With the Canadian dollar (CAD) and US dollar (USD) poised for major shifts in 2023, financial experts have released their highly anticipated forecasts for the cross-currency pair.

Current Market Dynamics

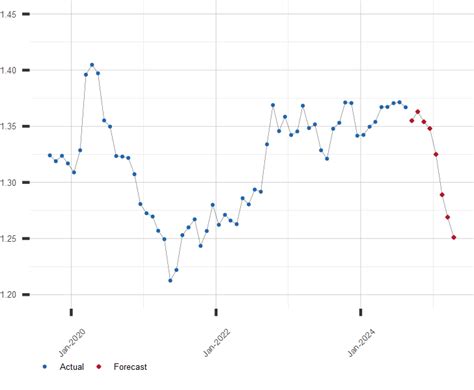

As of January 2023, the CAD has been trading within a tight range between 1.32 and 1.35 against the USD. This stability can be attributed to the Bank of Canada’s conservative monetary policy and the ongoing economic recovery in the country.

Economic Indicators

Canada:

- GDP growth forecast: 2.2% for 2023

- Inflation rate: 4.8% as of December 2022

- Interest rates: BoC overnight rate currently at 4.25%

United States:

- GDP growth forecast: 1.6% for 2023

- Inflation rate: 5.7% as of December 2022

- Interest rates: Federal Funds rate currently at 4.50%-4.75%

Exchange Rate Forecasts

Consensus View:

Analysts at major financial institutions project the following CAD/USD exchange rates for 2023:

| Period | Minimum | Average | Maximum |

|---|---|---|---|

| Q1 2023 | 1.30 | 1.32 | 1.35 |

| Q2 2023 | 1.28 | 1.30 | 1.33 |

| Q3 2023 | 1.26 | 1.28 | 1.31 |

| Q4 2023 | 1.24 | 1.26 | 1.29 |

Bearish Outlook:

Some experts believe that the CAD could weaken significantly against the USD in the coming months. They cite the following factors:

- A potential economic slowdown in Canada

- Rising interest rates in the US

- A strengthening US dollar due to geopolitical tensions

Bullish Outlook:

Conversely, other analysts anticipate a strengthening of the CAD against the USD. Their arguments include:

- A resilient Canadian economy

- The Bank of Canada’s dovish monetary policy

- A weakening US dollar due to global economic uncertainty

Factors to Consider

Interest Rate Differentials:

The difference in interest rates between Canada and the US is a key factor that influences the CAD/USD exchange rate. As the US Federal Reserve continues to raise rates, the CAD may come under pressure.

Global Economic Outlook:

The overall performance of the global economy can impact exchange rates. A slowdown in China or Europe could lead to a weakening of the CAD.

Political and Geopolitical Events:

Political instability or geopolitical events can also affect the CAD/USD exchange rate. For example, the ongoing conflict in Ukraine has created market volatility.

Implications for Businesses and Investors

The fluctuating CAD/USD exchange rate can have significant implications for businesses and investors who trade across the border.

Businesses:

- Importers may face higher costs when purchasing goods from the US.

- Exporters may benefit from a stronger Canadian dollar, as their products become more competitive in the US market.

Investors:

- Currency traders can take advantage of exchange rate fluctuations to generate profits.

- Investors in Canadian assets should consider the potential impact of a weakening CAD on their investments.

Conclusion

The CAD/USD exchange rate is expected to experience significant fluctuations in 2023. Businesses and investors should closely monitor the market and adjust their strategies accordingly. The forecasts provided by financial experts offer valuable insights, but it is crucial to consider all relevant factors before making investment or business decisions.