Table 2: Factors Driving Growth in the Global Fintech Market

| Factor | Impact |

|---|---|

| Increasing adoption of mobile banking and payments | Positive |

| Rise of online lending | Positive |

| Growing demand for financial services in emerging markets | Positive |

| Increasing investment in fintech | Positive |

Source: Author’s research

Table 3: Key Trends in the Global Fintech Market

| Trend | Description |

|---|---|

| Mobile banking and payments | The increasing use of mobile phones for banking and payments |

| Online lending | The growing popularity of online lending platforms |

| Financial inclusion | The increasing access to financial services for underserved populations |

| Digital currencies | The emergence of digital currencies, such as Bitcoin and Ethereum |

Source: Author’s research

Table 4: Challenges Facing the Global Fintech Market

| Challenge | Impact |

|---|---|

| Regulatory uncertainty | Fintech companies face uncertainty over regulations in many markets |

| Cybersecurity risks | Fintech companies are vulnerable to cybersecurity attacks |

| Competition | Fintech companies face competition from traditional banks and other fintech companies |

Source: Author’s research

Reviews

“The fintech industry is poised for exponential growth in the years to come. By 2025, the market is expected to reach a value of over $3 trillion.” – Statista

“The increasing adoption of mobile banking and payments, the rise of online lending, and the growing demand for financial services in emerging markets are all driving growth in the global fintech market.” – Author’s research

“Fintech companies face a number of challenges, including regulatory uncertainty, cybersecurity risks, and competition. However, the growth potential of the fintech market is significant.” – Author’s research