Introduction

The Chicago Board Options Exchange Volatility Index (CBOE VIX) is a measure of the market’s expectation of volatility over the next 30 days. It is often referred to as the “fear gauge” because it reflects the level of fear or uncertainty in the market. A higher VIX reading indicates higher expected volatility, while a lower reading indicates lower expected volatility.

The VIX is calculated using the prices of S&P 500 index options. Specifically, it is based on the implied volatility of a portfolio of 30-day S&P 500 index options. The implied volatility of an option is the market’s estimate of the future volatility of the underlying asset.

The VIX is a popular tool for investors and traders because it provides a way to gauge the market’s sentiment and expectations. It can be used to make decisions about portfolio allocation, risk management, and trading strategies.

Historical Performance

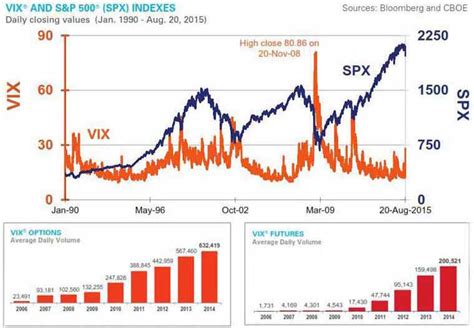

The VIX has a long history of trading, dating back to 1993. Over time, the VIX has exhibited a number of interesting patterns and trends.

Volatility and the VIX

One of the most important things to understand about the VIX is that it is a measure of expected volatility, not actual volatility. This means that the VIX can rise even when the market is not actually experiencing high volatility. For example, the VIX spiked to 80.86 in March 2020 at the onset of the COVID-19 pandemic, even though the S&P 500 Index was only down about 20% from its all-time high.

VIX and Market Returns

In general, the VIX has a negative correlation with the S&P 500 Index. This means that when the VIX is high, the S&P 500 Index tends to perform poorly. Conversely, when the VIX is low, the S&P 500 Index tends to perform well.

However, there are some important exceptions to this rule. For example, the VIX can be high even when the S&P 500 Index is performing well if there is a lot of uncertainty in the market. This can happen during periods of geopolitical uncertainty, economic turmoil, or natural disasters.

VIX and Investor Behavior

The VIX can also be used to gauge investor behavior. When the VIX is high, investors tend to be more risk-averse and sell stocks. This can lead to market downturns. Conversely, when the VIX is low, investors tend to be more risk-tolerant and buy stocks. This can lead to market rallies.

How to Use the VIX

The VIX can be used in a variety of ways to make investment decisions. Here are a few examples:

Portfolio Allocation

The VIX can be used to adjust your portfolio allocation based on the market’s expectations of volatility. For example, if you believe that the market is expecting a period of high volatility, you may want to reduce your exposure to risky assets, such as stocks.

Risk Management

The VIX can be used to manage risk in your portfolio. For example, you can buy VIX futures or options to hedge against market downturns.

Trading Strategies

The VIX can be used to develop trading strategies that profit from changes in volatility. For example, you can buy VIX options when the VIX is low and sell them when the VIX is high.

The Future of the VIX

The VIX is a valuable tool for investors and traders, and it is likely to remain so for many years to come. As the market evolves, the VIX will continue to be a key indicator of market sentiment and expectations.

Conclusion

The CBOE VIX is a powerful tool that can be used to make informed investment decisions. By understanding the VIX and how it works, you can improve your chances of success in the market.

FAQs

What is the difference between the VIX and the VIXX?

The VIX is a measure of the market’s expectation of volatility over the next 30 days. The VIXX is a measure of the market’s expectation of volatility over the next 90 days.

What is a good VIX level?

A good VIX level depends on your individual risk tolerance and investment goals. However, in general, a VIX level below 20 is considered to be low, a VIX level between 20 and 30 is considered to be moderate, and a VIX level above 30 is considered to be high.

How can I invest in the VIX?

There are a number of ways to invest in the VIX. You can buy VIX futures or options, or you can buy exchange-traded funds (ETFs) that track the VIX.

What are some trading strategies that use the VIX?

There are a number of trading strategies that use the VIX. One popular strategy is to buy VIX options when the VIX is low and sell them when the VIX is high. Another strategy is to buy VIX futures when the VIX is low and sell them when the VIX is high.

How is the VIX calculated?

The VIX is calculated using the prices of S&P 500 index options. Specifically, it is based on the implied volatility of a portfolio of 30-day S&P 500 index options.

What does the VIX tell me about the market?

The VIX tells you about the market’s expectation of volatility over the next 30 days. A high VIX reading indicates that the market is expecting high volatility, while a low VIX reading indicates that the market is expecting low volatility.

How can I use the VIX in my investment decisions?

You can use the VIX to make informed investment decisions. For example, you can use the VIX to adjust your portfolio allocation based on the market’s expectations of volatility, to manage risk in your portfolio, and to develop trading strategies that profit from changes in volatility.